Can an owner of a small creative/marketing/digital agency make decent money?

The answer is yes, but like anything worthwhile, it takes discipline, hard work, and some luck.

The business model itself is really simple: be great at sales, control costs (especially labor), do excellent work, and have a good CPA.

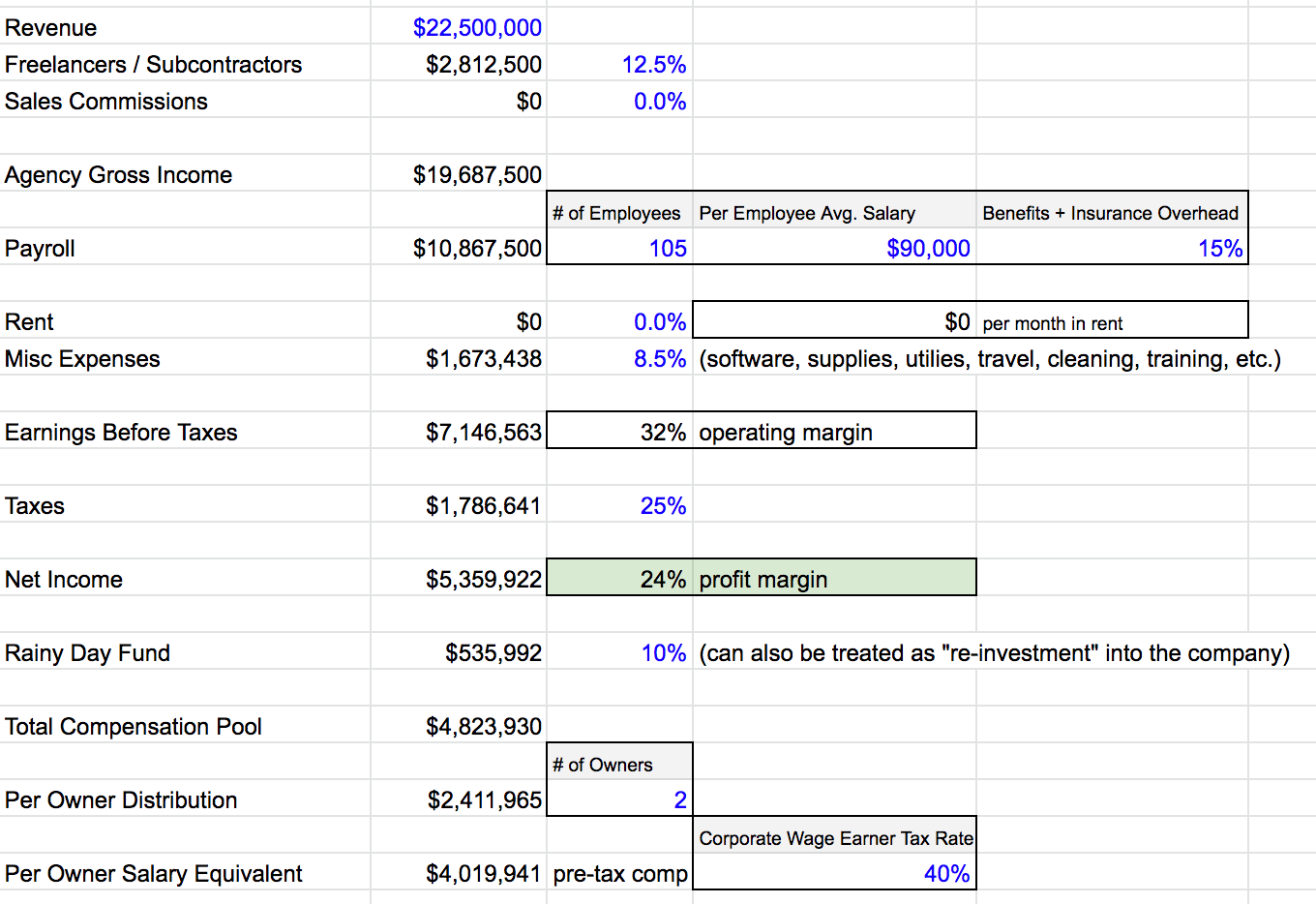

I built a really simple model on Google Sheets to show the inner workings of a small agency’s business from the owner’s perspective. You can copy and play around with if there are assumptions you’d like to test: check out model here.

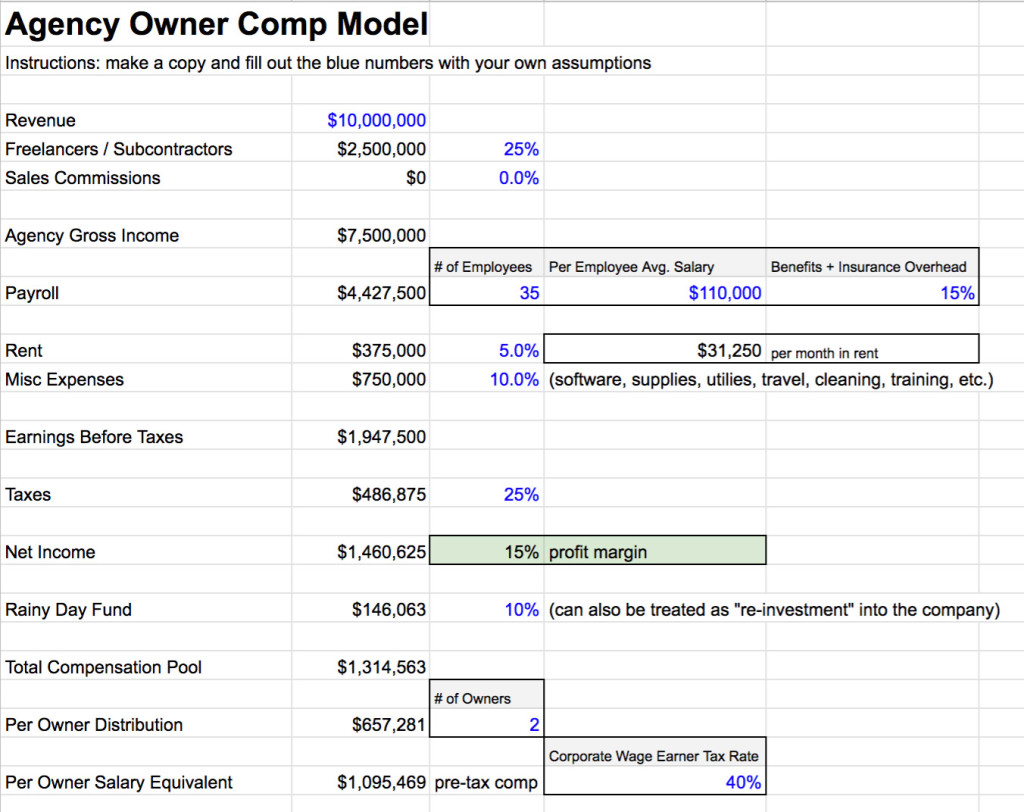

This model shows how an agency making $10 million can net its 2 owners $1 million each in pre-tax comp each year.

This leaves out a lot of nuances and details that are normally found in a financial model of this sort (esp. in the way expenses, taxes, and payroll are treated), but this exercise gives a high-level view of the business model that I’ve lived through for the past 13+ years.

One note: I define Agency Gross Income (AGI) in here as top line revenue minus any freelancer/subcontractor costs as well as any sales commissions. If you are a media agency that runs clients’ advertising spend through the business, I would include that up here as well. The AGI is what I use to make assumptions on percentages for rent and miscellaneous expenses. The thinking is that if you have a business that’s really dependent on freelancers/subcontractors, you’re likely to avoid on-going overhead associated with co-located full-time staff.

In the following sections, I’ll go over 3 scenarios to show the model in action.

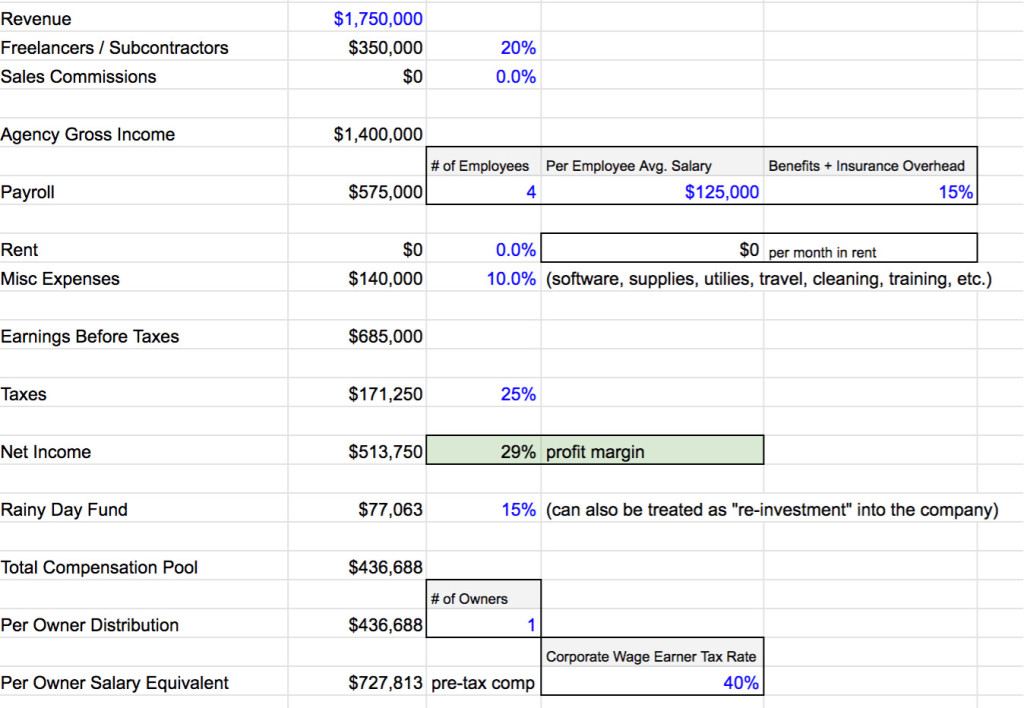

Scenario 1: Small Revs But Great Margins & Cost Control

This is a 5-person agency (1 owner plus 4 full-time employees) that had top line revenues of $1.75 million.

They leaned heavily on their network of freelancers and subcontractors, spending 20% of their revenue ($350k) to work with various overseas talent. They saved quite a bit, often getting the equivalent of full-time experienced talent at under $30k salary rates.

In order to effectively manage these overseas workers and communicate well with clients, the owner has brought in senior project management types. He also has a creative director on staff. Their average salary ends up being $125,000.

The team operates in a fully distributed capacity. People are spread all over the world and they mainly communicate via Slack and Zoom. The owner does splurge on travel costs, getting the team together at various locations at least 4 times a year to plan, bond, and collaborate in-person. Their expenses for software services, travel, conferences, and equipment total $140,000.

The owner works with his CPA to get an effective tax rate of 25% on his earnings, which means Uncle Sam gets a little over $170k.

The net income for this business is almost $514k, which is a 29% profit margin. In my book, that’s a pretty solid agency business.

The owner has no debt and decides to put aside 15% of the net income ($77k) towards the rainy day fund, which has already accumulated over $200k in the past 3 years, enough to cover the full-time team for a few months.

The comp for this single owner is almost $437k, post-tax. For someone with an effective tax rate of 40% taking similar take-home pay from a big corporate job, that’s the equivalent of a $728k salary.

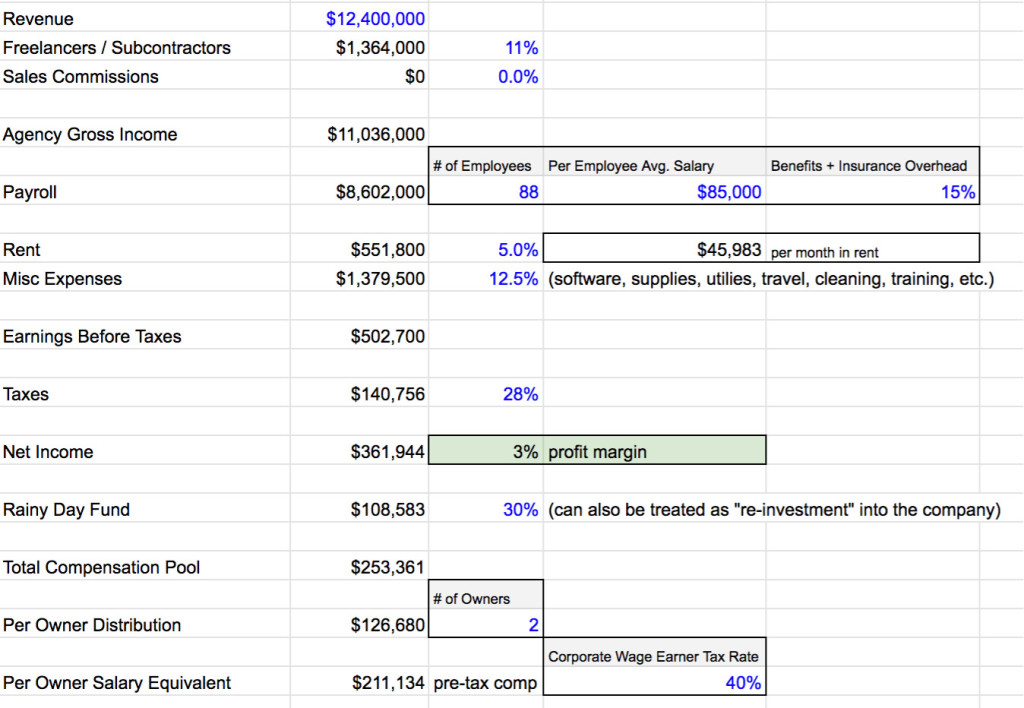

Scenario 2: Impressive Top Line But Struggling

This 2-owner agency with 88 full-time employees (90-person team total) based in New York City had annual revenues of $12.4 million.

They spent over $1.3 million on freelancers/contractors and over $550k (about $46k/month) in rent for their spacious 2-floor office in Manhattan. The biggest expense, of course, is their full-time team. At $8.6 million, payroll eats up nearly 70% of the revenues.

After about $1.4 million in various non-payroll expenses, the pre-tax earnings come in at just under $503k. After paying about 28% in taxes, the net income is $361k, a profit margin of slightly under 3%.

Out of this, the owners decide to “re-invest” $109k to fund operations as they’ve had some trouble with client retention and have also tapped into their line of credit with the bank.

The total compensation pool for the owners is $253k, split two ways, leaves $127k for each, or, if they were corporate wage earners, the equivalent of a $211k salary.

An impressive office in Manhattan, big clients, and growing headcount. However, margins are razor-thin and the efficiency of the team needs work. The owners, for all the risk they bear and all the people they oversee, are getting less than market rates for someone who might be hired full-time to their work.

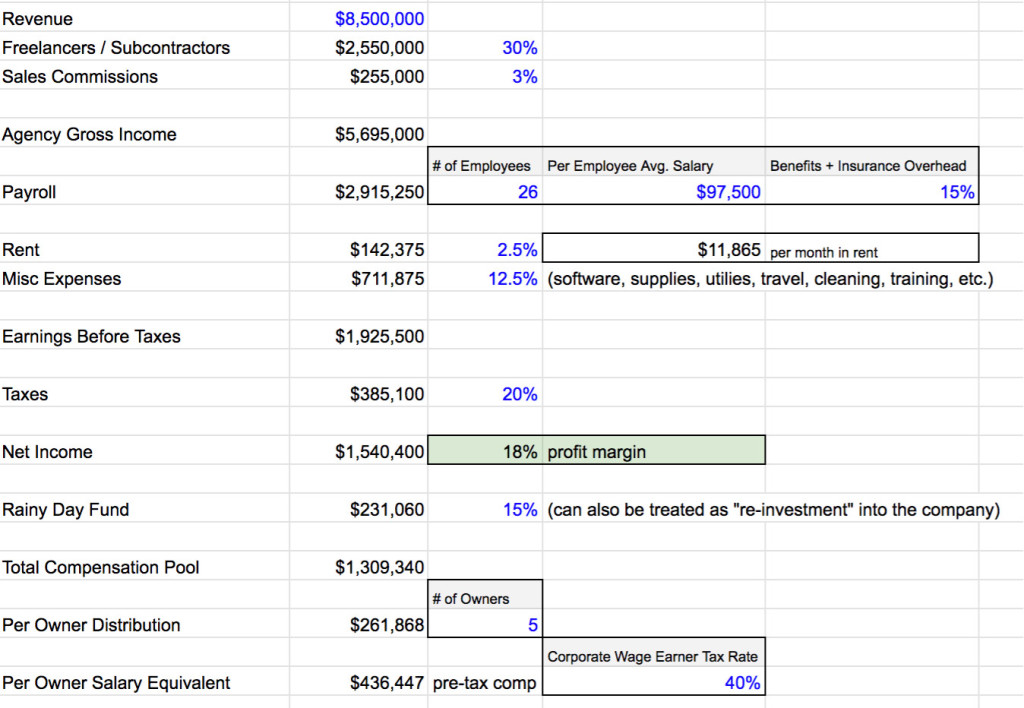

Scenario 3: Strong Business, Many Owners

Five friends joined forces to start an agency some years ago. They now employee 26 full-time team members across the United States, some working from home and others working out of co-working spaces in Los Angeles, San Francisco, Chicago, and Atlanta (at around a $12k expense per month total). Their revenue for the year is $8.5 million.

The team leans heavily on freelancers to execute on a number of projects, having spent over $2.5 million (or 30% of their revenues). They also paid out $255k in commissions to business development consultants and other partners that referred new opportunities throughout the year. Payroll was at $2.9 million, a mix of experienced strategy-focused talent and younger (cheaper) creatives.

The company has been pretty efficient in their work and booked over $1.9 million in earnings before taxes (23% operating margin). They worked with their CPA to get their effective tax rate to 20% and so were left with $1.5 million in net income, an 18% profit margin.

The owners collectively decided to put away 15% of the net income towards their rainy day fund, part of which they agreed might also fund future internal projects.

This left a little over $1.3 million to be split 5 ways by the owners, a $261k distribution per owner. This would be equivalent to a $436k salary for a corporate wage earner.

Scenario 4: Scaling Up Nicely

Imagine if the co-owners in Scenario 2 got their act together, improved margins, cut costs including their Manhattan office, and gradually scaled up. That’s the potential setup in this scenario.

The 2-owner agency has $22.5 million in topline revenue. They spent over $2.8 million on freelancers/subcontractors and close to $11 million on payroll. With a fully remote team, they’re able to have a broad range of experienced and junior talent at salary levels that are lower than if they had solely hired New York City employees. Expenses are fairly tight as well, giving the agency over $7.1 million in earnings before taxes.

If the agency can keep this up and even exceed $10 million in pre-tax earnings year after year, they’re going to be flooded with buyout offers from private equity shops or other strategic buyers. Even at $7+ million, they present an attractive option for buyers.

The owners, after paying taxes at a conservative 25% rate and setting aside $536k to the Rainy Day Fund, can divvy up $4.8 million in post-tax cash. This is a cool $2.4 million to each owner, the equivalent of a $4 million corporate salary per person.

Assuming the agency can keep growing or at least maintain this level of profitability and pre-tax earnings, the owners will continue to have more options. They can elect to sell all or part of the business to get a lump sum of money to defray risk or they can continue to keep milking steady profits and invest their post-tax dollars into different assets.

Takeaways

Over the past 14+ years as a co-owner of Barrel, I’ve operated within this fairly simple business model. I’ve seen this simulation play out in so many different ways, both in our business and in those of other agency owners who were willing to share.

When I first started out, what felt like success were the visible trappings–large headcount, big office, brand name clients, nice furniture, and catered lunch from cool spots.

However, as we struggled through some tough years, we gleaned a lot of valuable lessons and started to see what was essential to making this type of business work.

There are numerous factors to making it all work, but fundamentally, when sales is good and the work is done efficiently with a lean operation, there will be plenty to take home. The number of owners is also a big factor, as seen in Scenario 3. This doesn’t mean it’s bad to have multiple owners, just that a team with multiple owners needs to achieve greater scale for comp to go up. Lastly, it helps to keep clients happy and retain them, especially if you can do work for them with great margins.

One thing that really appeals to me is the prospect of running a profitable business for the long term. It’s not the sexiest thing in the world when compared to the blinding pace of VC-fueled growth businesses or the huge outcomes of tech companies, but there’s something neat about stewarding and growing a solid cash-generating asset over time. I’d love to scale Barrel to the size of the company in Scenario 4 and beyond.

And of course, when you’re able to build a sustainable cash-generating asset, it’s very possible to set yourself up for a lucrative exit later on, either to strategic buyer, a holding company, or to a private equity/investment firm. A good business gives its owners options, and this can come in the form of cash or various exit opportunities.

I periodically ask myself: what would I do differently if I were to start an agency today? And related to that: could I actually start my own agency today and build it faster and smarter?

I’ve found it important for me to be able to say “nothing” to the first question, because if there was something, it’d better be an initiative I’ve already started to pursue. An example is our shift to using more freelancer talent. I had caught myself wishing we could be better about leveraging freelancers to augment our core team during busy periods but making excuses about quality control and additional communications overhead. Thanks to some really patient and dedicated team leaders, we’ve been able to build out a robust freelancer pool as well as processes to support their use on various client projects. The shift wasn’t easy, but absolutely necessary to help us be a more flexible and scalable team.

When it comes to whether or not I could start my own agency today and build it up faster and smarter, I honestly don’t think so (and definitely don’t want to!). We had many lucky breaks along the way as well as the opportunity to build up a brand name. As experienced as I am today, it would take an immense amount of work to build things up from scratch. I take great pleasure these days in continuing to grow what we have, so the thought of starting from square one is a bit daunting.

This is not to say that I won’t start another business at some point in the future, but I’m having a good deal of fun working on the business right in front of me.

Very sobering your insight that after 14 years, you don’t believe you could build your agency faster and smarter. A lot of glass eating along the way sounds like.

Thank you for the thoughtful breakdown of different agency scenarios. As a new agency owner, your summary of sales and lean team is worth it’s weight in Bitcoin.

Very insightful information thank you for sharing it.

Thank you Peter for sharing such insightful information and the agency scenarios. Really enjoyed reading your articles. Thank you!

Fantastic breakdowns and analysis Peter. I’ve owned a boutique agency for 30 years and as the company grew I only saw my take-home go down. Keeping it lean and efficient now.

Very useful resource.

Very helpful! Thank you.

Spot on—we’re closest to Scenario 1. I used to dream of the scale in Scenario 2, but I’ve found this lean, efficient pace far more sustainable and rewarding. Great breakdown!