Intro

I’m starting a series to share my stock investments and what was going through my mind when I bought them. I’m hoping that over time, I’ll be able to revisit these posts and see what I got right and what I could have assessed differently.

I’m not an investment professional, so please don’t take any of these posts as investment advice. I’m simply looking for ways to get good returns while learning about businesses.

You can sign up for my newsletter to get updates whenever I published these posts, which will probably be around once a month. You can also check out my non-retirement holdings here.

General focus

When I analyzed my 2020 stock purchases & lessons learned back in October, I mentioned my primary investment themes. These were:

- Cloud infrastructure

- Team collaboration

- Digital commerce

- Entertainment & media

- Social media

- Telehealth

You can read more about each of these themes and the companies I hold in the blog post. I intend to continue buying mostly within these themes. If you look at these as a whole, it’s clear that the overarching theme is about connectivity, better user experiences, convenience, increased access, and mobile computing.

December 2020 Buys: Airbnb, Okta, Cloudflare, and Zoom

Airbnb (ABNB) at $135.00

After much anticipating and believing it to be a sure thing, I balked at buying Airbnb on the day of its IPO on December 9 when its stock skyrocketed and closed at $144.71. Things cooled off over the next few days so I put in limit orders for $135 and $120. The $135 order got filled pretty quickly on December 14 but the stock never dipped low enough to fill my $120 order.

I once thought I would pick up a much more significant amount of Airbnb shares, but I don’t mind starting with a smaller position and steadily building my position over time as the business fully recovers from COVID-19, gets its international bookings back, and continues to improve its financials through scale.

I enjoyed reading this analysis of the S-1 and feel that Airbnb will need to keep on innovating and keeping its hosts happy in order to compete with the likes of Booking.com and Vrbo.

While Airbnb is often categorized as a hospitality business, I think it fits nicely into my digital commerce thesis as a platform that facilitates seamless transactions between hosts and guests.

Okta (OKTA) at $259.38

Okta is an identity management solution that helps businesses manage permissions and access to software applications. In a world where employees need an ever-growing array of software services to do their jobs and companies interact with customers via software, Okta is a fast-growing identity layer that will become increasingly important in managing security and privacy concerns. This Founder’s Field Guide episode with Okta co-founder and CEO Todd McKinnon provides some great background on the business and the vision.

Okta reached a 52-week high of $287.35 in late December. Having established a smaller position at $195 earlier in the year with some retirement funds, I had told myself I should continue to increase my position, but I ended up chasing other stocks and forgot for a while. In the days after hitting its high, I noticed Okta starting to slide and thought it would be an opportune time to jump in. I bought a much more significant position this time around and look forward to holding it for a very long time.

As Okta grows into a full-fledged identity platform that is an integral part of every piece of business software (akin to how Stripe is the go-to payments platform for so many software companies), it’s possible to imagine the company’s market cap expanding way beyond its current $30-billion range. However, in the near term, the company needs to keep up its growth to live up to its 40x revenue valuation and expand its adoption among businesses.

Cloudflare (NET) at $77.50

We’ve been happy Cloudflare customers for some years now at Barrel, using their content delivery network (CDN) services to protect and speed up websites we deploy for our clients. I first bought in back in September 2019 when it IPO’d and have added to my position since then.

Since then, Cloudflare has continued to build its massive edge computing network and expand its security and developer offerings. This massive in-depth post on Cloudflare’s 2020 innovations does a great job of going into the details of their technology and how all the pieces fit. I was also impressed with COO Michelle Zatlyn’s interview on Founder’s Field Guide. I like where Cloudflare is positioned as it becomes an embedded solution for security and performance in the ever-growing cloud.

Zoom (ZM) at $345.06

I’ve been all over the place with Zoom. Having bought when it IPO’d in 2019 for $63, I shed some shares at $164 and again at $237 when COVID-19 sent the stock shooting straight up. I didn’t need the money, but I panic-sold to “capture some gains” instead of thinking long term. I’ve since corrected my ways, but I’ve also gone in the other direction and picked up Zoom at much higher prices: $497, $382, $521, and $373.

After picking Zoom up at $521 in October on an impulse, I’ve been looking for ways to dollar cost average it down by buying shares whenever it dipped in price. With my latest purchase at $345.06, I now have a cost basis of $357, a far cry from when I saw monster gains from my $63 entry point.

I think Zoom will continue to grow as a business. Its video conferencing is sticky as hell and the enterprise voice calling Zoom Phone solution has surpassed 1 million seats. I’m eager to see how Zoom expands its offering. It’s very clear that Zoom is gearing up for some kind of acquisition. There’s talk of Zoom offering its own email service or perhaps getting into productivity software. The big question mark is whether Zoom will be able to execute at the same level on something new as it has with video conferencing. I’ve become a fan of founder and CEO Eric Yuan and am willing to hold for the long term to see what he does.

January 2021 Buys: Stitch Fix, Draft Kings, IAC, Facebook

Stitch Fix (SFIX) at $56.00

Stitch Fix had been on my radar since I listened to founder and CEO Katrina Lake on Founder’s Field Guide back in August. I wasn’t convinced that Stitch Fix had figured out personalization or hit upon a really compelling shopping experience, but I felt the company would have a leg up on other sellers of clothing through its embrace of data science, tech, and logistics. I told myself I would start a small position at some point.

Then, in late December, I heard an Invest Like the Best podcast with Marathon Partners Equity Management’s Mario Cibelli and his take on his visit to Stitch Fix’s distribution center really resonated with me. For context, Cibelli was an early Netflix investor who did due diligence on Netflix’s distribution centers to see how it was clearly outcompeting Blockbuster during the DVD days. Cibelli’s impression of Stitch Fix was that the way it handled logistics makes it very different from traditional e-commerce businesses and the innovation will allow them to distance themselves from their competitors. These include: being designed to handle a very high volume of returns (a margin killer for typical ecomm businesses); a system that allows them to send a predictable number of shipments out per day; and products boxed in a way that clothes can be tried on right away vs. the plastics and pins that typically accompany packaged clothing.

A thought that occurred to me was: could Stitch Fix one day transition from a direct seller of clothing to a seller of backend services for other clothing retailers and brands à la Amazon with their marketplace and AWS? A thought I had was that perhaps they offer personalization APIs and logistics services and become a standard for how people buy clothing online.

Draft Kings (DKNG) at $46.00

I promised myself to do this less, but Draft Kings was a FOMO-driven buy as my friends all picked up positions, and I didn’t want to feel left out. I don’t know the sports gambling landscape too well but it’s clear that more and more states will legalize sports gambling and the pro leagues have embraced them as well. The question is how well Draft Kings will fare against the competition, which includes FanDuel, BetMGM, and Penn National Gaming (driven by Barstool Sports). I won’t be too upset if this stock stagnates but I also won’t be too surprised if the stock continues to stay hot and keep gaining.

IAC (IAC) at $190

IAC is a holding company that wholly owns or holds majority control of brands like ANGI Homeservices, Vimeo, Care.com, and Dotdash. In 2020, IAC completed its spin-off of Match Group (MTCH), which owns dating brands like Match.com, Tinder, okcupid, and Hinge. I’ve owned a position in Match Group for some time and it’s done pretty well, going from $66 to over $150 in less than 2 years.

My interest in IAC comes because of its plans to spin off video hosting service Vimeo. I’ve used Vimeo personally and for Barrel since its inception and have seen its transformation from higher brow YouTube-wannabe to an enterprise video hosting solution and indispensable tool for creatives. While IAC saw a jump in stock price on news of the spin-off, implying that the gains are pretty much baked in, I can see a scenario in which Vimeo continues its fast growth (44% year-over-year in Q3 2020) and grows into a solid standalone business.

Facebook (FB) at $248.54

Back in 2015, I started buying up as much Facebook as I could, seeing how much of our clients’ dollars it was consuming via its advertising platform. The staggering growth of Instagram was also a sign that Facebook was just getting started.

The scale and financial success of Facebook is truly staggering. The company continues to mint profits, and calls for boycotts, especially over the summer, didn’t make a dent. It’s an amazing money-making machine that knows how to take ads and put them in place of the people who’re likely to respond to them.

Facebook feels like a risky company to own in the long-term because of various threats: government regulation and anti-trust moves might break it apart; hate speech, misinformation, and other unsavory uses of the platform continually plague its brand; and there are social media platforms like Snap and TikTok siphoning off its user engagement. I don’t see Facebook’s position eroding much in the coming years and can even see further growth as it extends its tentacles further down the purchase funnel and integrates its platforms more tightly with checkouts and payments.

Facebook is my third-largest single-stock position. It was by far my largest position until 2019, when I sold some to fund the down payment on our new apartment. I joked to my friends that I’m investing in Facebook now to fund my future vacation home. I added a good chunk of shares in October at $279 and saw the price slide down steadily since then. It felt like a good time to add some more once it hit below $250. Even with that, my overall cost basis for Facebook stock is right around $131.

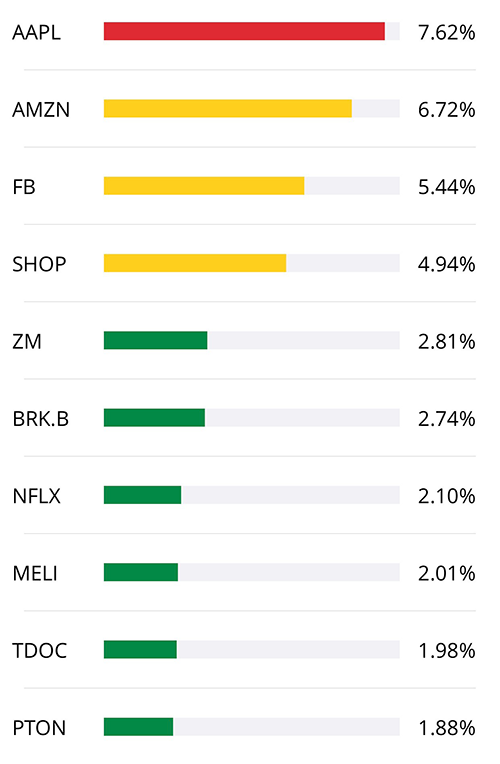

Top 10 Single Stock Holdings

I’ll include a screenshot of my top 10 single stock holdings every time I do a Recent Stock Buys update so I can go back and see how this evolves over time. I use Personal Capital (disclosure: affiliate link) to link all my brokerage and retirement accounts together and see stuff like this.

Here’s the latest as of January 18, 2021:

I’ve owned shares of Apple since 2008 and Amazon since 2014. Cool to see these two really grow over the long-term.