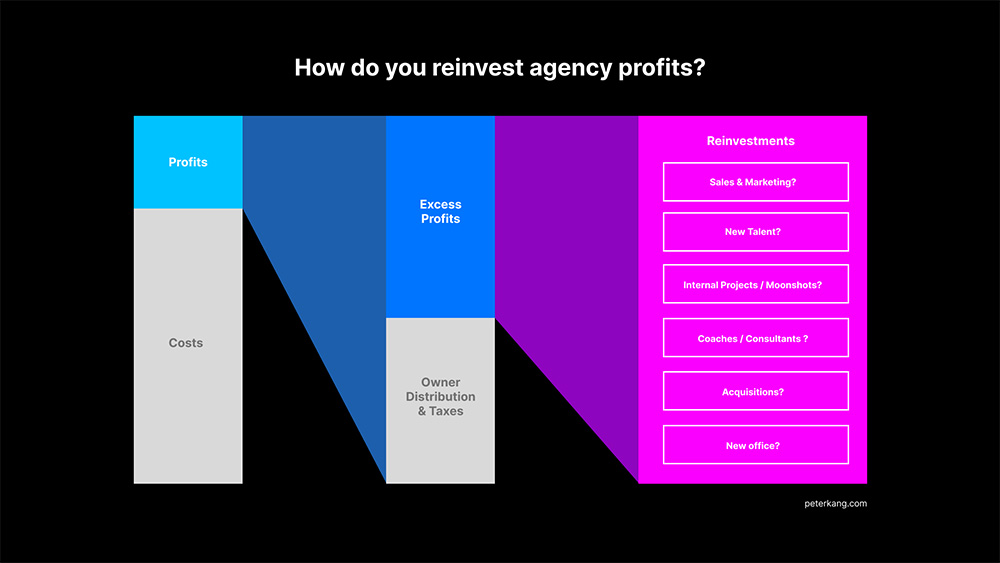

One of the learnings from running an agency business for a while is that when business is going relatively well and we’re able to generate profits, it’s critical to make some investments that can ensure that favorable results continue.

You can, of course, dividend out all the profits and take home more dollars. But to protect future profits, it’s worth exploring ways to stay competitive and differentiated. I’ve jotted down some thoughts below including some ideas for reinvesting profits as well as things to avoid.

1. Prioritize sales and marketing

Reinvest in projects, initiatives, and personnel likely to generate more opportunities for the business in the future.

These may include projects like redoing your website, refining your positioning, sprucing up your case studies and deck materials, or doing something bigger like a hosting a series of in-person events or sponsoring a conference. Whatever can get you in front of prospects and shed positive light on the firm is, in the long run, going to be worthwhile.

If you have a founder-led sales practice, you might experiment with hiring an outside firm to generate more leads or invest more heavily to build out a full sales team with SDR/BDRs and account execs. Or maybe you leverage your network and community and roll out a more comprehensive referral program that pays out healthy commissions to people who send you business.

There are so many ways you can invest in sales and marketing. What’s important is to keep track of your investments and the results that follow.

One very underrated investment is in marketing to existing clients – we’re often attracted to the lure of new clients but there’s great ROI in engaging existing clients with various marketing activities (check out David H. Maister’s Managing the Professional Service Firm which has a whole section on this – I excerpted it here in a previous blog post).

2. Avoid using billable resources on internal projects

Your mileage may vary, but we’ve wasted hundreds of thousands of dollars of profits trying to build our own software solution. It’s fine to have software come out as a byproduct billable work (assuming client is okay with you keeping the IP), but when we put direct dollars to launch software & then try to maintain it, things get messy. The pull of client projects often take away from internal projects gaining any momentum. Better, in my opinion, to outsource these initiatives or to spin out a separate business with its own P&L.

3. Engage coaches and consultants

We continue to get a lot of value working with different coaches and consultants who advise us on various aspects of our businesses. Whether it’s an executive leadership coach, a sales coach, an agency veteran helping with positioning or account growth, or a consultant who can help us get more out of our various software systems (CRM, JIRA, etc.), these people can help save time and quickly impart new perspectives that might’ve taken us much longer on our own to gain.

4. Be vary cautious about increasing headcount ahead of signing new work

Even with what feels like a strong pipeline and the possibility of big long-term engagements, we’ll hold off on making any full-time hires of billable resources. Hiring ahead of having contracts that are 100% locked-in risks burning cash (bye-bye excess profits!), especially if things drag out with project start dates. We like to instead invest in having a bench of vetted freelancers who can come in on relatively short notice if necessary. Of course, when we do sign clients and have certainty in revenue for the long-term, we can then make the call on whether or not to increase headcount.

One note is that hiring sales and marketing personnel falls into the reinvestments mentioned above in point #1. These non-billable resources are a bet that you can generate more future opportunities, so should be seen as separate from hiring headcount to increase billable capacity.

Parting Thoughts

Reinvesting profits to drive growth is a very important activity, one that we’ve fumbled in various ways over the years. The amount you have to reinvest will also vary on factors like the profitability of the business (doing work profitably, keeping people fully utilized, managing costs, etc.) and how much you’re taking in owner distributions. It’s possible you prefer to take as much out of the business and run things incredibly lean or maybe you take minimal distributions and believe plowing most profits into the business will compound better. No right or wrong, just depends on your preference, plans, and priorities.

A couple other options I haven’t mentioned here: 1) acquisitions – if you have excess profits and an appetite to keep growing, exploring potential acquisitions of smaller firms that complement or expand your services and capabilities could be an option and 2) service expansion – reinvesting through discounted rates or by taking less margin on projects designed to help your firm get footing in services that you don’t typically offer. These are a couple other areas to contemplate with excess profits.