In my twenties, I rarely thought about my personal finances. I paid my bills, paid off my credit card each month, and kept up with my student loan payments. I didn’t think too much about retirement savings, and whatever leftover money I had, I kept in a savings account.

It was only when I was close to turning thirty that I started to think more about my finances. A couple of blogs influenced me:

- Mr. Money Mustache: This blog is about a man who achieved financial freedom at age thirty through savings and disciplined frugality. A couple habits I picked up from his blog were: 1) not buying things I didn’t absolutely need and 2) putting away a more significant portion of my income into savings. From reading the blog, I also realized that I had enough money to immediately pay down the balance of my student loans rather than keeping cash in a sub-1% interest-bearing savings account, thus eliminating all those extra interest payments. Looking back, so many financial decisions seem like common sense, but I just wasn’t paying any attention.

- Dividend Mantra: This blog (no longer run by the same person) chronicles the journey of a man trying to find financial freedom by age 40 through frugal living and investment of his savings into high dividend stocks. Dividends are payments made by companies to shareholders. Not all companies pay dividends, but there are companies that pay as much as 5-6% annually per share. So if you own $1,000 worth of a company’s stock, you could get $50-$60 in cash over the course of a year. What Dividend Mantra is trying to do is to accumulate a portfolio that will generate enough dividends to support his living costs, making it possible for him to live without holding on to a full-time job. The blog goes into great detail about each of his stock purchases as well as line-by-line breakdown of his monthly expenses.

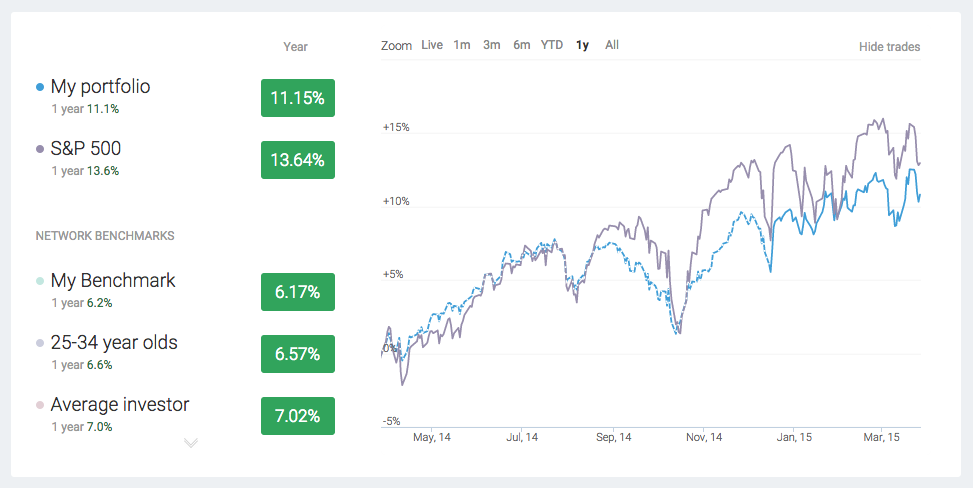

Over the past couple of years, I’ve slowly become better at saving and investing. From not having any plan, I now save around 60% of my monthly income, splitting it between Sharebuilder stock brokerage account and a Betterment account. I use Sharebuilder to buy individual high dividend stocks each month. I use Betterment for their auto-investing service—all I had to do was indicate the stocks-to-bonds ratio I wanted for my portfolio, set a monthly deposit amount, and let them take care of the rest (for a small fee). Because all of my Sharebuilder investments are stocks, I’ve set my Betterment account to be mostly bonds. If you’re interested in the breakdown of my investments, you can check it out on Openfolio, a service that lets you share your portfolio and also benchmark and follow the investments of others (the image at the top is a screenshot from its Dashboard page).

My goal is to continue upping my monthly contributions so that I can put away as much as 70% of my monthly income towards investments. This will require some discipline on my end in terms of controlling my expenses. I think being smarter about spending habits will help. I’ve written previously about how eating brunch at home has been a great money saver. Drinking less and cooking at home are also ways that can contribute to savings very quickly. I’m not one to completely give up a good time out with friends and family, but I also know that going out too often quickly loses its appeal and becomes repetitive. I think a good goal for me will be to limit dinners and drinks out to once a week.

A few other resources on personal finance

- While I didn’t agree with or follow all of the advice in the book, I thought Tony Robbins’s Money: Master the Game was a nice, inspiring read about taking control of personal finances. I’ve recommended it to some friends, and one thing I did act on was to get rid of my investments in mutual funds with high fees and to buy low-fee index funds instead.

- Smartphone apps: I use SigFig to link up all of my investment accounts and to see an aggregated view of performance and holdings. I also check Mint every now and then to review my credit card charges and bank accounts. I’ve also been playing around with Robinhood, a startup that lets you buy stocks commission-free. I’ve put a small amount of money in here to speculate on stocks I normally wouldn’t buy. I won’t be funding this account regularly, but I was thinking about collecting loose change around the house and investing with that for fun.

I think being able to manage personal finances is an important life skill that only becomes more valuable as you get older. I’ve been lucky that my personal income has grown over the years with the growth of my business, but I know that earning more money is only part of the equation. By eliminating wasteful spending and becoming more comfortable with investing, I’m hoping to make gains in my thirties to make up for missed opportunities in my twenties.

One thing that I want to answer before I finish: what’s the ultimate goal of saving, investing, and tending to my personal finances? For me, it’s not about early retirement or reaching some kind of magic number. What I’d love to see is slow and steady growth that gives me a sense of security and stability. I know that money can be a powerful tool in giving me the flexibility to go places, spend time more freely, and to help people in need. To that end, I’m excited to continue learning ways to better understand and manage my personal finances.