I’m taking some family time this month as we welcomed our son Xander. As a result, I’ve not been as involved day-to-day although I’ve kept up with emails and checked in with my Barrel partners.

There’s a lot of down time with a newborn, especially the late nights when I’m rocking the baby for a few hours giving Mel some time to sleep before the next feeding. These moments have been good for catching up on some reading and for sketching out some thoughts and diagrams that have swirled my mind for the past few months.

This is my third parental leave and each time has offered me some space to think more deeply about the business at a much higher level–less focus on today’s problems and more reflections on where we want to go and what major bets I’d like to see us make in the coming months.

About Agency Journey: This is a monthly series detailing the happenings at my agency Barrel, founded in 2006. You can find previous episodes here.

Highlights

Falling Short on Revenue Goals, Rounding Out 2023

We began 2023 with a goal to increase 2022 revenue by 11.5%. Within a month, as deal activity moved at a snail’s pace, we revised the figure down – we were happy if we could repeat 2022’s revenues again, a 0% increase.

Now with one quarter left, it looks like we’ll be experiencing a down year in terms of revenue – most likely an 11% drop in year-over-year revenue if we are able to sign the most likely deals in our pipeline. If not, the drop could be higher.

While on the surface this is fairly disappointing – to shrink revenue by double digit percentage – the truth is that 2023 will probably end up one of our more profitable years to date. We did a lot to get operationally efficient, reduce client churn (while boosting client satisfaction), and managed to avoid getting stuck with costly over-budget projects.

The vanity metrics of topline revenue and headcount are down quite a bit at Barrel, but as a business, I’m fairly confident we’re on the right track. What I’d like to see for Q4 is more proactive movement to get existing clients thinking about their top priorities, website-related initiatives, and budgets for 2024. Retaining and growth accounts will allow us to start with a higher base and put less pressure on new business. That means we have to initiate conversations and bring some ideas to the table in the coming weeks.

Leads Analysis Takeaways

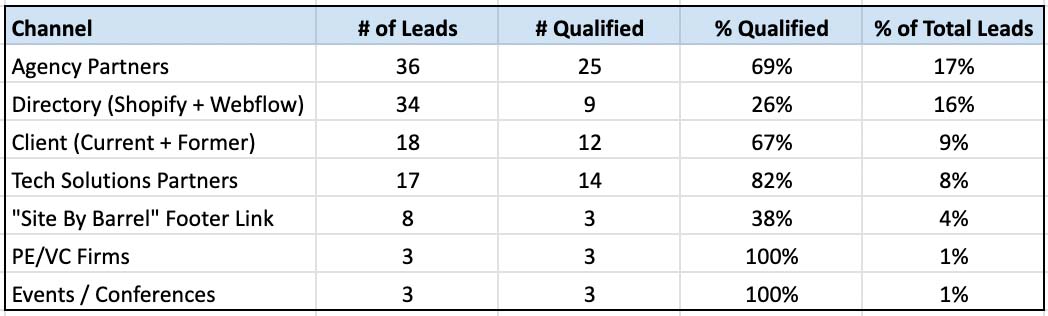

We took a closer look at the 200+ leads that came to Barrel this year in order to get a better feel for where our quality leads come from. We still have some more clean-up to do, but I generated a quick table from the data we have so far. We’ve managed to attribute 55% of the leads to specific channels. Here’s the breakdown and also what percentage of those became qualified leads:

A year-to-date view of where our leads came from, representing 55% of total leads that we were able to confirm attribution for.

My primary takeaway from this is that we ought to continue developing relationships with other agencies to generate deal flow. This means not only reaching out and build more relationships with other agency operators but finding ways to bring these other agencies more leads, whether it’s through introductions to people in our network or to our clients who need complementary services.

The other takeaway is that our efforts with tech solutions partners, notably Shopify and Recharge, have been fruitful. We will continue to invest in strengthening our relationships with them by bringing them more leads and collaborating on co-marketing initiatives.

And lastly, we will continue to benefit from delivering great work and service to our clients and staying in close touch with those who don’t continue to stay with us. Many of our best referrals have come from clients who’ve moved through multiple companies, bringing us in at every turn.

A few other observations:

- We get high volume of leads from our Shopify Partners and Webflow Partners directory listings. Most are not really qualified (and most Webflow leads get passed along to BX Studio, our sibling agency that focuses on Webflow), but still interesting how active they are.

- We have a lot of room to grow our PE/VC leads. I think private equity firms are especially important channel partners for great opportunities. Our network isn’t as extensive as it could be, so it’ll be worth our while to find more inroads.

- In-person events and conferences are also opportunities for us to increase qualified lead count. I think there may be more than this table represents but we just didn’t attribute them accurately.

- One channel that’s not reflected here but something I want to find a way to track is social media. Lucas and I have been ramping up our LinkedIn and Twitter social activity and we’ve actually had people reach out with opportunities after seeing us pop up on their feeds. So far, these are people who fit into existing channel categories (agency partners, clients, etc.), but it’ll be good to note that they were influenced to reach out by our social media activity. An added bonus would be if we were able to get leads from colder contacts as a result of the social media posts.

Top of Mind

Examining Our Business Model

A few months ago, I enjoyed reading Madison Avenue Makeover, a book about digital agency Huge and its attempt to revamp its business model. The big shift for Huge was redefining its value proposition for clients, shifting from the “do whatever the client needs done” mindset, and offering clear “products” that would allow for higher margin pricing and more focused value-add work for clients.

Huge worked with The Business Model Company (TBMC), which specializes in helping agencies adopt the productization approach to their business model transformation. I listened to the interview with TBMC cofounder Caroline Johnson on 20%: The Marketing Procurement Podcast and was inspired to do some more thinking for Barrel.

I started with some sketches on a legal pad, trying to visualize and make sense of our current business model and ended up creating some slides. These are still works in progress, but the exercise of putting these together has helped me refine the labels we use to describe our offerings and the types of clients we end up having on the roster.

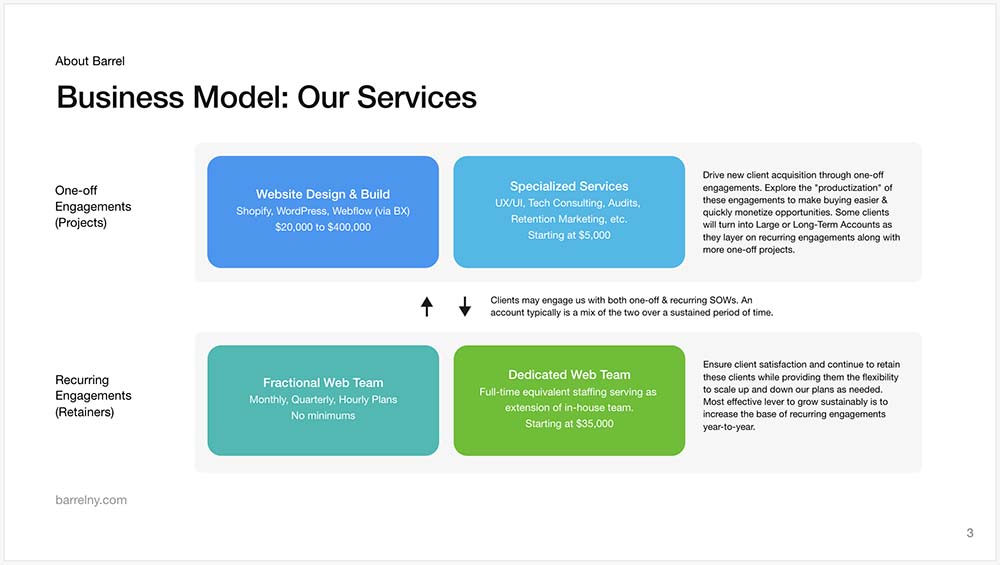

This slide highlights the common ways our clients engage with us, both in type of work we do and in the engagement model (projects vs. retainers).

For Our Services, by mapping out the ways in which our clients engage us, both in the type of work and the engagement model (project vs. retainers), I was able to get a clearer idea of areas that we ought to spend time further developing. Our Website Design & Build projects and Fractional Web Team retainers are well established, but we can benefit from having a much more structured and well-defined menu of Specialized Services. We also ought to invest in marketing and streamlining the way we run our Dedicated Web Team service. Only a handful of clients engage us this way, but this service drives most the revenue from our Large Account clients.

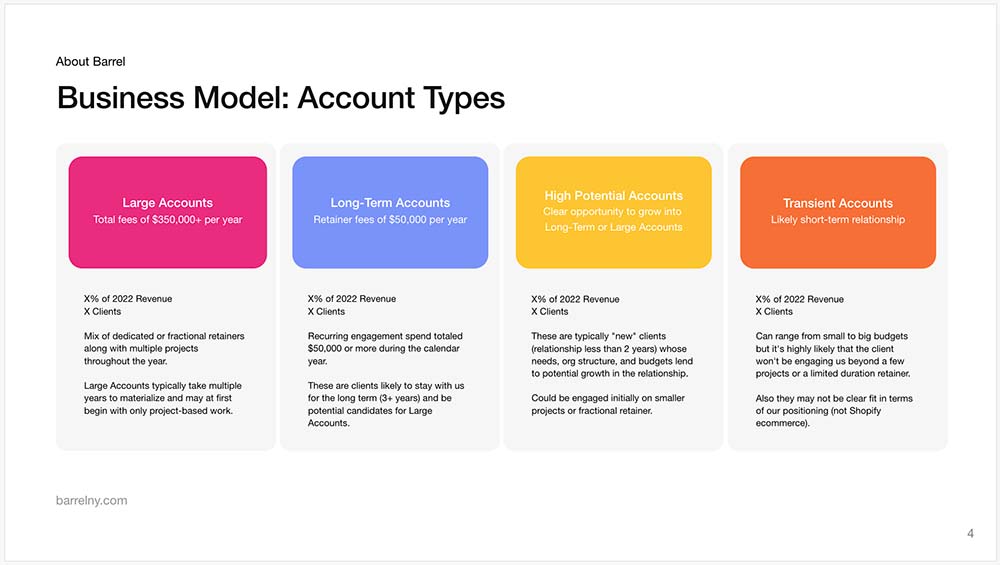

We’ve never formally tried to define types of accounts in the past. By taking the time to define and segment accounts, I instantly saw opportunities for us to take action in growing these accounts.

In defining Account Types, even if these are rudimentary and subject to later tweaks, I instantly saw potential opportunities for improving client retention and achieving account growth. One clear example is in how we staff our accounts, especially at the account management role. Transient Accounts should, as much as possible, be kept off of experienced account managers who are better deployed on valuable Large Accounts and High Potential Accounts. Long-Term Accounts can be fertile ground to level up less experienced Account Managers although even within this category, we might have a spectrum ranging from “limited budgets / may churn soon” to “Large Account potential”.

By segmenting accounts in this view, it’s also helpful to imagine what mix of our services from the previous slide can make up the account activity for each of these types. Large Accounts may consist of a Dedicated Web Team and a few Specialized Services throughout the year. A Long-Term Account will most likely be a Fractional Web Team plan. The High Potential Account is where things can get really creative with a mix of any of the services.

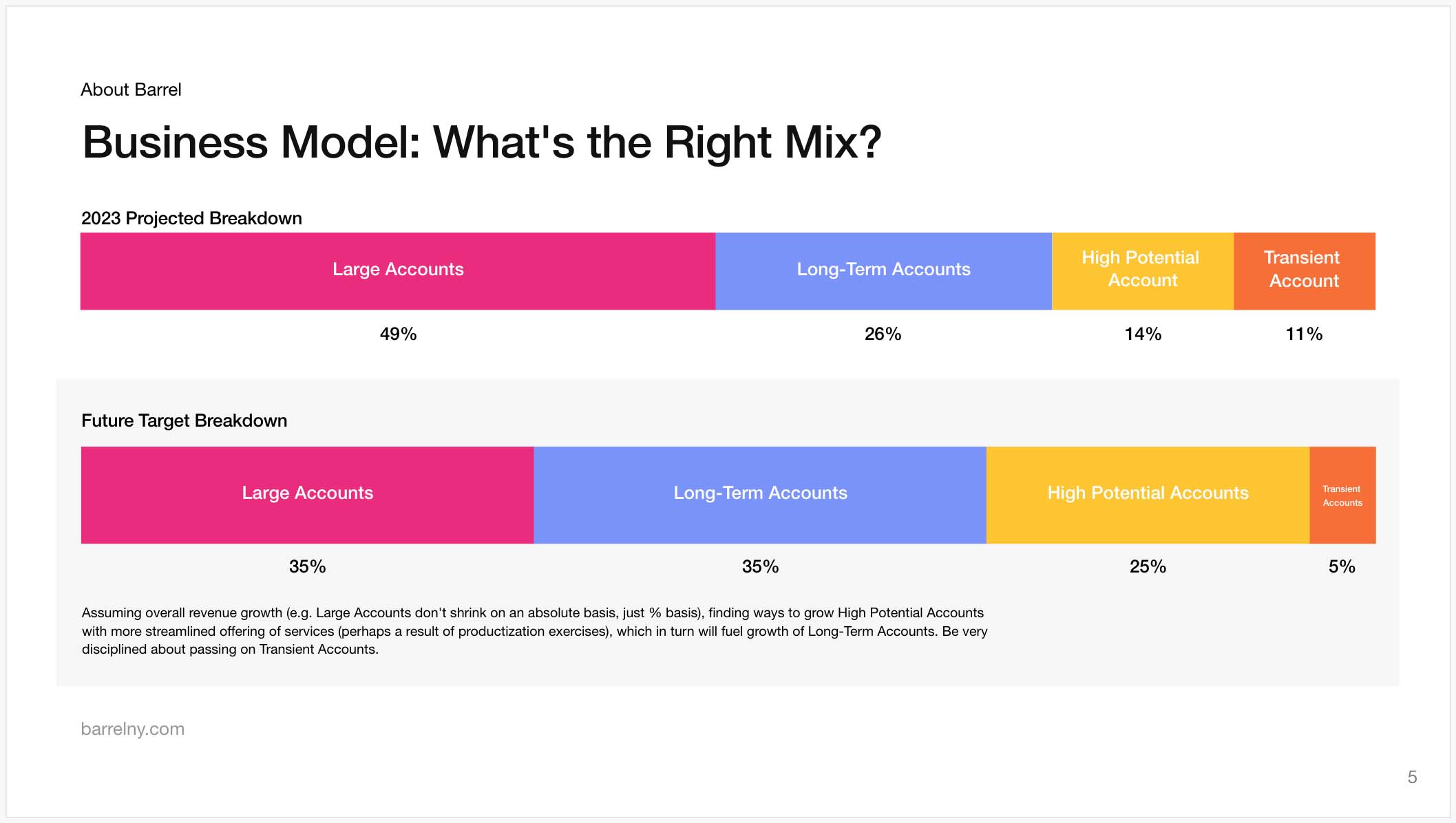

I tried to sketch out what an ideal breakdown of account types could be in the future and why.

In another slide, I added a % component to the account types to get a sense of our revenue mix. I have in mind to do a similar slide breaking down our services but for now, I found it easier to generate the account type figures for 2023.

Looking at our projected breakdown for 2023, I then tried to imagine what a more ideal future breakdown could be and why. The key takeaway is that High Potential Accounts would need to grow so that it could be a more reliable feeder to Large and Long-Term Accounts. This means being more disciplined about shrinking Transient Accounts.

The 35%-35% breakdown between Large Accounts and Long-Term Accounts is probably a long ways off (unless we get unlucky and lose some of our Large Accounts in the near term, gulp) and I actually think 40% Large Accounts and 30% Long-Term Accounts is more realistic given where we are today. Regardless, doing this type of visualization exercise has been helpful in sparking additional ideas.

One analysis we have not yet run but is top of mind with these account types is how each of them fare year-over-year in terms of retention. For example, if Large Accounts totalled $3 million in 2023, then what is expected of those same clients in 2024? My guess is that these figures will vary depending on the segment. Having a baseline, establishing goals, and then defining activities to hit these goals is something we’re keen to get done in the coming weeks.

I’ve shared these with the Barrel partners and the goal is to get these (and additional slides) to a place where we can share with the team and use as an alignment tool to talk about our business model.

Shared with Partners

“Prior life experience may have a dramatic effect on threat perception. In post-traumatic stress disorder, the stress response systems become dysregulated, leading to persistent hyper-vigilance and sensitivity to innocuous stimuli. Trauma that occurs during childhood seems to have a particularly strong effect and increases risk for a wide variety of psychological and physical health problems. Conversely, a positive childhood tends to dampen the stress response, and encourages healthy risk-taking.” (Todd Hargrove, Playing With Movement)

There are “traumas” that happen in business as well. Negative experiences with clients, employees, and specific assignments that can lead to “hyper-vigilance and sensitivity to innocuous stimuli.” I’ve caught myself on more than a few occasions saying things like, “We can never do that kind of project again” or “We should never work with such a client again. Sometimes these statements can make sense and serve as protective guidelines but in most cases, they’re overreactions to situations that have more nuanced lessons.

“‘Asking for qualities’ describes this other kind of role-playing. When introducing this idea, I usually say something like this: ‘Imagine that I am the director of a television series. Knowing that you are an actor that plays tennis, I ask if you would like to do a bit part as a top-flight tennis player. I assure you that you needn’t worry about hitting the ball out or into the net because the camera will only be focused on you and will not follow the ball. What I’m mainly interested in is that you adopt professional mannerisms, and that you swing your racket with supreme self-assurance. Above all, your face must express no self-doubt. You should look as if you are hitting every ball exactly where you want to. Really get into the role, hit as hard as you like and ignore where the ball is actually going.’ When a player succeeds in forgetting himself and really acts out his assumed role, remarkable changes in his game often take place; if you don’t mind puns, you might even say that the changes are dramatic. As long as he is able to stay in this role he experiences qualities that he may not have known were in his repertoire.” (W. Timothy Gallwey, The Inner Game of Tennis)

I think this can be a great training tactic, especially for sales or client-facing roles. The concept of “act as if” as part of building up someone to feel more natural doing something. The book The Inner Game of Tennis is one that we’re discussing at next month’s Barrel partner’s meeting, and I’m really excited. It’s packed with all kinds of great nuggets around learning, skills development, and focus/concentration.

“A candidate is either 100% qualified or not. There is no middle ground. Don’t hire the best available candidate (i.e., the “least worst” candidate); hire the person who meets all the mandatory requirements and is 100% qualified.” (Victor Cheng, Extreme Revenue Growth)

We’re hiring for a couple of new roles. This quote stood out to me because the roles are ones we haven’t hired exactly for in the past and have some vagueness around their requirements. Perhaps that means we haven’t done enough to specify what our definition of “100% qualified” means. Might have to go back to the drawing board.

Interesting breakdown on Lead Sources, Peter. I’d love to learn more about the ACV, CVR% and % of New Business Revenue for each segment. Not all leads are created equal, as you say.