I last wrote about my personal finance “stack” in the summer of 2017. A lot has changed since then, so I want to make this an annual activity and use it as an opportunity to examine how I’m managing my money. Without going into any absolute figures, I’ll share how I organize my money, what types of investments I’ve made, and the services and tools I use. Money is something that’s still a tough topic to freely discuss with friends and family, but I think there’s a lot to gain by sharing different approaches and methods. If you have any tips or approaches to share, feel free to email me!

Main Sources of Income

My primary source of income comes from Barrel. I receive a deposit every two weeks. We follow a business finance framework called Profit First (check out the book) where owner’s comp is determined as a percentage of the receivables collected during the past two weeks. This number fluctuates depending on the company’s performance and its ability to collect, so I have to make sure I keep a bit of buffer in my checking account for leaner months. I also receive a quarterly profit distribution, which typically goes right into some kind of investment.

My other sources of income are mainly from my investments. I get dividend income from my stock holdings as well as from my real estate investments. In 2018, my total dividends added up to nearly 3-weeks’ worth of salary (if I took an average of my Barrel income), which I used to invest in more opportunities.

My only other major income source was on the sale of a West Philly real estate property that I invested in with friends. It netted a nice 30% return for what was less than a 6-month period to buy, lightly renovate, and flip a house.

Expenses

I went back and looked at all my bank account transactions from 2018, and I was surprised to see that for every $1 I had in expenses, I put $2 to work in investments. I was convinced for a while that I was spending way too much going out and buying stuff, but I felt a lot better after looking at the hard numbers.

My biggest expense for the year was the mortgage plus the maintenance fee on my parents’ co-op in Sunset Park, which, from a quality of life perspective, is one of the best uses of money I’ve made in my life. Having my Mom and Dad live just a 10-minute drive away, especially now that Mel and I have a baby, is incredibly helpful and priceless. Plus, our son will be able to grow up with his grandparents nearby.

My personal credit card statements were fairly predictable month-to-month: dining out, books, gym and streaming subscriptions, and ride sharing. I bought a few articles of clothing and shoes throughout the year as well and also spent a fair amount on wine and liquors, both for myself and as gifts.

I contribute a monthly amount to a joint family account that I share with Mel (roughly 20% of my monthly income). We use it to pay our utility and cable bills, life insurance premiums, home supplies, and groceries. We’ll also use it occasionally to book travel although we usually have to supplement with our personal credit cards. It’s a lean account that typically has a balance closer to zero towards the end of the month after everything’s been paid up.

Investments & Savings

Here’s a breakdown of how I allocated my money in 2018:

- Private equity in startups: 35%

- Real estate: 25%

- Stocks: 23%

- Cash: 16%

- Crypto: 1%

Startups

In 2018, I made 4 investments in startups. Three were early stage but I got to know the founders and thought they were very promising. The fourth one was in a well-known startup that I hope has a successful IPO in 2019. I don’t think I’ll be as aggressive in allocating so much of my personal funds to startups in the future, but it was an interesting experience and a chance to observe and participate in the investing process (I invested with a group of friends for all of these). It became super clear to me that, especially for early-stage startups, so much hinged on pre-existing relationships with the founder and the belief in that founder’s abilities and track record vs. anything substantial or concrete about the venture itself. Hopefully these companies start taking more solid shape and gaining traction.

Real Estate

I love real estate. It’s not glamorous, but it provides a real need (housing) and offers both cash flow and tax advantages. A big, big shoutout to my buddy Welton for being the driver and mover behind almost all real estate deals that I participate in. In 2018, I invested in two more West Philly projects. One was a 5-unit gut renovation project that, by mid-2019, should become an income-generating property. The other was the flip that I mentioned above, which happened at lightening speed and returned all my capital plus a sizable gain in less than half a year.

I also had the opportunity to invest a small amount in a Brooklyn property. It’s actually a building that’s just a couple avenues over from my own apartment, and I pass by it every time I go running at Prospect Park.

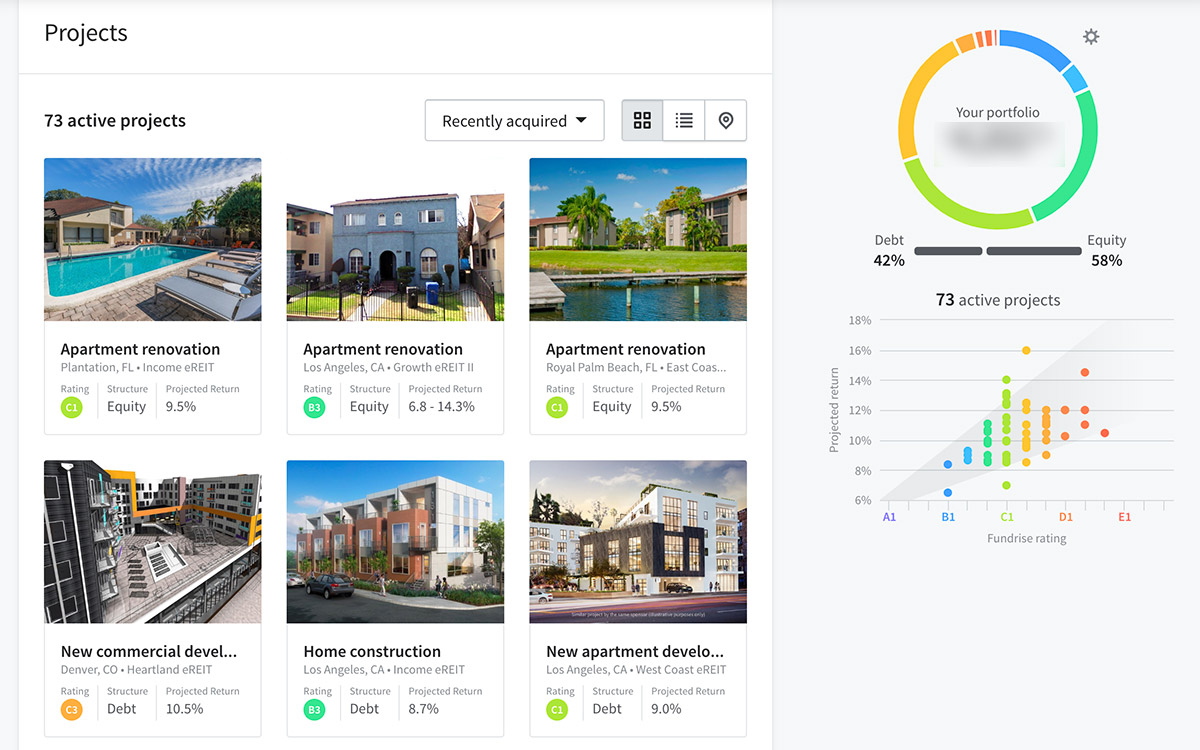

A screenshot from Fundrise showing some of the projects I’m invested in through their platform. On the right is a chart showing the distribution of the 73 active projects and the types of investments they are by rating (risk level) and projected returns.

Towards the end of 2018, I started to up my recurring monthly investments in Fundrise (disclosure: if you sign up using this link, I get a referral bonus, which basically waives my fees for 90 days), an online real estate investment platform. I had put in $1,000 a couple of years ago just to test it out and noticed that it had already returned 20%+ during that time in quarterly dividends. I took a closer look at the various mix of projects, which span all over the United States, and thought it’d be an easy way to diversify my real estate investments. Fees-wise, Fundrise takes 1% annually, 0.15% of it for “investment advice”, which is basically the use of their online platform, and 0.85% for the actual asset management costs. There’s also a 0-2% “Asset Origination/Acquisition” fee that they levy for putting their portfolios together. For my plan, I’ve selected the Balanced Investing approach, which promises both dividend income and a good amount of property appreciation. My Fundrise account should be growing significantly in 2019 now that I have automatic investments enabled, so I’ll be able to report back on its performance in 2020.

Stocks

We all know how poorly 2018 ended in terms of the public markets. One big shift happened for me in 2018–I stopped picking and buying single stocks and decided to focus solely on index funds. I do have a small recurring amount that goes to a basket of tech and e-commerce stocks on Motif (disclosure: another referral link that gets me a free month on Motif), but I began allocating larger chunks to index funds. I figured that since index funds already reflect winning stocks and rebalance as companies come in and out of the S&P 500 or whatever other formula the portfolio manager is using, there’s no need to handpick “winners” on my own and load up on risk. Plus, I have way too much exposure to a handful of tech stocks right now that I thought it was a good moment to change course. The ironic thing is that a big chunk of these index funds right now are driven by the big tech stocks, namely Apple, Microsoft, and Amazon, but I’m buying into the index funds with every intention of holding for the next few decades, so it’ll be a case of “set it and forget it”.

In terms of the specifics, I been buying two index funds, both with Fidelity. The first is their FZROX Total Market Index Fund, which tracks 2,500+ stocks and is supposed to be broader in terms of exposure to mid and small cap companies in the US. The attractive thing about this index fund was the zero fees. I also bought FXIAX, which is Fidelity’s version of the S&P 500 index fund. It’s got a low 0.015% expense ratio, which is better than Vanguard’s 0.14% expense ratio for their S&P 500 index fund. I’ve been putting away about 25% of my income into these for the past 6 months. If I don’t end up investing as much into startups this year, I’ll probably buy even more.

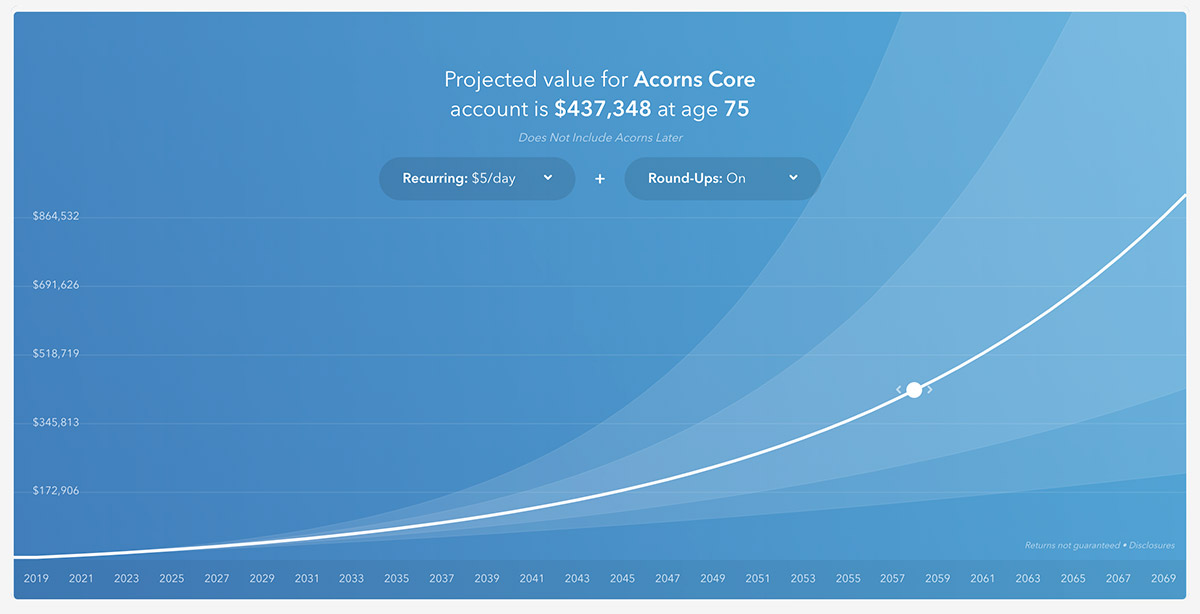

Based on my current investment level of $5/day and some round-ups, I can expect to have a portfolio worth $437k+ in 40 years. Not bad for what amounts to a cup of matcha each day!

One more thing I should note – I’ve been using Acorns (disclosure: referral link) for over 2 years now and it’s still taking $5/day from my bank account as well as any “round-ups” from my credit card transactions (e.g. if I paid $2.81 for coffee, Acorns would take $0.19) and investing it into a mix of index funds and ETFs. If you’ve never bought stocks or saved much in the way of investments, I’d highly recommend just putting a few bucks away per day into Acorns–it’s super easy to set up and it’s got a beautiful intuitive interface. I’ve had friends and family get on this and it’s been great to see them get in the habit of saving and investing.

Cash

With rising interest rates on savings accounts, I opened up a banking account with Citizens Access to take advantage of their rates (2.25% as of this writing). I’ve typically held very little in cash, preferring to plow it into stocks or other investments. However, with the market down, I’ve decided not to sell any of my stocks (while hoping they’ll bounce back at some point in the future), and so that’s limited a source of capital that was so handy during a bull market. For example, in 2017, I remember selling some of my stocks to help pay for the down payment on my parents’ co-op. Within a month of having sold stock, the market had continued its frenzied rally and left my portfolio higher than before I had sold any shares, effectively giving me a “free” down payment (of course, nothing is ever free, especially if there are capital gains and tax implications, but it was a nice feeling!). With such rallies a thing of the past in this bearish market, I’ve decided to squirrel away chunks of cash so that I’ll have the flexibility to invest when opportunities present themselves.

Having cash earning 2.25% per year is pretty nice, especially knowing that it’s instantly available when needed. I have a small $500/month recurring deposit on but I’ve been able to contribute bigger chunks on an ad hoc basis.

Crypto

This wasn’t even worth mentioning, especially since 2018 was a year of seeing all my crypto holdings go to negative. The total sum of my allocation for crypto was in January 2018, when prices were just coming off their 2017 high. I left on my recurring purchases on Coinbase for too long and so the purchases got made before I noticed and turned it off. I haven’t sold anything (in fact, I ended up buying a little bit of ETH the other day just because it looked so cheap), but I consider my holdings in crypto to be purely speculative and have no expectations. To me, it’s akin to walking up to a roulette table at a casino and putting a few chips on a number. I like the momentary feeling, but after it lands on another number, I shrug and walk away.

Money Philosophy

Once my son’s social security number comes through, I’ll be setting up a 529 plan for him. That’ll be another type of investment which I’ll gladly contribute to over the next 18 years. With the cost of education continually on the rise, it’ll probably be a good idea to start saving as early as possible. I lucked out in that being from a low-income household made me eligible for various grants, which in turn allowed me to escape with relatively small student loans (about $20k total) that I was able to pay back within 5 years of graduating college.

I know that my investment approach will continue to evolve over time as my risk tolerance changes and as my income level fluctuates. However, I think there are some timeless principles that I’ve learned over the years that have become clearer and clearer to me as I’ve given the topic of money more thought. Here they are:

Live Below My Means

I’m not a penny-pincher by any means and I don’t consider myself a frugal shopper. I drink that $6 iced matcha if I’m in the mood. I’m a satisficer in that I’ll immediately buy the first thing that fulfills my base criteria whenever I’m shopping, prices be damned. However, I’ve tried my best to adhere to a lifestyle where it doesn’t really cost all that much. A nice meal out once a week perhaps, a few book purchases a month, a nice bottle of wine or whiskey every now and then, and a handful of annual vacations–my pleasures are fairly simple and are the same things I was doing when I made a third of what I make now. Lifestyle creep ain’t got nothing on me. Living below my means is a superpower in that it allows for greater savings and flexibility in the long run. If I need to make a bigger purchase later on, perhaps a home renovation or a really elaborate family vacation, I’ll be in a much better place to afford it and minimize (or downright avoid) any need for debt.

Know Where the Money Is Going

I’m not in a position to give any advice on asset allocation and how best to diversify, but what I’ve found incredibly helpful is to understand how money flows in and out of my various accounts and to have a snapshot of my different assets. Mint has been a great tool for this. I’m not the type to review my credit card statements every month, but I do like going into my various brokerage accounts a few times a month to see how my holdings are performing and to see how many dividends have come in. I also keep a spreadsheet to account for any assets that are not easily tracked through Mint. I’ve made it a habit to do these periodic checks and it’s been a great way to revisit some of my investment decisions from time to time and to get a sense of what’s working and not working. Occasionally, I’ll notice that my credit card bill is too high and cut back the next few months or I’ll spot a charge on a subscription I no longer need and cancel it (I use Trim to get alerts on charges, which is nice).

It sounds so simple and obvious, but for most of my twenties, I barely paid attention to my finances and lived paycheck to paycheck, only looking to see if I had enough to pay off three things: rent, my credit card bill, and my student loan payment. These days, I’m more attuned to the flow of money across my dozen or so banking and investment accounts, and treat it much like I treat my own body–feed it well, don’t do things I’ll regret, and put it to work.

Keep Learning

Personal finance and investing, like other disciplines, are deep subjects with incredible degrees of complexity and nuance. The more I uncover from reading about these topics, the more I learn that there are things I know very little about. I’m eager to continue my education, especially when it comes to being a more knowledgeable investor. Whether it’s the world of angel or venture capital investing or snapping up and assembling a group of cash-generating small businesses, there are endless possibilities. The most important thing is to stay curious, continue absorbing new information, and to admit that I know very little.

That’s it, it’s just those three very simple principles that I keep in mind when it comes to money. I always tell myself that money is not the same thing as success, happiness, and wealth. Money is a means, a tool, that can enable some of the things that lead to success, happiness, and wealth, but it can also be a source of discontent, jealousy, and inadequacy. This is why it’s more important than ever to embrace the on-going education and continue learning how to handle money as a tool.

Services Mentioned in this Post and Others I Use

- E*Trade – this is my primary brokerage account for single stocks, which I’ve stopped purchasing; I’ve decided to mainly leave this account alone except to move dividends out every few months so I can reinvest those elsewhere

- Fundrise – real estate investment platform; I have a recurring monthly investment here

- Motif – you can create your own ETF / basket of stocks; I have a recurring monthly investment in three baskets of stocks mainly focused on tech and Chinese tech/e-comm; Motif lets you buy partial shares through your own basket of stocks, so you can create a basket with say Amazon, Netflix, Microsoft, and Google and buy $100 worth each month, accruing partial shares in each

- Fidelity – this is my primary retirement account but I also opened up an investment account to buy index funds (FZROX and FXIAX)

- Acorns – where I put in $5/day plus some change that goes into an investment portfolio of low-cost index funds; highly recommended for first-time investors who’re unsure about committing large amounts to stocks

- Citizens Access – I park my cash in here in order to take advantage of their above-market savings interest rate (2.25% as of this writing)

- Coinbase – what I used to buy cryptocurrencies, mainly Bitcoin and Ethereum

- Trim – nifty tool for getting SMS alerts on charges; it also helps you save on various bills but I haven’t utilized that part at all

superb post, very well organized and articulated. thanks for sharing

very interesting, thanks for sharing

Hi Peter. Thanks for sharing your portfolio data. Very insightful and inspiring. I just opened my first retirement account. Are you still in FXAIX? Fidelity recently launched a zero-expense-fee fund, and I’m curious what you think of it. I was reading through this thread https://usefidelity.com/t/fidelity-zero-fee-funds-here-are-the-pros-and-cons/145 and it doesn’t seem all that bad to me. Do you believe it is reasonable to obtain something similar to FXAIX but with a 0% fee? TIA!

Yup, FXIAX I just had from a while back before the zero-expense-fee funds launched, so I did end up switching mostly to FZROX. A lot has changed since this 2019 blog post and I’ve actually pulled back on contributing much to index funds at the moment. Trying to build up my cash position again after some large expenses associated with buying property + some startup investments, so will resume regular index fund buys when I feel comfortable with my cash cushion again.