It’s been almost 9 months since my last personal finance update. You can see all my past personal finance updates right here. Over the years, I’ve gone from talking about personal finance tools to focusing more on asset allocation, the investment decisions I make with my money.

Note: All content here is for informational purposes only and do not constitute any investment advice. Please do your own due diligence and make your own investment decisions.

Note on What’s Included / Excluded

The numbers discussed in this post include most of my brokerage accounts, bank accounts, and retirement accounts. They do not include all of my wife’s accounts, just some of our joint accounts. Over time, we have moved to handle most of our family finances centrally, but we still maintain our personal bank accounts separately, so cash amounts held by my wife are not reflected here nor are her retirement amounts and her taxable investments, which are 100% in low-cost index funds. I’ve also excluded our two sons’ 529 plans which we contribute to regularly to each month.

As I’ve done in past updates, I’ve excluded our primary residence and my parents’ co-op in Sunset Park. I’ve also excluded any angel/LP investments and real estate partnership investments to keep things simpler. This snapshot also excludes the value of my stake in Barrel as a business.

I believe that in the next 3-5 years, my private investments in early stage startups and VC funds may turn out to be a significant part of my net worth. In the past 12 months, my Barrel partners and I launched Barrel Venture Partners and ramped up our efforts to increase deal flow and get in on promising early stage investments. However, because of the opaque and uncertain nature of private investments and their valuations, I will continue to refrain from counting these investments until they experience some kind of liquidity event (e.g. they get sold, go public, etc.).

My Holdings

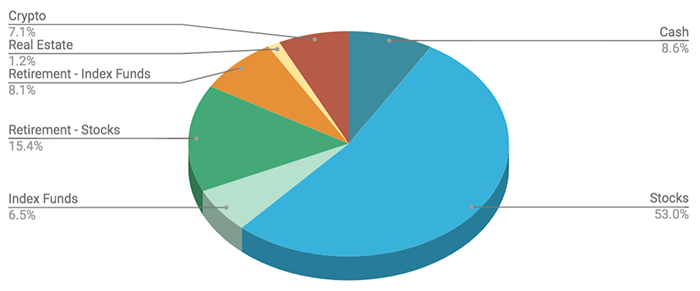

The overall value of my holdings increased by 30.6% since mid-September 2020 (8.5 months). The foundational contributor was savings from my Barrel income, some going to cash and some going into stock and crypto investments. The wild appreciation of crypto was a big driver. My stock investments also grew during this time.

Note: I use Personal Capital (disclosure: referral link) to track my holdings. I bring the numbers over to Google Sheets and also add in my crypto holdings (via Coinbase) to get the full picture.

These percentages are as of June 4, 2021

|

As of June 4, 2021

|

|

|

Cash

|

8.6%

|

| Stocks |

53.0%

|

| ETFs / Mutual Funds |

6.5%

|

| Retirement – ETFs / Mutual Funds |

8.1%

|

| Retirement – Stocks | 15.4% |

|

Real Estate (REITs, Fundrise)

|

1.2%

|

|

Crypto

|

7.1%

|

Here’s a 3D pie chart view of the same data:

Income Source

Almost all of my income comes from my business, Barrel. My co-founder Sei-Wook and I follow the Profit First model and each take a percentage of our total revenues as pay every two weeks as well as a set percentage of quarterly distribution. As the business has grown, the numbers have steadily increased over the years. Looking back at our first full year of compensation in 2007, the 2020 numbers were almost 13x the amount. In 2007, we paid ourselves the bare minimum to make rent on our respective apartments (for me, a $700/month room in Astoria) and to buy some groceries. It was lean times back then. Thankfully, our perseverance has paid off and we each make enough to live comfortably and put money away for savings and investments.

Minimal amounts of cash comes from dividends, a few thousand dollars a year. I used to be really into holding high-yield dividend stocks, but I’ve soured on stocks that distribute taxable cash and prefer businesses that retain earnings and reinvest in their growth with value showing up in the appreciation of their stock price over time (check out this article on Warren Buffett’s take on dividends, which inspired me to revisit my investing approach a few years ago). This is why I’ve been focused on identifying and buying high growth tech stocks more than anything else.

More Aggressive Allocation Into Stocks

I continued shifting my assets from instruments like bonds and real estate investment trusts (REITs) into high growth technology stocks. I’ve chronicled my stock investing journey in several posts and feel good about the roster of businesses in my portfolio. With many of these companies, I anticipate holding for years to come and potentially adding to them along the way.

In April, I conducted a “spring cleaning” of my portfolio and sold off my low conviction positions while creating a new rubric to help me monitor my higher conviction picks as well as evaluate new opportunities. I’m feeling pretty good about this approach and know that my true advantage is time arbitrage – my ability to patiently hold stocks for long periods of time and weather through the ups and downs. It’s an approach that’s helped me over the last 5+ years with stocks like Apple, Amazon, Facebook, and Netflix.

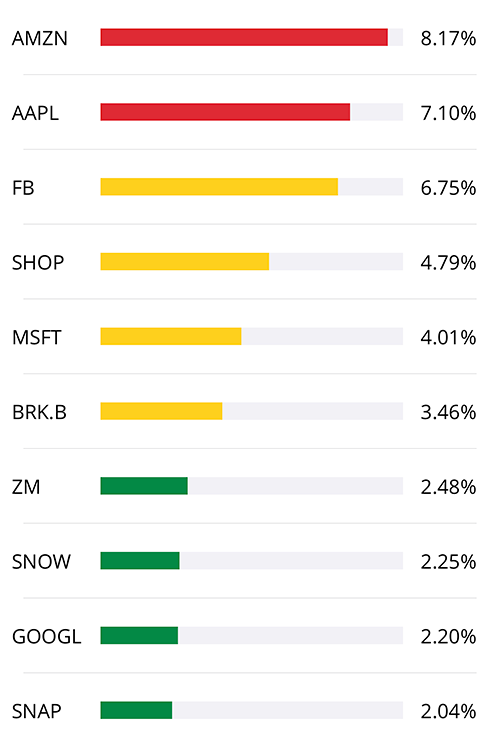

Here’s a snapshot of my top 10 holdings, which now make up 43.25% of my single stock investments:

My top ten single stock investments, which make up 43.25% of the portfolio.

Combined with my index fund holdings, most of which track the S&P 500, a great bulk of my investments are tied up in Big Tech – primarily Amazon, Apple, Google, Facebook, Microsoft. I view these as relatively “safe” holdings that continue to grow as businesses with strong (i.e. monopolistic) holds on things like commerce, mobile, cloud computing, and digital advertising. I’ve focused my investing energies into finding the next generation of companies that may grow to join the ranks of these Big Tech companies one day. In the past 12 months, I’ve ramped up my positions in companies like Snowflake, Zoom, Cloudflare, and Okta. It’s still early days for these businesses, but my bet is that they will experience steady growth over the next 5-10 years.

Living Through Volatility

The main drawback of being invested in assets like high growth technology stocks and cryptocurrencies like Bitcoin is the volatility. The prices can fluctuate pretty drastically over a short period of time.

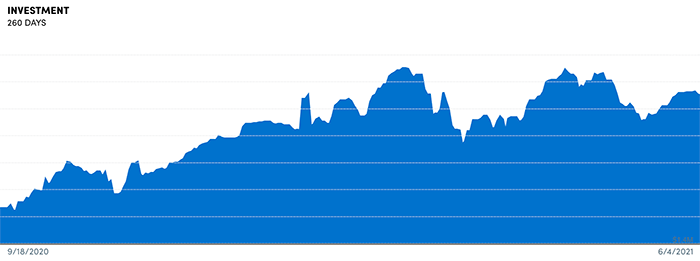

This chart shows the ups and downs of my investment portfolio over the last 9 months:

Volatility of my stock investments over the past 9 months. Note the peaks and valleys in the middle.

There have been some high peaks and low valleys. I remember weeks when I saw dozens of positions lose thousands of dollars each. I also remember moments when it felt like prices would keep going up forever. All throughout, I told myself not to let daily prices impact my thoughts and instead, to focus on the long-term prospects of my investments.

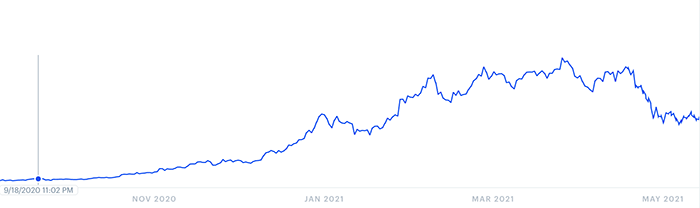

The volatility has been even more intense on the crypto side, where the prices of Bitcoin and Ethereum skyrocketed to new highs before pulling back and giving back nearly 50% of the gains.

My crypto portfolio’s volatility has been even more drastic.

All throughout, I’ve kept my bi-weekly purchases of BTC and ETH going and won’t pay much attention. I have my reservations about whether or not cryptocurrencies are great long-term investments (Bitcoin die-hards may find that blasphemous), but I’m contributing relatively small sums and writing this off as one might an expensive lottery ticket habit.

I feel like I’ve been pretty good about staying even-keeled and not letting volatility impact me much. I do wince when I see the total value of my investments down by more than 10% after a miserable week of drawdowns due to fears of inflation or some other macro-economic news, but prices usually bounce back, and I feel more assured by following quarterly earnings and seeing that the companies I own are performing well as businesses.

The oft-repeated mantra for me is: you’re in it for the long-term, be patient.

Reminder to Keep It Simple

I’ve had the privilege of investing excess funds to test out and learn different types of investments over the years. The returns have been okay, but the learning experience has been invaluable. I think if I was solely focused on wealth creation and being safe, I would have been better off sticking with a “set-it-and-forget-it” approach of buying index funds. I found myself agreeing with personal finance guru Ramit Sethi when he tweeted about how the investment opportunities available to rich people (i.e. accredited investors) are often very overrated:

I agreed with Ramit Sethi’s tweet about rich people and their access to better investments – it’s not necessarily true.

More exclusive opportunities don’t necessarily mean they’ll have better results. I learned from first-hand experience of getting pre-IPO shares of Lyft or in various angel and real estate investments that perhaps sticking the same amounts in an S&P 500 index fund could have yielded much better results. These opportunities did, however, do a great job of stroking my ego and making me feel like I had “made it”.

And if I’m honest with myself, many of these “cooler” and “more exclusive” investments have been about FOMO, the hope of a 100x home run return, and the feeling that “not everyone gets to be in on this.” The more I continue to educate myself and become a disciplined and discerning investor, I should be able to block out these more emotional pulls and instead evaluate the risk and rewards with clearer eyes. That said, such behavior may take years, and even decades to truly hone.

Looking ahead, I want to tell myself to keep it simple:

- Keep auto-investments into index funds going (set it and forget it)

- Make a handful of single stock picks each year after doing my due diligence

- Make a handful of early stage investments each year but don’t go overboard

- Be laser-focused on Barrel and continue to increase the value of the business as well as its free cash flow

The Joys of Self-Managing My Finances

I used to think that once you hit a certain income level, it was the “right thing” to entrust everything to a wealth manager. I’m not totally ruling this out because I can see scenarios where having professionals handle the myriad of investments and tax implications may help me in the future.

For now, I want to take the opportunity to learn as much as I can about managing money and seeing how much I can grow and diversify our family’s assets on my own. Managing my own finances has been a fun subject to nerd out on, and my increasing literacy has given me confidence to make decisions on my own versus deferring to others or staying ignorant and doing nothing.

Like many people, I grew up in a household where we never talked about money openly all while knowing that money was a big stressor. What got imprinted in me as a result was that the only way to not be stressed (and therefore happy) was to have a lot of money. However, this did little to help me understand the true value of money, what it enables and also what it’s unable to do. In the end, money is a tool, and like all tools, there are instances where it’s appropriate and instances where it’s useless and even harmful. Understanding this about money is something that comes from openly discussing and understanding it head-on versus making it a taboo topic that only rears its head when there’s trouble. Personal finance and money literacy is something I hope to instill in my kids as they grow up. In order to do that, it means I’ll have to continue my own education as well.

This was a fantastic read, Peter. I love how well-written and level-headed this post is. Thanks for sharing your asset allocation, I tend to follow a similar allocation and looking to expand consistently over the next 3-5 years.

Wishing you further success in your future endeavors! Hope to meet you some day down the line.

Great read as usual Peter! Loved how you avoided sharing anything on Angel investing and your reflections on how your approach to and discipline with personal finance has grown over the years (and will continue to). A great treatment to the long game and importance of reflection.