This is the 3rd edition of Recent Stock Buys, where I share my thinking behind recent stock purchases.

Disclaimer: I’m not an investment professional, so please don’t take any of these posts as investment advice. I’m simply looking for ways to get good returns while learning about businesses.

Intro

I was hoping to ease off on the buying in March and adopt a more “watch and see” attitude after heavy activity in February, but as the market slid and high growth tech stocks took a hit, I couldn’t help but deploy cash to increase my positions in some of my higher conviction stocks. I also picked up one new position in a company I’ve been a customer of for a very long time.

Towards the end of the month, my annual retirement contribution hit (I get it as a once-a-year lump sum), so I had some dollars to play with as well. Last year, I took my time deploying all the cash in this account. I didn’t want to think about it for too long, so I quickly made some choices that felt pretty good.

Here are all my trades of March 2021:

- Dropbox (DBX) at $23.38

- Zoom (ZM) at $323.71

- Snowflake (SNOW) at $225.43

- Okta (OKTA) at $202.12

- Cloudflare (NET) at $62.15

- Pinterest (PINS) at $68.66

- Berkshire Hathaway (BRKB) at $252.18

- Teladoc (TDOC) at $183.92

- Redfin (RDFN) at $68.54

- PayPal (PYPL) at $248.32

- Twitter (TWTR) at $66.12

Buying the Dip

- Zoom (ZM) at $323.71

- Snowflake (SNOW) at $225.43

- Okta (OKTA) at $202.12

- Cloudflare (NET) at $62.15

- Pinterest (PINS) at $68.66

- Teladoc (TDOC) at $183.92

The first week of March saw a significant pullback on many of the high-flying tech growth stocks that make up a good chunk of my portfolio. Snowflake, which I had bought a sizable chunk of in February at $305 slid down to $225. I had also bought Pinterest on two occasions in February, at $69 and $84, only to see it dip back to under $69 in early March. And then there were Zoom, Okta, and Cloudflare–all positions I had increased in late December that were below my purchase price. Lastly, I saw Teladoc, one of my Top 10 holdings, dip below my cost basis for the first time. I decided that if I liked the business when I first bought it and still believed in its long term potential, it made sense to double down. TDOC was my 2nd largest purchase of the month by value.

These are all companies that I feel great about for the long-term. I anticipate impressive, above-market compound annual growth rates (CAGR) over the next five to ten years for all of these businesses and am happy to have picked up additional shares “on sale”.

New Position: Dropbox (DBX) at $23.38

I’ve been a Dropbox customer for over a decade. I can’t remember a time when I didn’t have Dropbox. And yet, I had never really felt too excited about their long-term business prospects because beyond storage, it wasn’t clear how else they could provide value for their customers. Their collaborative document software Paper didn’t seem to be getting as much traction.

Digging a bit into their financials, though, this felt like a value tech stock that could be a solid hold as long as it maintained its steady lower-teens growth and great gross margins (79%). At over $2 billion in annual recurring revenue (ARR) and almost $500 million in free cash flow, this is a strong business that’s minting money. At the time of my purchase, the company was under $10 billion in market cap, so basically at 5 times sales. The company also seems to think its stock is undervalued as it initiated a $1 billion buyback in February.

With founder Drew Houston still at the helm and heavily invested in the success of the company, there could be breakthroughs in product to introduce new revenue streams. A week after I bought, Dropbox announced its acquisition of e-signature and document sharing service Docsend (those pesky investor decks) for $165 million. It’ll be interesting to see how Docsend integrates with Dropbox and if this can generate meaningful returns for Dropbox by increasing average revenue per user (ARPU) and attracting new customers.

Adding to a Safe Bet: Berkshire Hathaway at $252.18

I often like to think of my investing portfolio as consisting of four parts:

- Mega-cap tech stocks (FB, MSFT, APPL, GOOG, AMZN)

- Growth tech stocks

- S&P 500 index funds

- Berkshire Hathaway

One thing to note is that Apple is highly represented across mega-cap, S&P 500, and Berkshire (as of Dec. 31, 2020, Berkshire owned over $120 billion worth of Apple stock), so in many ways, my portfolio has very high exposure to Apple as a whole.

Even with Apple being a big component of Berkshire, I still find it one of the safest bets I can make in terms of investing in a stock whose business fundamentals are sound and margin of safety is quite robust (nearly $140 billion as of Dec. 31, 2020). Over the years, I’ve enjoyed reading Warren Buffett’s annual shareholder letters and listening to various analysts break down Berkshire’s many business units and investments. Not too long after reading this year’s annual letter, I decided to pick up more shares and increase my position (6th largest single stock holding in my portfolio).

The fact is, Berkshire is a cash machine. Its operating income – earnings from its businesses and not its stock investment gains – were $21.92 billion in a down year. The cash holdings pile up even as Berkshire continues to ramp up its stock buybacks while also plowing cash back into capital expenditures for its railroad and energy utility businesses. It’s hard not to respect the patient soundness of the Berkshire machine. It’s unlikely you’ll get double-digit annual growth with Berkshire in the future, but it’s very likely that Berkshire’s book value – the amount shareholders would roughly get if all of the company’s assets were liquidated – will continue to increase and provide a measure of certainty in the value of the company’s stock.

Greatly Increasing Smaller Positions: PayPal, Redfin, and Twitter

- Redfin (RDFN) at $68.54

- PayPal (PYPL) at $248.32

- Twitter (TWTR) at $66.12

With my retirement contribution dollars, I split it among PayPal, Redfin, and Twitter. I’ve had tiny positions in each of these companies for a number of years and was interested in holding more meaningful positions in each.

I’ve been bullish with digital payments in general and feel that PayPal is well-positioned to continue growing and being a leader in the space. The growth of their crypto trading business was promising, and I think the growing pie will be big enough for PayPal, Square, Coinbase, and others to all co-exist and continue making money. Also, after surpassing $300/share in mid-February, the stock cooled off enough and at $248, felt like a good entry point. It’s still seen by many as an overvalued stock based on its rich valuation versus fundamentals, but over time, I feel like its sub-$300-billion valuation will feel like a bargain.

With Redfin, I wanted to get some additional exposure to the red hot real estate market, the wave of millennials buying homes, and the growing popularity of instant buying (iBuying). While Zillow was another option I considered, I liked Redfin’s brokerage model (different from Zillow’s home search model where any broker can pay to list and sell on it vs. being a Redfin agent) of bringing value to sellers and buyers with lower commissions. I think in the long-run, this customer-friendly approach can build greater brand loyalty and also feed into Redfin’s other services like mortgages, iBuying, and rentals. Redfin is still a small company compared to Zillow (sub-$10-billion valuation vs. Zillow’s $30+ billion valuation as of this writing) and has lots of room to grow. After hitting an all-time high of $98, the stock fell back to Earth in recent weeks. I added significantly to my small existing position at $68.54/share.

Lastly, with Twitter, I felt I was making a bet in the social media platform that I personally use the most. I’ve gotten tons of value from Twitter over the past couple of years and have also met some really great people through the platform. The news of some ambitious product roll-outs was also promising: subscription-model revenue stream via Super Follows, live audio chat via Spaces, overhauling its ad platform, etc. all point to signs of a reinvigorated company that, given its relatively smaller number of active users, exercises enormous influence over news and culture. I’ve held Twitter stock for over 6 years and in that time, the stock felt like it was going nowhere (my cost basis was $37.97/share for my 2015 purchase). This time around, I think it’s on the cusp of meaningful growth, so I’ve doubled down for the ride.

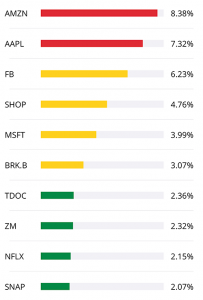

Top 10 Single Stock Holdings

In every Recent Stock Buys post, I share a snapshot of my top 10 single stock holdings. The major changes from the last post:

As of April 9, 2021:

- Teladoc (TDOC) new to the Top 10 at #7

- Google (GOOGL) no longer in the Top 10