This episode marks 5 years since I started this series. In 2020, I was looking for a way to write something monthly so I wouldn’t have to keep coming up with new topics. “Why not just write about stuff happening within the agency,” I wondered. And that’s what I did (see Episode 1).

Little did I know that the monthly ritual of setting aside a handful of hours to reflect and write would open so many doors. I’ve met dozens of agency operators, been invited to speaking engagements, and driven business to our various agencies as well as to others, all through consistently publishing month after month.

But most importantly of all, the few hours have been really important in my development as an entrepreneur and leader. It forced me to examine my progress (or lack thereof) and to question our strategy and approach to doing business. I was able to document frameworks and experiments and also reflect on why some things worked and others didn’t.

It was during the writing of this series that I came to the realization that a holding company was something we could pursue in a real way. I saw that more and more of my time and energy were being spent in imagining new agency businesses and supporting efforts outside of Barrel. As a result, I became more deliberate about the choices Sei-Wook and I would need to make about our involvement in Barrel vs. the holdco in the future. It was very rewarding to make the jump in mid-2024 and focus on Barrel Holdings full-time. The transition has been fun to write about, and it’s opened up new topics.

Another clear benefit has been the repetition of seeing similar challenges and business scenarios play out over and over again, which has helped me to become more aware and confident in my understanding of an agency’s business fundamentals. The importance of delivering value for clients (and retaining them), sales & marketing efforts, and hiring/managing talent – these became clearer and clearer over time while other less important aspects became easier to ignore and not worry about. Business used to feel so complex and daunting to me, but continually writing about it using first-hand experience helped it feel a lot less so.

I’d love to continue writing Agency Journey for as long as I can. I enjoy the ritual and take pride in the output. I’ve managed to continue writing it through the birth of 2 kids (my 2nd and 3rd) and through months when I was incredibly busy or working through various crises. I’ve come to see it as an essential part of my career and identity – it helps me improve and reinforces who I want to be.

To all those who’ve followed the journey, either from the beginning or along the way, I sincerely thank you for reading and for your support.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

The SuperFriendly Experiment Comes to an End

Back in March (see Episode 54), we “rebooted” SuperFriendly, buying the agency trademark from designer and entrepreneur Dan Mall and recruiting Jon Sukarangsan as CEO to see if we could build a next generation product design and design systems agency.

After 6 months, some pivoting, and lots of conversations with some really big brands, we felt that there just wasn’t enough traction to continue funding the business. We decided to part ways with Jon and end SuperFriendly’s operations. Jon will continue to offering design and AI consulting services through his own consulting company Summer Friday & Partners.

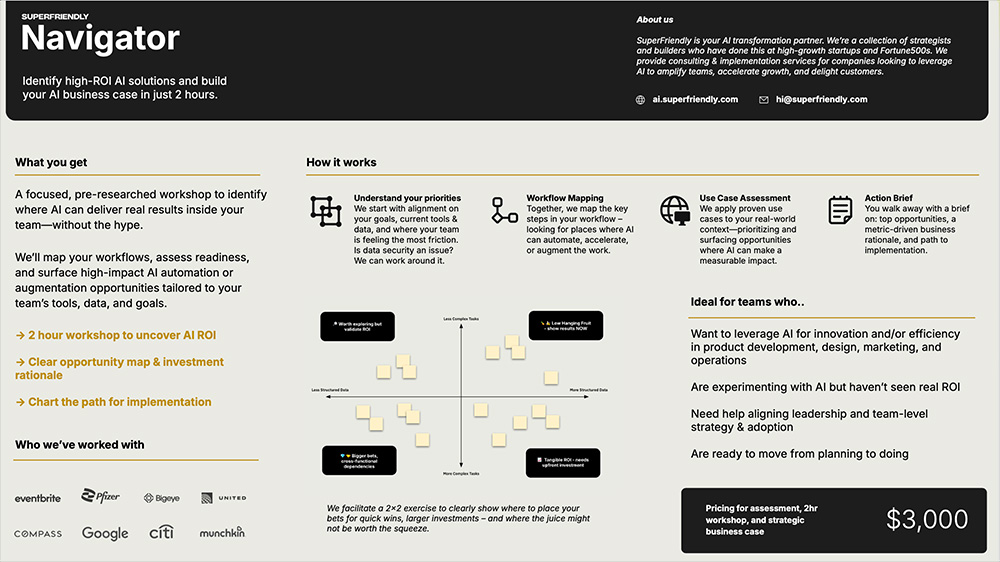

The “Navigator” was one of the later attempts to drive revenue while decreasing the sales cycle. It was fashioned as a workshop that companies could purchase to get clarity on how AI could help their org. We priced it competitively and targeted both enterprise and mid-market companies.

Given the types of companies we were talking to–some blue chip names and big tech companies–the long sales cycle was to be expected. It’s possible that Jon may close some of those deals later. However, the cash burn was just too high and given the opportunities ahead for us (see Top of Mind section), we decided that it was better to call it now and preserve some powder. We just didn’t see enough signs on the business development front to feel that things would pick up anytime soon.

We’re disappointed with the outcome, but as with any failed ventures, we came away with some good learnings. One key takeaway is that for any new agency launch (no clients, no revenue), we need to have a structure where costs are as low as possible and much of the operator’s comp needs to come from a “eat what you kill” arrangement. Given Jon’s deep experience in the agency space, we made an exception here and talked ourselves into a high monthly burn situation. Our bet was that the burn would slow down with revenue coming in right away. Unfortunately, that did not happen and it got to a point where the cash burn accelerated beyond our tolerance threshold.

Still, no regrets on the collaboration with Jon (and Dan). We tried some stuff, learned a lot, and now it’s time to move on.

BX Studio Nominated for Webflow Enterprise Partner of the Year

Out of the 1,000+ Webflow partners in the ecosystem, it’s great to know that BX Studio is definitely a top 10 agency partner. Last year, we were nominated for Agency of the Year. While we didn’t win, it was great validation that our efforts were noticed.

A screengrab from the Webflow Awards 2025 nomination page featuring BX Studio as a nominee for Enterprise Partner of the Year.

This year, we’re nominated for Enterprise Partner of the Year. We helped Webflow land Verifone as a customer, which was a very big deal. We have a great relationship with the Webflow folks, and we’re excited to continue our efforts in landing big logos for the platform.

2025 has been an absolute breakout year for BX, and it’s been fun to see CEO Jacob Sussman do his thing as a leader, closing big deals and building a really talented team.

Due Diligence Consulting with Essen Partners

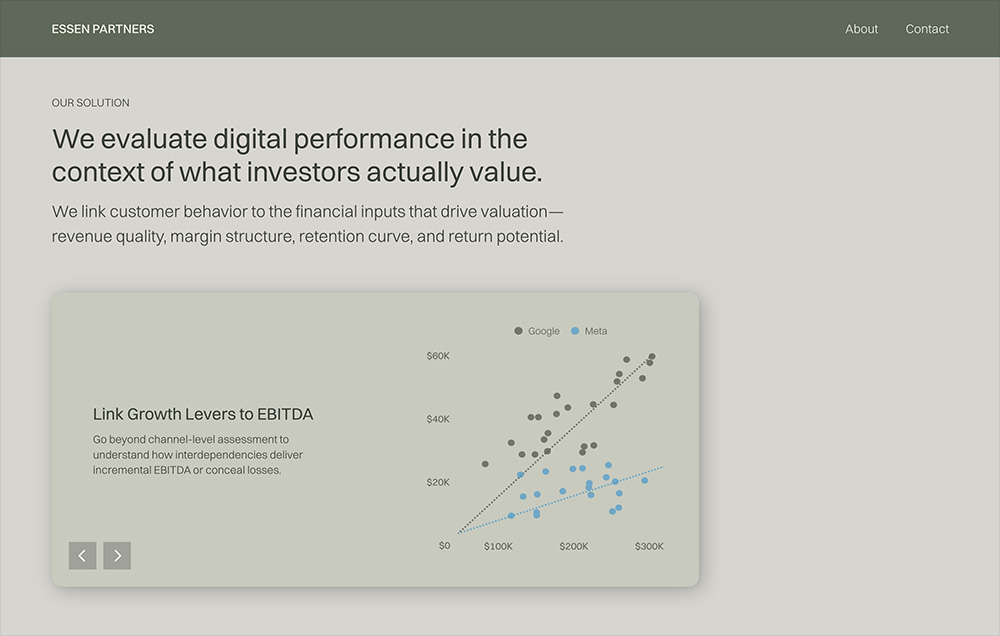

We teamed up Brad Donnelly, agency founder, investor, CMO, and former Barrel client to launch Essen Partners, a due diligence consulting firm that helps investors and M&A advisors better understand how digital performance drives enterprise value.

Earlier this year, Sei-Wook and I invested in reactivating our private equity and VC contacts. They’ve long been a source of quality leads for our Barrel Holdings agencies, and we wanted a way to more proactively build relationships.

Essen combines the deep expertise of digital marketers with insights that speak to what investors are really looking to understand (e.g. how digital performance drives incremental EBITDA).

When Brady approached us about his idea for due diligence consulting around digital marketing, we felt that it was a great way for us to partner and create a win-win situation: drive leads to Essen Partners so it could grow its client roster and also be on the receiving end of potential audit and implementation projects arising out of Essen’s consulting work.

To be clear, this won’t be a part of Barrel Holdings and is very much led by Brady’s expertise as a growth strategist and marketing leader. Sei-Wook and I are in focused on driving opportunities and resources through our network. We think this is the right amount of involvement given our primary focus (see Top of Mind), and we’re excited to see how we can help Essen get off the ground.

If you know of any investors (PE/VC) or investment banks who are in need of due diligence support or a 3rd party perspective on digital marketing and how it may impact valuation, give us a ring.

Top of Mind

Resisting the Urge to Be a Venture Studio

We were quite lucky that both Vaulted Oak and BX Studio, the first two agencies outside of Barrel, immediately captured momentum and became viable businesses within the first few months.

But this experience also led us to believe that we could spin up an agency nilly-willy and get the same results.

We were quickly humbled by how slowly Bolster grew, but felt that was just an anomaly. We launched Prima Mode and rebooted SuperFriendly not too long afterwards, thinking a different focus and leadership would help us recapture the spark of VO and BX. But alas, these two also didn’t take off.

We actually had yet another agency in the works–one that would leverage AI workflow automation as its main offering–but we caught ourselves. Instead of investing our time and energy into another 0 to 1 venture, why not focus on the companies that are already growing and grappling with bigger problems?

Old habits die hard. The 0 to 1 agency venture studio experience is fun. It’s cool to see a new entity come to life, and there’s nothing like developing new service offerings and signing your first few clients.

But as I mentioned back in Episode 57, there’s an opportunity cost that we need to weigh. Our larger “Tier 1” agencies (Barrel, BX, VO, and AO2) are poised for meaningful growth that, economically, dwarf whatever major gains may be had with the startup agencies.

We’ve started to cull the portfolio since I wrote about this (Catalog, SuperFriendly), and we’ve put a stop to incubating any more businesses. Instead, we’ll look to partnerships like Essen Partners where we’re involved in a lead gen and advisory capacity that benefits our entire portfolio with no operational responsibilities and no financial downside.

Sei-Wook and I have developed conviction that our path to meaningful growth and scale–we’d like to see Barrel Holdings doing 9-figures of annual revenue in the next few years–is to focus on agency acquisitions.

We had initially targeted $2 million revenue and up, but after going through the AO2 acquisition, we’d like to focus on $4 million+ revenue agencies with EBITDA that’s at least $800k and above. We feel strongly that we can provide support and value creation initiatives that can deliver revenue and profit growth.

To put things into perspective, a 10% bump on a $5 million revenue agency is the same dollar amount as a startup agency generating $500k in revenue. We’re making the bet that it’s more likely that we can consistently drive the 10% bump vs. getting a startup agency to $500k and beyond.

After a full year of experiments and explorations, we’ve come to value simplicity and focus even more. Rather than trying to launch new ventures and acquire agencies while not doing both particularly well, we’re opting to focus on acquisitions and do our best to really get good at sourcing and closing deals.

This will open up other new challenges, like figuring out how to finance larger deals where we’ll need more cash on hand as well as lender relationships that potentially replace our reliance on SBA 7A loans. It’ll be very interesting, and I’m sure we’ll learn a ton.

Lastly, when it comes to “launching” an agency, I think the one path that we’ll remain open to is the carve-out, where, if we see the strategic benefit and upside, we’d spin out a business unit from an existing agency to make it a standalone agency in the portfolio. Vaulted Oak was technically a carve-out of Barrel’s support and maintenance clients, and perhaps that was why it’s become a durable business.

By the way, there are folks focusing on the agency venture studio concept and not shying away from it – check out what John Ghiorso is doing at VantaFive and also what Eli Rubel is doing with his portfolio of businesses.

Shared Quotes

“For a system to scale, that system must have extremely high transparency and accountability. Often, people won’t want a higher degree of accountability for their performance or transparency in what they’re doing. Those are the types of people who get eliminated when the floor is being raised.” (Benjamin Hardy, Blake Erickson, and Tony Robbins, The Science of Scaling)

One thing we’ll need to do better at Barrel Holdings is to really define the floor and make sure we’re holding ourselves accountable while being transparent. We’ve tolerated subpar performance and not been forthright about accountability in several instances. For a holding company, this means a lower return on our invested capital, which means the flywheel we hope to create is at risk of stalling.

“Rather than seeing the defensiveness in terms of others’ behavior, the leverage lies in recognizing defensive routines as joint creations and to find our own role in creating and sustaining them. If we only look for defensive routines “out there,” and fail to see them “in here” our efforts to deal with them just increase the defensiveness.” (Peter M. Senge, The Fifth Discipline)

This is an incredibly important insight: whenever we sense that someone else is being “defensive”, we ought out asks ourselves, “What is it that we’re doing that might cause this person to behave in a defensive manner?”

We might not like the answer, but if we’re honest with ourselves, we might find that we often play a big role. This goes for business as well as personal situations.