It’s been a little over a year since my last update. In that time, there’s been a lot of changes to the financial side of my life. The biggest factor has been the purchase of a 2nd home, which has introduced all kinds of costs. Also, my stock portfolio, heavily concentrated in growth tech stocks, took a huge hit through the first half of this year, wiping out most of my gains from 2021.

You can see all my past personal finance updates right here.

Note: All content here is for informational purposes only and do not constitute any investment advice. Please do your own due diligence and make your own investment decisions.

Note on What’s Included / Excluded

The numbers discussed in this post include most of my brokerage accounts, bank accounts, and retirement accounts. They do not include all of my wife’s accounts, just our joint accounts. Over time, we have moved to handle most of our family finances centrally, but we still maintain our personal bank accounts separately, so cash amounts held by my wife are not reflected here nor are her retirement amounts and her taxable investments, which are 100% in low-cost index funds. I’ve also excluded our two sons’ 529 plans which we contribute to regularly to each month.

I’ve excluded our primary residence, our secondary residence, and my parents’ co-op in Sunset Park. I’ve also excluded any angel/LP investments and real estate partnership investments to keep things simpler. This snapshot also excludes the value of my stake in Barrel Holdings, which includes ownership interests in Barrel, Vaulted Oak, and BX Studio as well as any cash held at the company level. And this also excludes stocks purchased for the Barrel Partners Fund, in which we buy stocks of software companies that we pay to use at Barrel, as well as my joint brokerage account with Sei-Wook, which we’ve had for nearly 10 years with investments in various large cap companies.

Snapshot & Performance

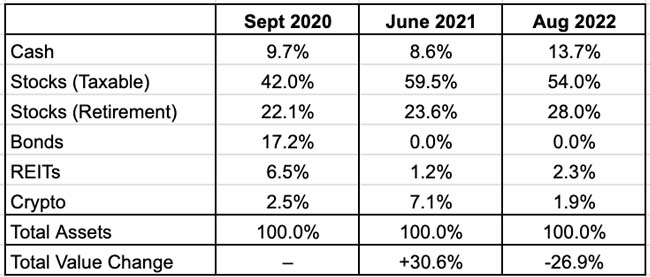

The overall value of my assets decreased by 26.9% since late June 2021 (13.5 months). You can see the changes over the previous snapshot periods:

Note: I use Personal Capital (disclosure: referral link) to track my holdings. I bring the numbers over to Google Sheets and also add in any other accounts that don’t connect manually.

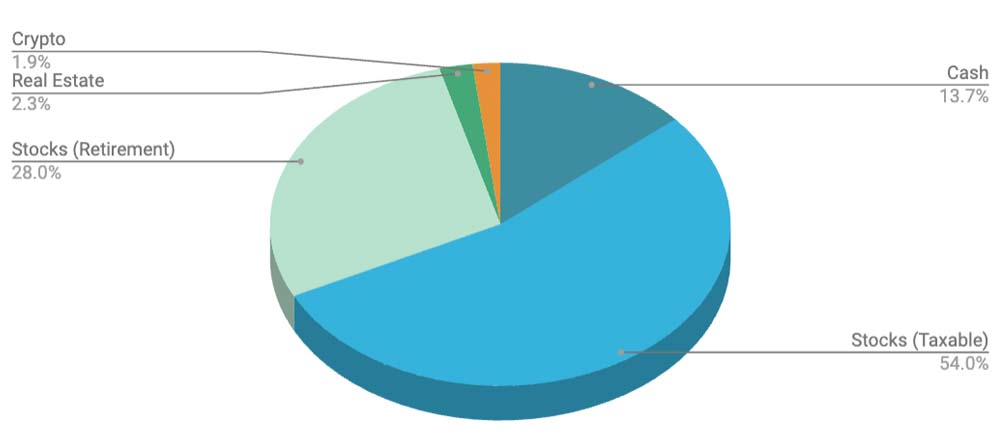

Here’s the breakdown of my assets in pie chart format. I’ve simplified the chart so that stocks also include equities-based ETFs and mutual funds. Values as of August 7, 2022:

Income Source

Barrel continues to be my primary source of income. The business posted record level of revenue in 2021, but struggled on profitability. We had some steep losses in Q4 2021 and Q1 2022 which led to a pause on profit sharing and cutbacks on ownership distributions. Thankfully, things have bounced back, so my income amounts will increase as long as we can keep growing both top-line and bottom-line numbers.

With our Barrel Holdings model taking shape, I can see our ownership distributions capped at a certain point with most profits retained to reinvest into funding growth, incubating new businesses, or buying businesses. We’re excited about growing our portfolio of businesses over the next 10 years and owning a holding company with robust streams of cashflow. It’s possible that we may take some distributions along the way, but I feel like if we can set up an effective compounding machine, we’ll want to keep as much money in the ecosystem as possible.

Big Change: Buying a 2nd Home

In late 2021, my family bought a 2nd home in Hudson Valley. I found an entry from July 2021, a few weeks before we came across this house, where I wrote this after our family enjoyed a 4-day Airbnb trip around the Kingston, NY area, not too far from where we eventually found the house: “Being in the Kingston area was fun and got a lot of great family pics. I do think I’m leaning more towards wanting our own place at some point. 2024. Need to be smart with finances and plan for it.”

I distinctly remember Mel sharing the Zillow listing with me and we knew right away that this place could potentially check off all the boxes of what we had deemed a “dream” vacation home: right amount of space to host guests, great views, private/rural feel, and close to Mel’s brother’s family. We bid all cash and almost 5% over asking in order to strengthen our chances of winning. Even then, we were outbid “by a lot” (according to the broker) but the winning couple pulled out the next day when they got cold feet on having too much space (they were empty nesters). We moved quickly to sign, make the down payment, and then to get a mortgage in place before close, knowing we’d have to pay all cash if the mortgage wasn’t ready in time. Thankfully the mortgage team was one we had worked with for our Brooklyn apartment and they helped us get things together really quickly. We also took advantage of the low rates at the time and locked into a 2.375% 30-year fixed rate, a great deal in hindsight given where rates are headed today. All in all, everything went fairly smoothly, and by October, the place was ours.

The view overlooking the Catskill Mountains is perhaps the best feature of the home.

The place has lived up to and surpassed our expectations in so many ways. The only downside is that it’s been a very expensive decision. In addition to the mortgage, we now have additional utility bills as well as costs that we never think about for our Brooklyn home: landscaping, pool maintenance, garbage collection, propane, and security.

There was also considerable cost to furnishing the home. Having been accustomed to the much smaller footprint of NYC apartments, we spent more than we ever did on furniture and some rooms still feel a bit empty! These big purchases added up quickly and made serious dents in our cash savings account. Also, seemingly little things like kitchenware and various appliances also added up.

But all in all, these costs all seem incredibly worth it when I think about all the amazing moments we’ve shared as a family up here. We’ve been able to host grandparents, relatives, and friends’ families nearly every other week, making productive use of our space. In lieu of traveling for vacation this summer, we’ve taken to exploring the area locally and making good use of our pool.

We decided early on to not turn the home into a short-term rental property. With two young kids, we just wanted to have a place where we could pack light and get to with the assurance that everything we need would be ready and waiting for us. This has been such a luxury and given us the motivation to make the trip multiple times a month, sometimes in brutal 3+ hours of traffic. As the kids get older, our family travels more, and we use the space less, we might revisit the decision, but for now, we’re okay not offsetting the costs with rental (e.g. Airbnb) income.

From a personal finance perspective, owning this home has meant that less amounts go to savings and investments. I’ve prioritized saving for my kids’ 529 and replenishing our cash reserves. I also sold some stocks and Bitcoin to free up more cash for peace of mind after all the large purchases. Doing some calculations, the tradeoff here is that I’ll be accumulating investment assets at a slower pace than before, but the quality of life and emotional upside of enjoying this place is well worth it. I have no regret in going for the home 3 years earlier than I had originally planned (2021 vs. 2024, as I wrote in my journal) – who knows what could transpire in that time. Better, in my mind, to have seized the opportunity.

Stock Portfolio Takes a Tumble

The first half of 2022 has been brutal for my stock portfolio across my taxable and retirement accounts. Gains on some my of largest positions such as Shopify, Snowflake, Cloudflare, Snapchat, and Asana were wiped out and then some as growth tech stocks tumbled on news of increasing interest rates, the war in Ukraine, and other news.

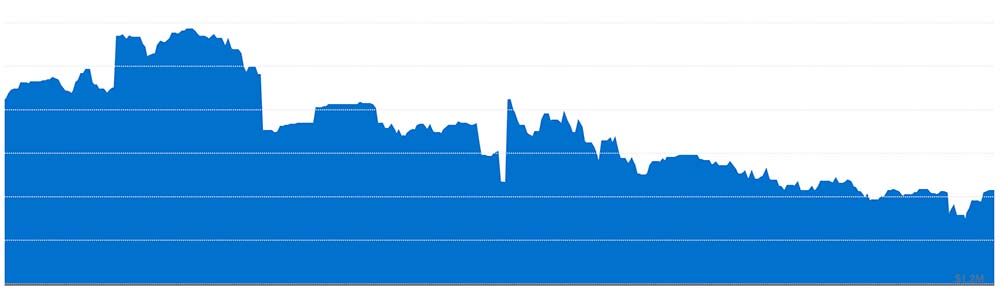

Since the personal finance snapshot in June 2021, the gradual yet precipitous erosion of value in my stock portfolio (taken from my Personal Capital account).

Buying a home at the peak of the growth tech stock exuberance was actually a blessing. I sold out of my lowest conviction stock positions to help fund the down payment and a few weeks later, as we began buying furniture, I sold pieces of my largest winners at their peak (I didn’t know this at the time) to free up some cash. Little did I know that some of these stocks would promptly go on to lose 60-90% of their value over the next few months.

During this period of steep losses, I rarely looked at my portfolio and accepted the reality that some stock prices might not come back up for a very long time if ever. I began to analyze each of my positions one by one and asked myself what companies I wanted to really be invested in for the long term. Like most folks swept up by the growth tech stock hype during 2020 and 2021, I had paid scant attention to fundamentals (e.g. profitability, gross margins, free cash flow) and been excited about growth rates and future potential.

I did nothing for a long time and then finally, in July, I did a bit of clean-up, selling out of 13 positions and trimming 1 more, realizing some steep losses, and then re-allocating the cash into 5 existing positions (Google, Berkshire Hathaway, Amazon, Adobe, and Snowflake) and 2 new positions (Autozone and TransDigm). You can take a look at my slimmed down portfolio here.

Moving forward, I may continue to buy up more shares in my highest conviction positions or just park them into a low-cost index fund.

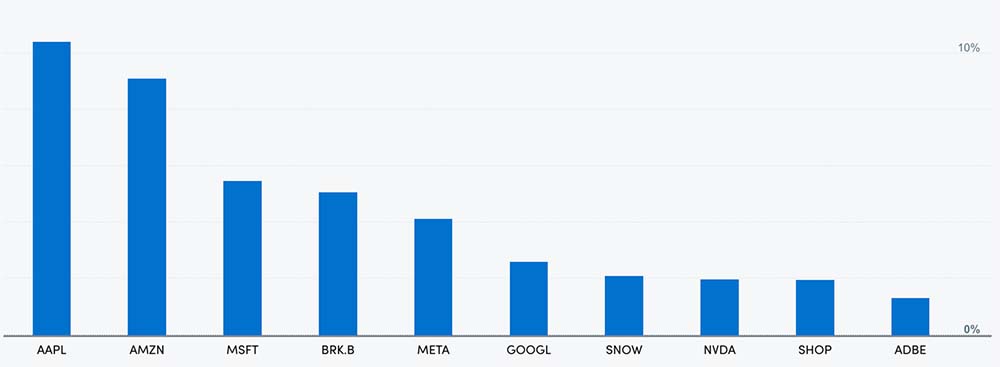

Here’s a look at my 10 largest single stock positions as of August 5, 2022:

My top ten single stock holdings. I’ve seen my portfolio grow more concentrated over the past year. My top 5 positions account for over 34% of my portfolio.

While seeing steep paper losses throughout early 2022 was unpleasant at times, I’ve come to really appreciate this downturn as an educational experience. It’s been interesting to see which companies have a solid foundation with a great balance sheet and continued growth throughout the market downturn and which companies, barely or not yet profitable, need to make drastic cuts and revise their overall strategy. When times are good, even weaker companies can look great with the right story.

The more I learn about investing and read about the best investors, the more apparent it becomes that those with great track records are able to cut through the BS and identify what makes a company durable and positioned to grow at favorable rates in the long run. It’s not easy and very few get it right most of the time. For those interested, I recommend checking out Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life by William Green.

Winding Down My Bitcoin Holdings

Over the past year, I saw my crypto portfolio peak and then tumble down nearly 70% from its highs. With my large amount of realized losses from my stock portfolio, I figured it was a good time to capture some gains in a tax-free manner on the crypto side. I sold out of 70% of my Bitcoin holdings. This allowed me to recoup 100% of the total amount I invested in since 2017 and 50% on top of that while still leaving 30% of my Bitcoin alone. Not the home run it would have been had I cashed out in November 2021, but I don’t regret the decision at all.

With a higher monthly burn resulting from the extra real estate property as well as costs associated with raising 2 kids, there’s something comforting about having more cash in the bank account. I can feel myself becoming more and more conservative with personal finance decisions especially with family in mind. While I’ll keep betting on myself with all that we’re doing with Barrel Holdings, when it comes to our family’s liquid assets, I’m more and more interested in embracing moderate rates of growth for reduced volatility and risk.

Cutting Back on Angel / Venture Investing

A pleasant surprise that I experienced recently was a wire that returned the exact amount of capital I invested in nearly 2 years ago. A startup I had written an angel check for was acquired and was able to return principal back to investors. In this environment, where many startups will likely fail after being unable to raise the next round of funding, getting 100% of my investment back felt pretty good.

To that end, I sometimes wish I had ignored the world of venture capital and just put all those amounts into an index fund or Berkshire stock. But then again, I learned a lot and met a lot of cool and interesting folks, so there’s that. Moving forward, we’ll still entertain investment opportunities at the Barrel Venture Partners level and still have a few capital calls remaining on some funds, but other than that, I’m more inclined to park money in unsexy stuff.

Privilege and Security

It’s hard not to feel self-conscious writing about personal finance and mentioning things like a 2nd home and writing angel checks. My parents never owned property while I was growing up, always renting and having to move every few years when they couldn’t afford rent anymore or the landlord had different plans. But I never saw or felt any of this to be a problem. My sister and I always had a roof over our heads and our own rooms with our own PCs. We knew our parents struggled with money but they always found a way to provide for us.

So when I take time to write something like this, I’m very grateful for the privilege of even having these assets, of having been exposed to things like stocks and real estate, and I hope that in sharing, there’s some useful takeaways for others.

What’s become clearer to me over the past few years is that with kids, personal finance has evolved to be about financial security and being able to provide. I’m not concerned at all about hitting some kind of big number that’ll satisfy my ego. Instead, it’s about having enough to keep my family safe, comfortable, and happy. It’s about being able to do things together and to provide my kids with interesting educational opportunities.

This exercise of taking stock of my personal finances is really about ensuring that there is enough buffer and some peace of mind to feel good about our family’s financial situation. I believe that there are enough nuts squirreled away here and there to weather unanticipated hardships and that we have ways to quickly reduce our monthly burn if necessary (e.g. turning either of our residences into rentals). I also think we’re well positioned to keep on compounding through existing investments and continued contributions to both retirement and taxable accounts.