What a difference 15 months makes. Since my last update in August 2022, my life has changed in ways that I did not anticipate. We welcomed a new child, moved out of Brooklyn, and traded in 3 mortgages plus a car payment for 1 mortgage and 3 car payments.

Overall, personal finances are in good shape with monthly expenses going down and liquid savings going up. I won’t try to predict what the next 12-18 months might look like, but I doubt it’ll be as eventful as it has been for the past year or so.

You can see all my past personal finance updates right here.

Note: All content here is for informational purposes only and do not constitute any investment advice. Please do your own due diligence and make your own investment decisions.

Note on What’s Included / Excluded

The numbers discussed in this post include most of my brokerage accounts, bank accounts, and retirement accounts. They do not include all of my wife’s accounts, just our joint accounts. Over time, we have moved to handle most of our family finances centrally, but we still maintain our personal bank accounts separately, so cash amounts held by my wife are not reflected here nor are her retirement amounts and her taxable investments. I’ve also excluded our three sons’ 529 plans which we contribute regularly to each month.

I’ve excluded our physical real estate holdings as well as any angel/LP investments and real estate partnership investments to keep things simpler. This snapshot also excludes the value of my stake in Barrel Holdings, which includes ownership interests in Barrel, Vaulted Oak, BX Studio, and Bolster as well as any cash held at the company level. And this also excludes stocks purchased for the Barrel Partners Fund, in which we buy stocks of software companies that we pay to use at Barrel, as well as my joint brokerage account with Sei-Wook, which we’ve had for 10+ years with investments in various public companies.

Snapshot & Performance

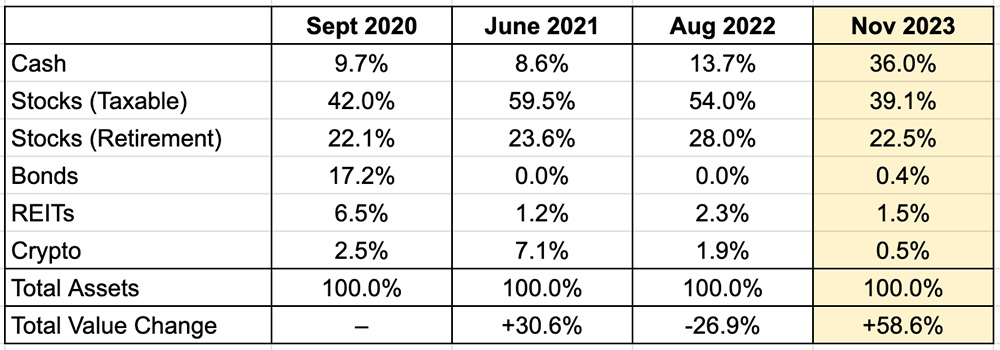

The overall value of my assets increased by 58.6% since late August 2022 (15 months). You can see the changes in allocation and the value change over the previous snapshot periods:

Note: I use Empower Personal Dashboard (formerly Personal Capital) (disclosure: referral link) to track my holdings. I bring the numbers over to Google Sheets and also add in any other accounts that don’t connect manually.

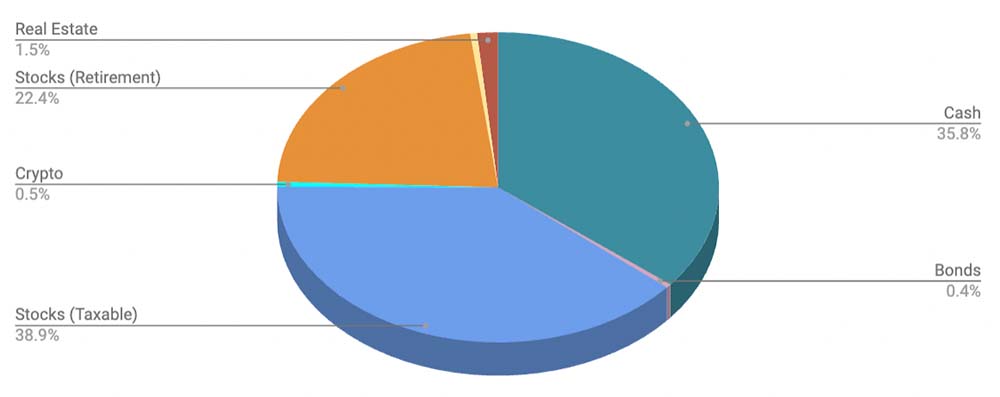

Here’s the breakdown of my assets in pie chart format. I’ve simplified the chart so that stocks also include equities-based ETFs and mutual funds. Values as of November 10, 2023:

Note: Real Estate here is for the REITs via Fundrise.

Income Source & Divesting of Properties

Barrel continues to be my primary source of income. I also took small distributions from profits that flowed up to Barrel Holdings from Vaulted Oak and BX Studio as well.

The most impactful sources of cash in the past 15 months has been the sale of our two properties in Brooklyn. Our condo, which we owned for 4 years, sold for nearly 20% more than we bought it for, which led to a nice return on our equity. On the other hand, we lost money on my parents’ co-op in Sunset Park as it sold for below our purchase price. Nonetheless, we got a big chunk of the down payment back after mortgage payoff and all the fees.

Left, our son Teddy waving goodbye to the willow tree that we often passed by in our Brooklyn neighborhood. Right, a last look at our Brooklyn condo in Greenwood Heights.

In addition to the cash influx, we’ve gone from having 3 mortgages to just 1, which greatly improved cash flow. We currently live in Rhinebeck at what used to be our weekend home. After learning that we were going to have kid #3, we decided to make the move out of Brooklyn, which cascaded in a bunch of life-changing transactions.

Going Big on Cash, Earning Interest

I mentioned last year that my appetite for risk was on the decline, especially with family obligations. I took this to heart and greatly increased our cash position this year. Prior to the property sales, I put aside whatever savings I could into our high yield savings account. Earning 4% then 4.25% and now 4.5% on our cash started to add up to meaningful amounts.

Meanwhile, my stock portfolio, which took a beating in 2022, recovered a good deal. I even trimmed my position in Nvidia when the stock experienced a huge jump in late May, putting the gains aside into my cash savings account.

I also liquidated most of my remaining Bitcoin holdings (I already sold out 70% of my holdings in 2022), shifting the gains there into cash. I now have a very miniscule position in crypto, mostly in Ethereum.

A few months ago, I shifted most of my cash, including the amounts from the sale of our Brooklyn properties, into the JPMorgan 100% U.S. Treasury Securities Money Market Fund (VHPXX), which as of this writing, is yielding 5%. I still categorized this as “cash” in my breakdown as I can easily move money in and out of the account. The amount of monthly interest that the account is earning right now is more than enough to cover the monthly mortgage of our home, which feels really nice.

High interest rates have presented challenges in other parts of my life (in business, in thinking about potentially buying another home, in buying a car, etc.), but in the realm of having cash savings, high interest rates have been great.

Passive Investments, Keeping It Simple

I feel like I’m right back to where I was several years ago, perhaps as far back as 2017, before I went down the rabbit hole of angel investing, cryptocurrencies, single stock investing, and real estate. I learned so much and enjoyed the journey, but I also lost a bunch and was lucky not to have lost it all.

These days, my investing approach is dead simple: automatic withdrawals each month that go to my kids’ 529 plans, index funds, Fundrise’s REITs, and our savings account (which I then sometimes move to the VHPXX money market account).

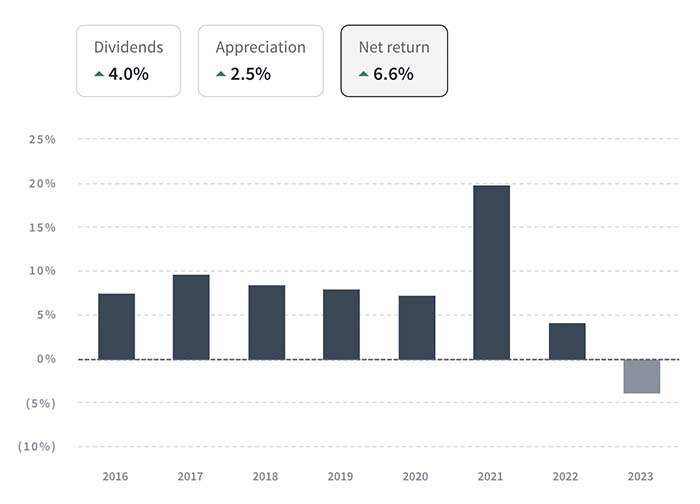

I’ve debated on whether or not to stop putting money into Fundrise (disclosure: referral link) but because it’s a relatively small sum, I’ve decided to let it just run. It’s gotten a 6.6% annualized return since I started in 2016, which is okay. 2023 looks like it’s been a tough year.

A screenshot of lifetime performance of my Fundrise account. 2023 looks to be the first down year.

For the index funds, I’ve continued to use Fidelity’s zero-fee funds, Fidelity® ZERO Total Market Index Fund (FZROX) and Fidelity® ZERO Large Cap Index Fund (FNILX). Both are up in the teens percentage-wise for the year.

Fidelity’s zero fee funds lock you into staying with Fidelity, but perhaps not a terrible trade-off for have zero expense ratio.

Our savings account is with Citizens Access, which is currently yielding 4.5%. I know there are some other savings accounts yielding a bit more, but I’ve been too lazy to chase the extra 0.25% of yield.

On a side note, I bought I Bonds in October 2022. At the time, the US Treasury was offering 9.62% APY for 6 months. Since then, it’s come down to 3.38%. I could probably roll this into my higher yielding money market account but I actually don’t mind the idea of money being squirreled away in different places, so I may leave it here for the time being. I honestly forgot to even account for it in this blog post and had to go back to update my numbers and chart again.

What’s My Number?

Over the summer, while hanging out with a group of friends, one topic we discussed was about a hypothetical “number” that we were after. We didn’t clarify whether this was overall net worth or liquid cash and investments, but some people did have a sense of a target.

It was interesting to hear the reasons – one friend’s number accounted for inflation while also yielding enough interest at a conservative rate to afford him a comfortable lifestyle to the end of his days without the need to work; another friend felt his number would leave enough for his kids to be taken care of; and another friend just chose a number that felt nice and round but not too ostentatious.

When it came to my turn, I didn’t have an answer for a number. Instead, in what might’ve sounded like a cop out, I talked about how I hoped to continue owning a portfolio of cash-flowing assets that would keep compounding over a long period of time. The goal for me wasn’t a precise number, but to be able to keep on enjoying the game of business while ensuring financial stability and flexibility for my family.

In the past year, I started some basics of estate planning by inventorying all the various investment and bank accounts, insurance policies, and other assets in a shared document with my wife. At various points, it got me thinking – if I were to perish tomorrow, what kind of financial position would I leave my family in? It’s a tough mental exercise and one that brought up additional questions:

- Is our lifestyle and spending habits commensurate with our financial position (and how would it be impacted if my earning power disappeared?)

- What’s a reasonable amount to save up and provide for my kids’ education and other expenses? What expectations should we have about their own ability to make/save money?

- Will there be enough to take care of others in my family (parents, sister, etc.) as well?

While not the most pleasant topic to focus on, I found it helpful to explore my thoughts on these. It made me realize the changing nature of my relationship to money – what was once all about accumulation and possibilities has added new facets like obligations and contingencies. And it gave me a different perspective on how to think about “my number” – whatever would be “enough” to furnish my family with the basics and basic comforts.

Understanding Personal Finances as a Means to Not Think Much About It

I started doing a variation of this exercise since 2015. Personal finance had always been an elusive “I’ll get to it when I get to it” chore for much of my twenties and early thirties. After paying off my student loans, I thought I was home free – no debt, cash in my checking account, and able to use my credit card for most purchases in life. But through friends and the Internet, I was able to learn more about investing, retirement accounts, saving, and the magical concept of compounding. It opened a whole new world.

What I find most gratifying about this exercise and having a general system for being on top of my personal finances is that it removes the feeling of uncertainty and unease when you’re in the dark about your financial standing. I have a fairly solid sense of our family’s burn rate and how long we could live off savings if our incomes dropped to zero. I also have a sense of how I’d like to continue saving up for the future (namely our kids’ education) and what our financial trajectory looks like at a consistent and conservative rate. Knowledge is both enlightening and empowering.

And because this is a system and a habit, I don’t dwell as much on my personal finances. Knowing where we stand and how money and investments flow means I don’t need to constantly think about it. A once-a-year deep dive is plenty. Not having to think about money all the time, I believe, is a luxury of its own.