Capping Off a Full Year of Reflections

I began Agency Journey last September as a way to make space to reflect on the many decisions and various efforts that go into running Barrel. My hope was that in creating a record of my thoughts, I could A) personally benefit from the exercise of examining and looking back on different highlights and challenges and B) help others by sharing my learnings and mistakes.

The series has been a rewarding experiment and has been fun to write. This 12th episode caps year one of the series. I appreciate all the folks who’ve followed along and encouraged me. I’m excited to continue writing these.

To commemorate the milestone, I decided to change things up and invited my Barrel co-founder Sei-Wook to contribute to part of this episode. As our Chief Operating Officer and President, Sei-Wook has done a tremendous job of making progress on our various business operations functions, and I’m eager to share his take on our journey.

About Agency Journey: This is a monthly series detailing the happenings of my agency Barrel, founded in 2006. You can find previous episodes here.

Highlights

In my inaugural Agency Journey episode, I noted the importance of recruiting and how key talent would help us to scale the business. In the 2nd episode, I talked about the need for Barrel to embrace technology and upgrade our systems with software automation. Both topics have been top of mind for us for the past year and we’ve made a great deal of progress in each area. Sei-Wook has led the effort in upgrading both our recruiting process (which we now call “talent acquisition” internally) and modernizing our finance system with new software and automation processes.

Below, Sei-Wook shares some details on what we were able to accomplish:

Building a Talent Acquisition Discipline

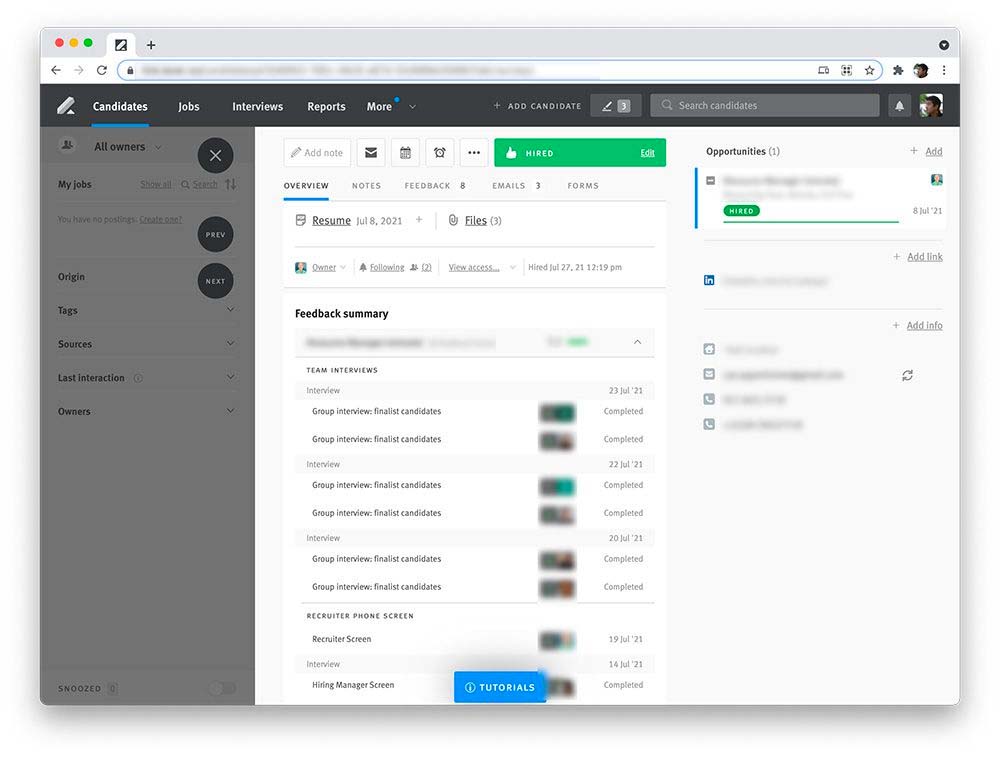

At Barrel, talent acquisition and recruitment has been a shared responsibility among our team leads, who serve as our hiring managers. Despite the importance of talent acquisition, it has always been secondary to a hiring manager’s team or client priorities. After years of discussion, we brought on an amazing Talent Acquisition Manager in James Bean. In a short two months, James has been able to make immense impact to the velocity of our hiring and building systems within talent acquisition. Here are some highlights:

- Decreasing Time to Hire – with centralized ownership of the end-to-end hiring process (e.g., posting new jobs, seeking out and screening candidates, vetting all applications, coordinating interviews with our team, and delivering job offers) we’ve increased the quantity of qualified candidates that we have interviewed and hired. Since James has started, he has already hired 6 new team members.

We’ve been able to use the full capabilities of our Applicant Tracking System, Lever, to centralize the process for our recent hires.

- Applicant Tracking System (ATS) – we’ve been able to take full advantage of the capabilities of our Applicant Tracking System, Lever. This includes integrating all interview feedback forms (previously in Google Docs), using templates to drive consistency in all our job posts, and adding candidate surveys to get feedback at all stages.

- Increased Collaboration – we’ve built out a repository of data in Notion to increase knowledge sharing among all hiring managers – from discipline-specific interview questions and job boards, to all job descriptions across the company. We’ll be tackling company-wide interview training next.

- Formalized Intake – We have formalized the intake of new roles from hiring managers and potential candidates from our team using Google Forms (previously all done via Email/Slack).

- Employer Brand – James has been working with our creative and marketing teams to enhance the presence of Barrel on various platforms – such as adding a LinkedIn Life page and ensuring all our open roles get exposure on our social channels.

We are just in the beginning stages of building up this discipline at Barrel to be stronger than ever. We are excited to continue investing time and resources to make talent acquisition an exceptional experience for candidates and our team.

Modernizing Our Financial Systems

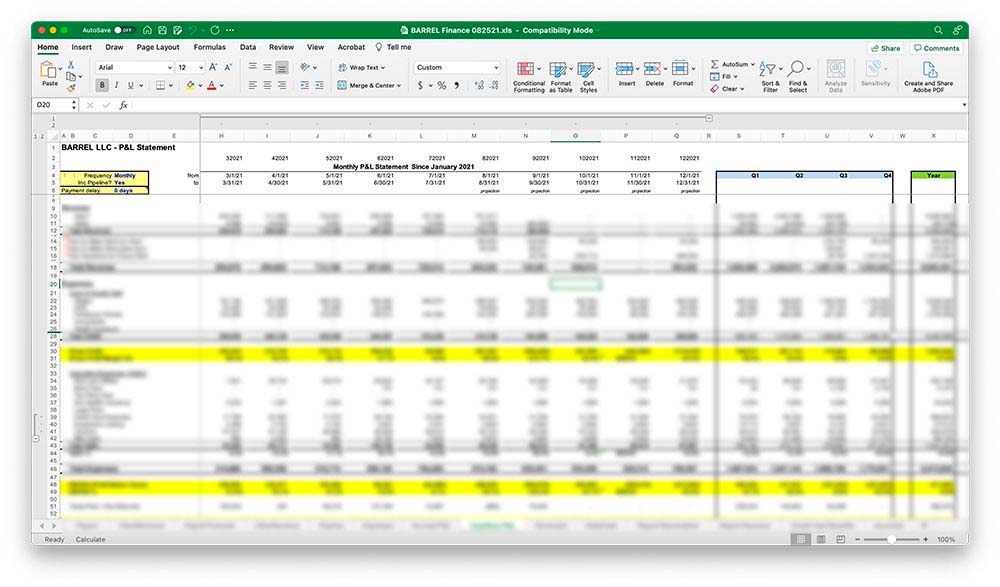

People are surprised to hear that we ran our company finances from Excel for the first 15 years of our business. One of Peter’s friends from his investment banking days helped get our business off the ground and built us an Excel model with custom macros and formulas (thank you, Sergey!). The strength of the Excel model, and one of the reasons it’s been so hard for us to move on from it, is that it was customized exactly for our business and provided us tailored reports on our historical data and future revenue. As our business has grown over time we’ve found the upkeep of the file to be very time-consuming and prone to human-error in data entry and reconciliation.

A view of our Profit & Loss report from our company’s Excel model, which we used for nearly 15 years.

We decided early this year to modernize our financial systems and move to cloud-based platforms with the guidance of a fractional CFO firm called Level10. Our goal was to have as much of our data live in the cloud and minimize manual data entry. We’ve gradually made the transition to a few key tools that have weaned our reliance on our Excel model:

- Quickbooks Online serves as the hub of our financial data. While setting up Quickbooks, we overhauled our categorization for our revenue and expenses, introduced a new accrual method and formalized our month-end close process.

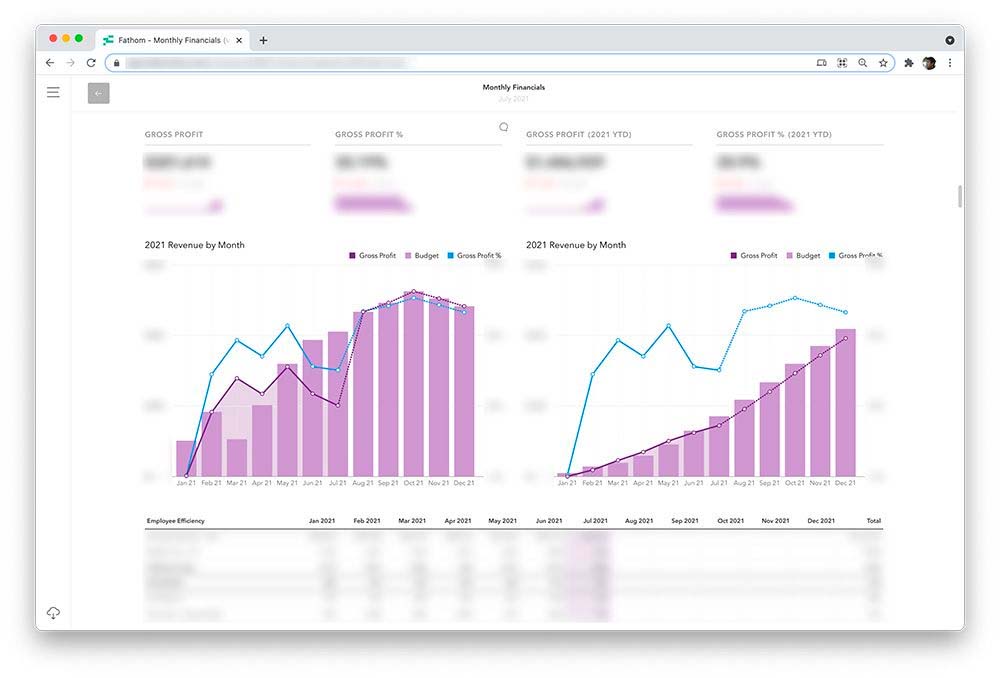

- Cashflow Frog and Fathom have given us the capability to run detailed reports and model out various future scenarios. These two platforms provide us a clear view of our projected future financials.

Fathom provides us real-time visuals of our financials and customized reports.

- ProcureDesk is a lightweight Purchase Order (PO) system where we can document the agreements we sign with our contractors and vendors and enter invoices against those POs. ProcureDesk helps speed up our invoice review and approval process and provides data to project future expenses.

This transition has been an ongoing learning process that has allowed us to segment our numbers deeper than ever before. I’ll delve deeper into these topics in some upcoming articles.

*End Sei-Wook’s section. You can find more writings by Sei-Wook on his blog at www.seiwook.com

Launching Vaulted Oak, a New Agency Business

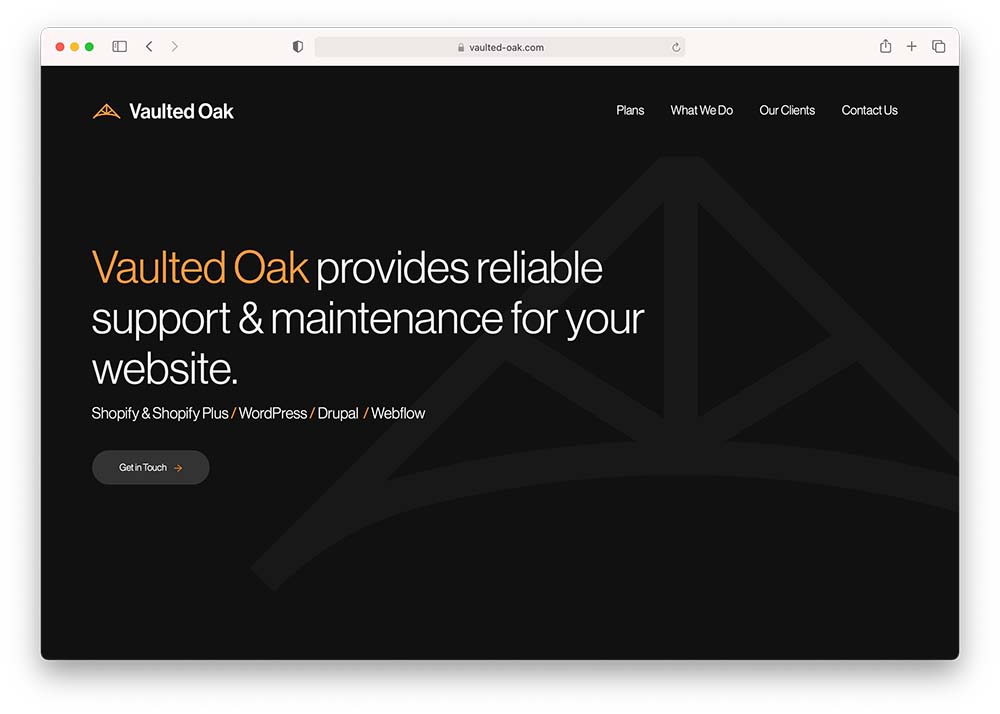

Earlier this month, we officially launched Vaulted Oak, a new spin-off agency focused on providing website support & maintenance for clients. After years of experimenting with different ways to deal with our growing portfolio of maintenance contracts, we ultimately felt that having a totally separate business would give us the best chance to allow Barrel to focus on growing its direct-to-consumer ecommerce work while also ensuring that certain long-time clients can transition to working with Vaulted Oak. We also saw an opportunity to have a business whose sole focus was providing cost-effective support services in the form of quarterly retainers. With Vaulted Oak, we feel that we can be a great landing spot for many clients whose original web agencies can no longer support them.

We launched Vaulted Oak, our new agency focused on website support & maintenance.

Heading up Vaulted Oak is Jason Fan, long-time Barrel employee and a personal friend of mine from our high school days. Jason was instrumental in growing several key accounts at Barrel and being an important contributor to our company’s growth. He expressed his desire to turn our book of maintenance contracts into a profitable business, so we agreed on a plan for him to transition into a co-founder and operator role. In just a few short weeks, Jason has already been expanding Vaulted Oak’s roster of clients while striking up relationships with various agencies that may become feeders for new businesses.

With the launch of Vaulted Oak, we also formed Barrel Holdings, a new holding company with Barrel and Vaulted Oak in its portfolio. The goal is to turn Barrel Holdings into an incubator of new agency businesses that can quickly scale up and become profitable by identifying great talent and a very focused niche, both in target customers and service offering. I’m super excited about this new platform and have several ideas brewing on ways to expand our collection of businesses

You can check out the full press release of Vaulted Oak’s launch here.

Top of Mind

Staying Disciplined on the New Business Front

New business has been slow the past couple of months. We’ve had some great opportunities but ultimately struck out a few big ones. While disappointing, losing is part of the game, so we try not to dwell too much. Instead, we take our learnings and quickly apply them to the next opportunity.

During our slow period, we’ve continued to remind ourselves that we must be disciplined in the opportunities we choose to pursue. We stick close to our new business qualification matrix and also ensure that budgets have ample buffer to allow our team to deliver our best work. The toughest thing about this is that we’ve had to pass on some very appealing brands that we’d love to be affiliated with, but we’re too far apart on the numbers to make it a prudent decision for us. We’re okay forgoing big margins on initial projects to establish a long-term relationship, but over time, we’ve come to draw lower-boundary limits to protect our downside. A handful of five-figure losses can quickly turn an agency’s cash flow forecast and put us in a bad spot.

Being patient while not winning new deals can be unnerving, but we’ve dealt with this by focusing on a couple of areas:

- Deepen our relationship with existing clients: By taking the time to better understand our clients’ needs and having developed a strong rapport with their team, we’ve been able to win incremental work that have been profitable while creating value for our clients. These include additions to websites, email marketing work, or integrations work that are not huge projects but have a very low cost of sales (usually a few convos and an SOW) and good margins that capitalize on existing workflows and familiarity. Stringing a number of these projects in addition to our retainers can all add up to a healthy sized account over the course of the year.

- Be ready for the next big opportunity: One of our Barrel Maxims is “turn setbacks into growth opportunities”. Even when we lose out on a major pitch, there’s always a silver lining. One is that we can usually count on some kind of feedback from the prospective client on why they went with someone else. This information can come in handy in helping us adjust our approach for the next pitch. In case of the big loss we had earlier in the month, we learned that our inexperience with a particular ERP integration was a flag. This is helpful and allows us to invest some time into finding ways to mitigate such concerns the next time. The other silver lining is that a great deal of the work we put into the pitch can be cleaned up and re-used on future pitches. In many ways, every pitch, win or lose, is an opportunity to strengthen our new business approach and our capabilities deck. Our Business Development team and team leads have done a great job of iterating and improving with every opportunity. The wins will come.

A quick glance at our HubSpot dashboard shows the lumpiness in revenue when we stay disciplined and hold out for the right opportunities. The droughts can last quite a while as evidenced on the right with the flattening green line before the sudden jump from a big win.

As I’m about to publish this episode, we received news that a prospect has just signed a fairly large website engagement that will get us back on track towards hitting our goals. The path is very lumpy (and bumpy), and as we shift towards having less clients who spend more with us, I expect the lumpiness to become the norm.

Shared with Partners

“Boutiques should generate approximately 80 percent of their revenue from existing clients and 20 percent from new clients. If your numbers differ significantly, rethink your business development efforts.” (Greg Alexander, The Boutique)

“A business that is exitable at the highest possible value has an Owner who is obsessed about the predictability and sustainability of the future stream of earnings. The greater the predictability and sustainability, the greater the enterprise value and, thus, the more attractive it is to a buyer.” (Keith J. Cunningham, The Road Less Stupid)

I paired these two quotes because they reminded me of the importance of our account management practice and how our greatest opportunity lays in going deeper with our existing clients and providing them as much value as possible. I think we’ve only scratched the surface on the potential to be strong agency partners to our clients and a big focus for our company will be in redefining the client experience moving forward.

“Agents need to stop focusing on the deal they almost got and focus on all the business that is out there. If one wants to look at waste, the customers they never contacted in anyway represent the real losses—not the one that got away.” (Gary Keller, Jay Papasan, Dave Jenks, Gary Keller, Dave Jenks, The Millionaire Real Estate Agent)

This reflects the sentiment I wrote above about our new business struggles and how our attention needs to be on winning the next deal, not lamenting on what “could’ve been”.

“But in the middle of the fight, he changed course; sales tax avoidance had tied the company in knots, requiring it to limit where it opened facilities and even where employees could travel. By agreeing to collect sales tax, Bezos surrendered his prized advantage. Instead, he took the longer view, making it possible for Amazon to open up offices and fulfillment centers in more populous states, much closer to its customers, laying the groundwork for one of the largest expansions in business history.” (Brad Stone, Amazon Unbound)

Another Barrel Maxim is “take the long-term view” and this story of Bezos’s decision to forgo the tax advantage in favor of building something greater is an excellent example of how embracing the long-term perspective can be turned into a competitive edge.

“Rather than seeing the defensiveness in terms of others’ behavior, the leverage lies in recognizing defensive routines as joint creations and to find our own role in creating and sustaining them. If we only look for defensive routines “out there,” and fail to see them “in here” our efforts to deal with them just increase the defensiveness.” (Peter M. Senge, The Fifth Discipline)

I don’t think I fully appreciated this quote until I finished reading Leadership & Self-Deception. Blaming someone for their defensiveness is usually a strong signal that we’re blind to our own behaviors that created the conditions for such behaviors in the first place. I find myself in this trap more often that I’d like to admit, where it’s easy to point out the fault in others and to call for corrective measures, when in fact, I would be much better served by examining my own behaviors and asking how I can do better.