It’s been an eventful past 6 months, and I wanted to revisit my personal finances to see how things have changed since my last update in March, when COVID-19 started turning into a pandemic in the United States, the market had hit its lows, and there was much uncertainty about what would happen next.

The High-Level Summary

In March, I saw our investments decrease by nearly 20% from their highs in late February. Luckily, my family was in a good cash position and I didn’t engage in any kind of panic-selling as prices went downward. In fact, I kept my automated investments going, contributing to my son’s 529 Plan and letting the auto-purchases of index funds keep on rolling.

There was also a brief period where my business took some big hits and things looked bleak. As a result, my co-founder and I suspended our pay as we scrambled to stabilize cash flow and drum up new business. Here too, we were lucky to bounce back in a matter of months and by August, we recorded one of the best months in the history of our business in terms of deal activity.

During this time, I became enthusiastically involved with investing in stocks coinciding with the historic rise in prices of tech stocks that moved the market from its lows to new highs. I focused most of my investments around three types of companies: cloud computing, digital commerce, and business productivity. My E*TRADE brokerage account alone grew over 114% during this period. I’ll get into more details in the Stocks section.

I’m pretty sure there will continue to be a good deal of volatility in the coming weeks and months as the election nears and COVID-19 still lingers as a health risk. But looking back at the last 6+ months, I do feel fortunate that given the ups and downs, our overall holdings grew by over 23% since my March update (and over 8% since the highs in February). Of course, this is but a snapshot and the picture can get ugly quickly or even rosier in a matter of days. This is why I prefer not to check these numbers often and only focus on what I can control–ensuring that I am putting aside money for emergency cash, saving for retirement, and with amounts left over, spreading them across various investments.

My Holdings (Cash + Investments)

As I’ve done in past updates, I’ve excluded our primary residence and my parents’ place from this. I’ve also excluded any angel/LP investments and real estate partnership investments just to keep it simpler (I should note that I did make a few investments in the past 6 months including a friend’s VC fund and another friend’s startup). These numbers also exclude the value of my stake in Barrel as a business.

I use Personal Capital (disclosure: referral link) to track these holdings. The total includes checking and savings accounts that I share with my wife as well as our shared Vanguard investment account. It does not include her own bank account and her own retirement account. I’ve also excluded our son’s 529 plan which we’ve been contributing to for nearly 2 years.

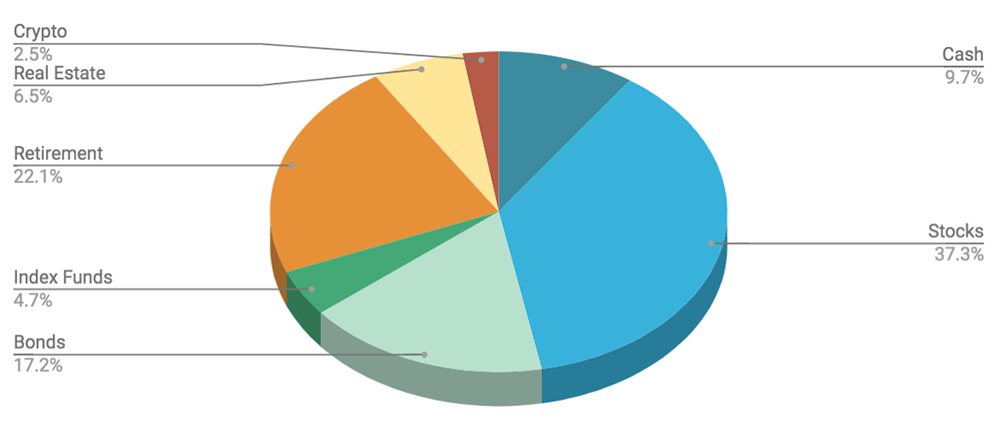

These percentages are as of September 18, 2020

|

As of September 18, 2020

|

|

|

Cash

|

9.7%

|

| Stocks |

37.3%

|

| Bonds |

17.2%

|

| ETFs / Mutual Funds |

4.7%

|

| Retirement |

22.1%

|

|

Real Estate (REITs, Fundrise)

|

6.5%

|

|

Crypto

|

2.5%

|

Here’s a 3D pie chart view of the same data:

Income & Expenses

Except for the brief pause in income from Barrel while we stabilized the business, there’s been little change here. Expenses have also stayed relatively the same with housing being the bulk of our monthly outflows. We briefly flirted with buying a vacation home in the Hudson Valley and even put down an offer for a home but we were outbid and I think it’s actually a good outcome. The more I think about, the less I’d like to be paying 3 mortgages at once and also needing to pay upkeep on 10+ acres of land 2+ hours away.

I’m actually close to refinancing my parents’ co-op, which would help save us a few hundred bucks per month (going from 4.125% to 2.75%). I’m also interested in refinancing our condo home we bought last year but I haven’t been able to see a sub-3% quote on it (we’re currently at 3.5%).

One spending vice I’ve had in the past 6 months is with buying alcohol, mainly wines and some spirits (mainly amaros). For a time, I got caught up in buying direct from wineries (Kenzo Estate, Corison, Realm Cellars, Idlewild) and joined a few clubs (Mayacamas, Martha Stoumen, Brown Estate), which means I’ll be well-stocked every Spring and Fall. I also joined Verve Wine’s The Grand Tour wine program, which sends four reasonably-priced bottles each month that’s curated around a theme. I found that I enjoy looking forward to the theme and reading the entirety of the descriptions that come along with the wines as much as the wines themselves.

Stocks

In my past personal finance updates, I wrote about sticking mainly to index funds and not trying to beat the market by buying single stocks. I think the index funds approach is still the prudent and smart thing to do, especially if you’re not interested in reading up on companies and spending time doing the research to pick stocks.

In the past 6 months, I’ve come to enjoy the process of learning about companies, reading materials on them, and forming an opinion on their long-term prospects. If I develop a strong conviction, I end up initiating a position. I rely on Twitter for leads on new ideas and then can go down a rabbit hole of listening to podcasts, reading blog posts, and even diving into financial documents to get familiar with a business. I’ll bounce ideas around with friends over text as well, getting their thoughts.

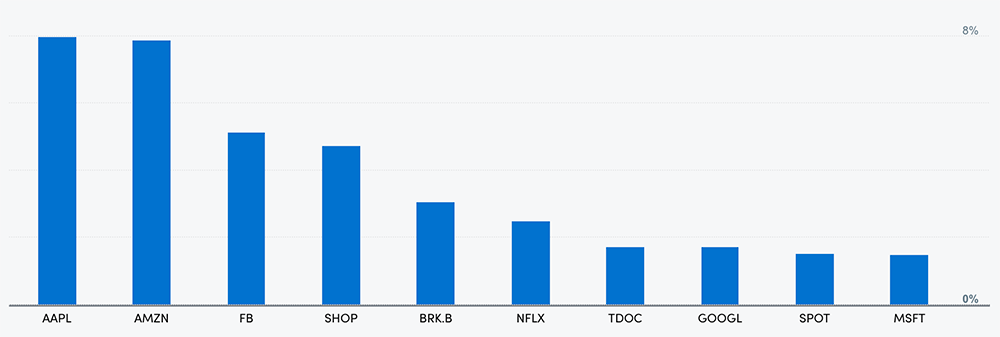

These are my top 10 single stock concentrations with Apple having overtaken Amazon in the past couple months.

The result of this has been a big bump in my stock allocation as I’ve moved over cash and bought a number of single stocks. One motivation for getting more into stocks was also the declining interest rates on our cash savings account. With sub-1% interest, I felt wasteful keeping nearly 20% of our holdings in cash. As of September 18, our cash holdings are down to 9.7% and single stocks are up to 37.3%. In my previous update 6 months ago, I had combined stocks with ETFs and mutual funds and that amounted to 30% of my holdings. That combined number now is at 42%.

I’ve kept my single stock purchases mostly around three themes: cloud computing, digital commerce, and business productivity. These buckets all touch upon the work that we do at Barrel, so I felt comfortable investing in companies whose tech I understood more easily and whose products we might already be customers of. This was also a chance for me to replay the missed opportunity of investing in software companies that we use at Barrel. I wrote about this in May to reflect on missed investing gains that were right in front of us.

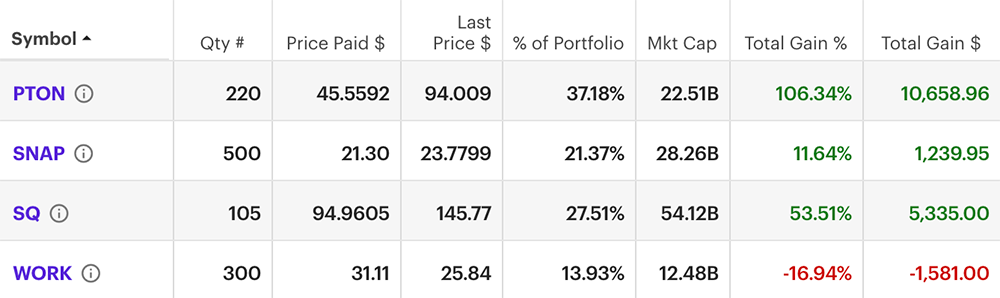

In early June, I challenged myself to pick 4 investments to hold on for the next 10 years, putting in $10,000 into each pick. I created a separate E*TRADE brokerage account for this. My picks: Square, Peloton, Snap, and Slack. Here’s my thread on Twitter where I share why I picked these. Overall, I felt these companies were still early in their growth trajectory and that they have high upside potential to innovate and strengthen their relationships with customers. 3+ months into this 10-year bet, things are looking promising with Peloton driving the bulk of the gains. The 4-stock portfolio is up 39% as of September 21.

I have a bunch of other purchases that I’ve shared in my Stock Investing page along with a Stock Watch List where I’ve been monitoring potential investments.

The biggest challenge that I’ll have to deal with in the coming years if I want to continue picking stocks is psychological. It’ll be the act of balancing my convictions with patience, skepticism, and decisiveness. These are all difficult things, so to dumb it down, a few simple rules for myself: buy to hold for the long term and only buy companies I believe will do well for the next 5-10 years and beyond; avoid selling and only sell if I absolutely need the money or I think the company is going into serious decline; ignore short-term gains and timing the market.

Let’s see how I stick to these rules.

One last bit: I bought a sizable position in Berkshire Hathaway (BRK.B) when it hovered around $182 ($218 as of Sept. 18). I thought the stock was underpriced for the assets it had and felt it was a safe long-term bet, more akin to an index fund than a high-growth tech stock. Ironically, Berkshire ended up buying an allocation of Snowflake’s hot IPO, but the amount is negligible given Berkshire’s sheer size.

Bonds

I trimmed some of my bond holdings to fund my single stock trades, but they still make up 17.2% of my holdings. These are Vanguard Admiral Shares in corporate high yields, muni high yields, and intermediate-term munis. I have the bonds on auto-reinvestment, so all the dividends will go towards compounding. The yields aren’t great (3-5% for the high yields) but I’m going to pretend these don’t exist and just forget about them.

ETFs / Mutual Funds

I’ve continued to contribute to my Fidelity account where I have an automatic recurring purchases set for the zero-fee FZROX and FNILX. I also have a smaller amount going to my Vanguard account where I buy VFIAX (S&P 500) and VSMAX (Small-Cap Index) each month. I will continue to let these keep on going regardless of where the market is and hold for the long term.

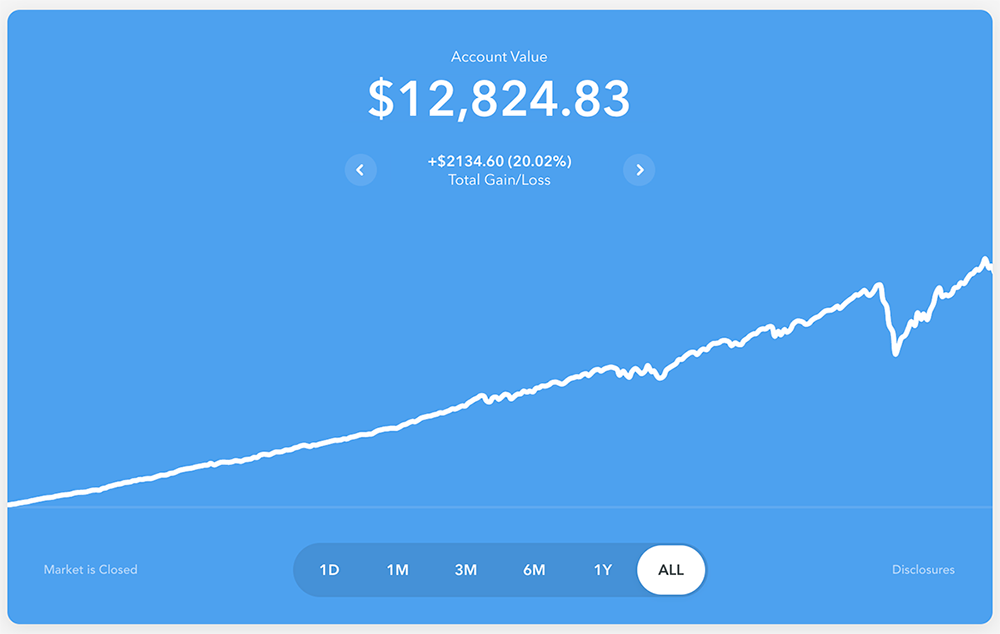

And lastly, I still put aside $5/day plus some “round-ups” into my Acorns account (disclosure: affiliate link). I’ve thought about discontinuing this a few times but it’s been running now for nearly 5 years, so I figure I just let it keep going. I realized I forgot to link my Acorns account with Personal Capital so the amount here isn’t factored into the holdings percentages but its inclusion wouldn’t impact the numbers much. Perhaps in 20 years or so, I’ll be pleasantly surprised by how much this has grown.

What five years of putting aside $5 and some round-ups to Acorns looks like.

Retirement

I’ve gotten a tad bit aggressive in my retirement account. Half of my SEP-IRA contribution was used to buy into a S&P 500 index fund. With the other half, I invested in some higher growth tech companies like Okta and MongoDB. I might continue this practice (the 50/50 split) as it gives me yet another opportunity to study and buy single stocks.

You can see the incredible growth of the retirement account (this is just my SEP-IRA account that has the Apple shares) over a 6-month period with the peak coming a few weeks ago around the time Apple’s 4:1 stock split happened.

My retirement account has outperformed all my other accounts as I was able to buy a good chunk of index funds at the market’s low point in late March and also from Apple’s huge run-up this year. I’ve been holding a decent number of Apple shares in my retirement account since 2015. The value of my retirement account from March 23 to September 18 has increased by 53% without me having made any new contributions during that time. That’s even after Apple has cooled down by over 20% in the past few weeks.

Real Estate

I’ve continued to hold on to my Vanguard Real Estate Index Fund Admiral Shares (VGSLX) although it’s still down 15%. I think it’ll be quite some time before commercial real estate returns to pre-COVID-19 levels of stability. I figure there will continue to be vacancies across the country as well as falling rents and failed retail shopping centers. I’ve decided to just leave this be and not put in more dollars.

With Fundrise (disclosure: referral link), the real estate investment platform, I’ve continued to put aside $250/month. This, too, I’m just letting run on automated recurring mode and letting the dividends compound over time. It looks like there’s still been some appreciation this year as the residential market doesn’t seem as impacted as the commercial market.

A screenshot of my account’s YTD performance from the Fundrise dashboard.

Crypto

I mentioned last time that I set up a recurring bi-weekly purchase for Bitcoin. I’ve let it run since then even as the price of BTC has gone up. In the last 6 months, the price of BTC has gone from around $6k-7k in late March to around $10k-$12k in the past 6 weeks. Of course, this is a very volatile asset and so I rarely look up the price and hope that the bi-weekly purchase frequency sometimes hits when prices are down.

I’m still unsure what the future of Bitcoin will be and I’m neither overly bullish or skeptical about it. I just figure it can be a small insurance policy that I can keep at a 2-3% allocation in case other assets falter or BTC prices explode to the moon.

Keep It Simple, Keep It Going

I’ve come a long way in terms of sophistication and understanding of finances since my first personal finance update in 2015. However, the principles have remained the same: save as much as I can and invest them into assets that can compound and grow over a long time horizon.

I’m in no hurry to get rich, and in many ways, I already feel rich being able to provide for my family and pay for all kinds of conveniences and pleasures. If anything, the reason to keep tending to my personal finances is to get some intellectual stimulation and more importantly, to have a sense of security. Knowing I have emergency funds, knowing I can help family members, knowing I can contribute to causes I care about, knowing I can invest in opportunities, and knowing I can trade money for more time and convenience are all forms of independence that I don’t want to take for granted. Staying on top of personal finances is always a good reminder of all that I’ve been lucky to gain and an important responsibility to steward for my family.