This is the 2nd edition of Recent Stock Buys, where I share my thinking behind recent stock purchases.

Disclaimer: I’m not an investment professional, so please don’t take any of these posts as investment advice. I’m simply looking for ways to get good returns while learning about businesses.

Intro

I freed up some cash in January by selling out of my REIT and bond positions. With REITs, I felt that commercial real estate will only suffer more in the coming years as leases expire. Many businesses will embrace remote work and go office-less or, if they do require offices, may opt for more flexible options like WeWork that don’t require long-term leases. With my bond positions (a few Vanguard funds), I felt I could get better yield in stocks and regretted having parked so much there in the first place.

I also sold out of all index fund positions in my Roth-IRA account, which was pretty paltry to begin with, in order to invest in some higher growth stuff. I still have a fairly significant amount of my net worth tied up in S&P 500 index funds, so I decided to shift over to some higher risk, higher reward positions.

With extra cash, I was very enthusiastic with my purchases while the market was extra frothy. Writing this at the end of February after a brutal week of price declines, it doesn’t feel great as I’m in the red with many of these purchases, but these are all businesses I’m excited for in the long run, so I’m not too worried.

Here’s a TLDR listing of all the purchases. You can read more about my thinking behind each purchase.

- Adobe (ADBE) at $472.28

- Pinterest (PINS) at $69.61 and $84.00

- Asana (ASAN) at $39.50

- Amazon (AMZN) at $3,314.58

- Gores Holding VI, will become Matterport (GHVI) at $19.20

- Microsoft (MSFT) at $244.73

- Snowflake (SNOW) at $305.25

- The Trade Desk (TTD) at $861.40

- Roku (ROKU) at $467.75

- Magnite (MGNI) at $60.77

January 2021 Buy: Adobe

Adobe (ADBE) at $472.28

Adobe had been on my stock watch list for quite some time. I always hesitated pulling the trigger because the stock “felt” expensive, but I could argue that’s been the case for most other tech stock that’s benefitted from being SaaS, work collaboration, and cloud-based.

With Adobe, I actually had no excuse–as a customer for nearly two decades, I’ve seen their successful transition from software-in-a-box vendor to a fully cloud-based digital collaboration platform. My company Barrel has dutifully paid thousands of dollars per month for Creative Cloud subscriptions for our employees even as daily usage has migrated to tools like Figma and Mural. However, we still need tools like Photoshop and After Effects from time to time and Adobe Sign, which feels inferior to DocuSign, is our default e-signature tool just because it’s baked into the Creative Cloud.

Much like Microsoft and their all-inclusive 365 (formerly Office 365) subscription, Adobe is in a great spot to continue innovating and rolling in new tools into their Creative Cloud suite, which grew at a CAGR of 23% from 2017 to 2020. And like Microsoft, Adobe’s offering goes beyond the productivity software and into the realm of platforms with their Advertising Cloud, Experience Cloud, and Document Cloud, allowing enterprises to run their advertising, marketing, analytics, content management, document management, and ecommerce operations in a centralized way.

Adobe is a behemoth and will continue, I think, to produce solid CAGR in the high teens and low twenties for years to come. With enterprise value at nearly 17 times revenue (for last 12 months), it’s possible that a lot of the anticipated growth is priced in, but it’s also possible that there will be some M&A activity or breakthroughs via AI/ML technology that helps accelerate growth for the company in the coming years.

February 2021: Pinterest, Asana, Amazon, Matterport, Microsoft, Snowflake, The Trade Desk, Roku, Magnite

Pinterest (PINS) at $69.61 and $84.00

I bought Pinterest before and after their February earnings call. They reported strong revenue growth (67% YoY) and especially with internationally (145% YoY). Their user growth benefitted from international expansion (46% YoY). If they can continue to build their advertising platform and increase the average revenue per user (ARPU) from $1.57 per user (Q4 2020) to something in Facebook’s ballpark ($10.14 worldwide in Q4 2020 and an insane $53.56 in US & Canada), it can mean a ton of growth for the business.

Asana (ASAN) at $39.50

At Barrel, we’re moving all of our project and task management functions over to Asana. Following my “invest in what we use” approach which I followed with Slack, Atlassian, Shopify, Hubspot, and Cloudflare, I added significantly more to my existing small position that I bought close to IPO last year. I think this is a very sticky platform that has a great user experience and enough flexibility and features to grow in usage as the customer scales up.

I was especially impressed with the Invest Like the Best interview with founder and CEO Dustin Moskovitz, whose thoughts on the work graph (similar to the social graph but with work-related data) and reducing “work about work” resonated deeply with many of the challenges we face at Barrel.

Amazon (AMZN) at $3,314.58

You’d think that having bought Amazon at $312 back in 2014 would make me less inclined by buy it again at more than 10X the price, but I’ve tried my best to forget about old prices and to focus instead on the future prospects of the business. I’m not too worried about Jeff Bezos stepping down as CEO. I think the company will continue its steady growth with AWS and its ecommerce and logistics businesses. I don’t anticipate the stock to appreciate as quickly it has in the past couple of years (100%+), but the fast growth of their advertising business as well as expansion of ecommerce penetration as a whole will continue to be a tailwind.

Gores Holding VI, will become Matterport (GHVI) at $19.20

Matterport powers the 3D walkthrough images that have become more common on sites like Zillow and Redfin. It announced a merger with Gores Holding VI, a special purpose acquisition company (SPAC), to become a public company. This is definitely a FOMO hype stock that I bought on a whim with little due diligence, but the more I learn about it, the more I feel bullish in Matterport’s potential to bring more and more of the physical world into the virtual one in a cost-effective and immersive way. Their use of technology to seamlessly stitch together images is pretty cool, and that their machine learning capabilities only get better as their database grows is a nice flywheel model for a continually improving product.

Microsoft (MSFT) at $244.73

As with Amazon, I increased my existing position in Microsoft with the belief that it will continue to steadily grow, backed by the brilliant performance of its Azure Cloud offering (up 48% in Q1 2021). The company has also done well with their Office business productivity subscriptions and have become essential in new ways. For example, Microsoft Teams, a competitor to both Zoom and Slack, saw incredible growth in the past year (115 million daily active users).

Snowflake (SNOW) at $305.25

I had initiated a small position not too long after Snowflake’s IPO when the stock price cooled down to $223. More recently, I read an in-depth post by Scuttleblurb (paywall) and had some back-and-forth thoughts about whether or not I should go for a much bigger position at $300+. The common knock is that the valuation for Snowflake is incredibly high–it trades at over 70x revenue estimates for FY 2022! But the promise is that Snowflake’s incredible growth rate, its stickiness with enterprises that use its data warehousing platform, and the huge total addressable market that touches pretty much all industry sectors will live up to the valuation and perhaps see Snowflake being worth hundreds of billions of dollars (current market cap is around $70 billion).

I decided to take my chances and bought in at slightly over $300 in early February. Going to forget about this for a few years.

The Trade Desk (TTD) at $861.40, Roku (ROKU) at $467.75, Magnite (MGNI) at $60.77

I’m grouping the three of these together because I bought them all with my Roth-IRA funds. I decided to make that account a “future of advertising” theme. I added Pinterest alongside these when I bought the second time this month at $84/share.

With The Trade Desk and Magnite, I had owned small positions that grew massively in 2020. I didn’t know much about these companies when I made those buys as part of a “small cap tech” basket. This time around, I did some more homework and learned about how each of these companies participate in the digital advertising ecosystem. The Trade Desk is a massive demand side platform (DSP) that enables media buyers to engage in real-time-bidding to get different ad formats to the right audiences. Magnite, on the other hand, is a supply side platform (SSP) which aggregates digital advertising inventory from publishers and platforms and connects with DSPs like The Trade Desk in order to get these ad slots filled. Check out this very informative primer on programmatic ads by Dhaval Kotecha for some easy-to-understand diagrams.

With Roku, I think it fits well with the growth of connected TVs (CTV) and the shift of ad spend from traditional television programming to those that show up on streaming services. Roku continues to grow its base of users and serve as an aggregator of streaming services, fueling its fast-growing advertising business. Both Trade Desk and Magnite are also seeing lots of growth from CTV – the overall pie will continue to expand as traditional TV dollars continue to flow out towards digital alternatives.

All three stocks are very expensive by any measure (TTD at 45x, MGNI at 25x, and ROKU at 28x last twelve months revenue), but my bet here is that more and more advertisers will start incorporating over-the-top (OTT)/CTV advertising into their marketing mix in the coming years and these companies are well-positioned to benefit.

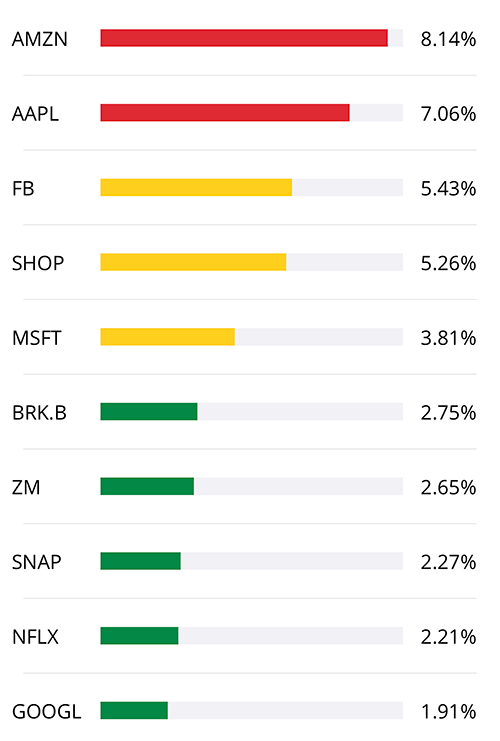

Top 10 Single Stock Holdings

In every Recent Stock Buys post, I share a snapshot of my top 10 single stock holdings. The major changes from the last post:

- Amazon is now at the top spot, surpassing Apple

- Microsoft entered the Top 10 at #5

- Both Snap and Google entered the Top 10 at #8 and #10, respectively

- MercadoLibre, Peloton, and Teladoc fell out of the Top 10

As of Feb. 26, 2021: