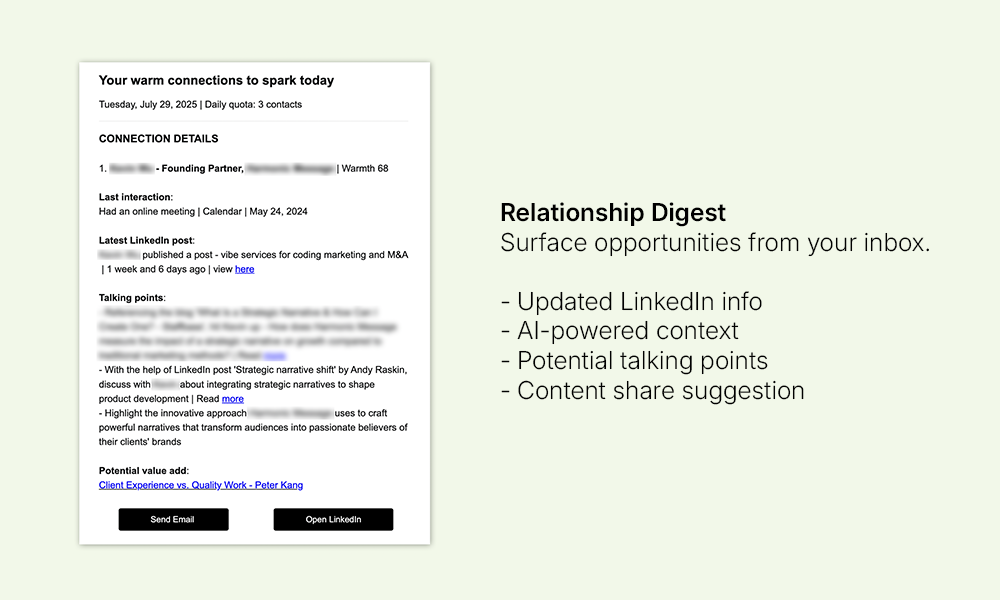

We’ve been using a tool for the past month that we developed internally. It’s called Relationship Digest and it sends an email every weekday morning highlighting 3 contacts from my past that I may want to reach out to.

The data comes from my inbox, calendar, and LinkedIn and the combination provides useful context. I found myself reaching out to 4-5 contacts of the 15 I get each week, including some people I would’ve never thought to reconnect with.

A screenshot of a daily Relationship Digest email.

With an inbox that’s nearly 20 years old, I think there’s a wealth of connection potential I can mine via Relationship Digest. Right now, we’re sketching out how this tool can be the backbone for a potential agency that specializes in helping people generate revenue through their existing relationships. Instead of the more all-encompassing term “RevOps”, we’re calling this “RelationshipOps”.

We’re tweaking and trialing this tool and service with our Barrel Holdings agencies, but it’s something we’re looking to market to other agency leaders in the future. Those with contact-rich inboxes and calendars are, in my opinion, going to get a lot out of this.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

AO2 Acquisition Finally Closes

In July, Barrel Holdings acquired AO2 Management, an Amazon agency with over 50 clients and a team of 30+ professionals.

Sei-Wook first met AO2’s founder Nathan Neeley at The Acquiror Summit in January hosted by The Fortia Group. We had been looking at other Amazon agencies at the time, so it was fortunate timing that we met Nathan. Due to some personal circumstances, he was looking to sell and become less involved with the business.

As we shared the Barrel Holdings model and how AO2 would remain a standalone agency that could grow as part of our portfolio, our initial talks progressed to a data request and an eventual offer. By early April, we had a signed LOI.

The deal process took a bit longer than we had anticipated. Recent rule changes at the SBA introduced more stringent underwriting requirements, which meant we had to produce more financial information. The uncertainty of the tariff situation led to some client pauses and churn on the AO2 side, which also made the finances look a bit shaky in the early going. But the AO2 team recovered and we eventually got the green light to move forward.

Right around a 100 days after signing the LOI, we finally closed on the deal. It was a long and drawn out process that could’ve died at any point along the way, but both sides persevered and we made it happen.

My co-founder Sei-Wook was the day-to-day force driving this deal and he kept the seller, the lender, and the legal and accounting teams all rowing in the same direction. Whether it was the granular details of the purchase agreement or the working capital calculations, Sei-Wook had a hand in making sure all of these pieces were done right.

Sei-Wook and I were eager to celebrate our AO2 closing in person so I came down to NJ. Unfortunately, the final wires took forever to clear on a Friday. We ended up eating some Korean noodles while stressed that the banks wouldn’t send & receive the wires in time. They eventually did a few hours later after I left to go home – we’ll have to pop a champagne another time.

Once the deal closed, we moved quickly to elevate AO2’s President Jessica Wright to CEO. Early on, we felt that Jessica was a very promising agency leader who could shine with the right structure and support. A long-time veteran of the Amazon ecosystem, her knowledge of the Amazon space is deep and we sensed her eagerness to build AO2 into a force in the Amazon agency space.

It’s been an intense past 2 weeks since close. Sei-Wook has been busy moving AO2’s payroll, benefits, and finance systems over to our Barrel Holdings stack. I’ve been focused on getting a better handle on the sales & marketing side.

One realization, which inspired the later section on sales & marketing in this episode, was that AO2’s lead generation capabilities and pipeline were not quite where we thought they were. Even during the due diligence process, we observed that there was regular activity happening (webinars, outreach email campaigns, conferences) and that there were enough organic leads to generate 2-3 wins per month. What we found instead was that inbound deal flow was non-existent and that there had been a recent reset of the sales team, including a stop to most outbound efforts. Marketing efforts had largely slowed as well.

Perhaps we should’ve dug in deeper and more frequently through the latter stages of the deal, but it’s too late to dwell on that now. We need to act quickly to install some foundational pieces and make sure we can jumpstart the pipeline again in the coming months.

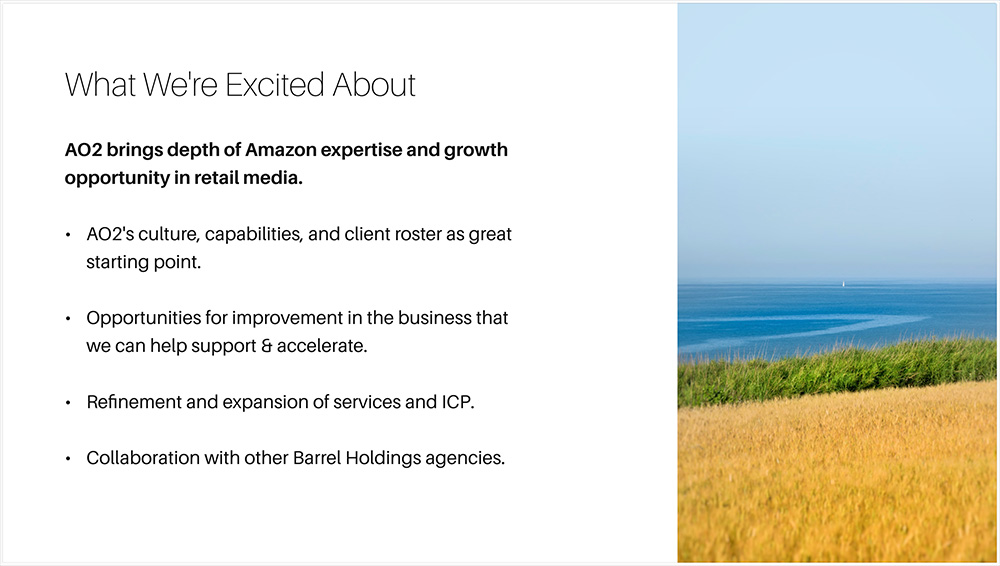

A slide from our intro presentation to the AO2 team on the first business day after the transaction closed.

Overall, this was a big milestone for us. It’s a deal that’s more significant than the others we’ve done in the past and a great stepping stone towards doing bigger deals in the future.

In the immediate term, we’ll be focused on setting up Jessica and the team for success and helping set strategy and goals to make AO2 an important part of our portfolio.

If you’re wondering why we went after AO2 when we already have Prima Mode in our portfolio, here are a few reasons:

- It’s been challenging to scale up Prima Mode from scratch. We like the progress Saniya has made in the past year, but it’s also a very long ways from having the infrastructure, team, and client roster to be a big driver of our portfolio.

- We liked that AO2 already has a built out structure to support dozens of clients with team members focused on various services ranging from Amazon Advertising to operations and creative. They also have a seasoned team of account managers.

- AO2 also comes with an Amazon DSP seat which we hope can become useful as we cross-sell advertising capabilities to our other agencies, most notably Barrel. There may be opportunities to collaborate in helping our clients run larger campaigns on Amazon.

- Amazon is a big retail media channel and AO2 also has experience on Walmart. Retail media in general is a capability we’d like to have in our portfolio.

- There are lots of low-hanging fruit operationally that we think we can put in place to drive higher margins and reinvest into growing AO2.

Good Q2, Slow Start to Q3

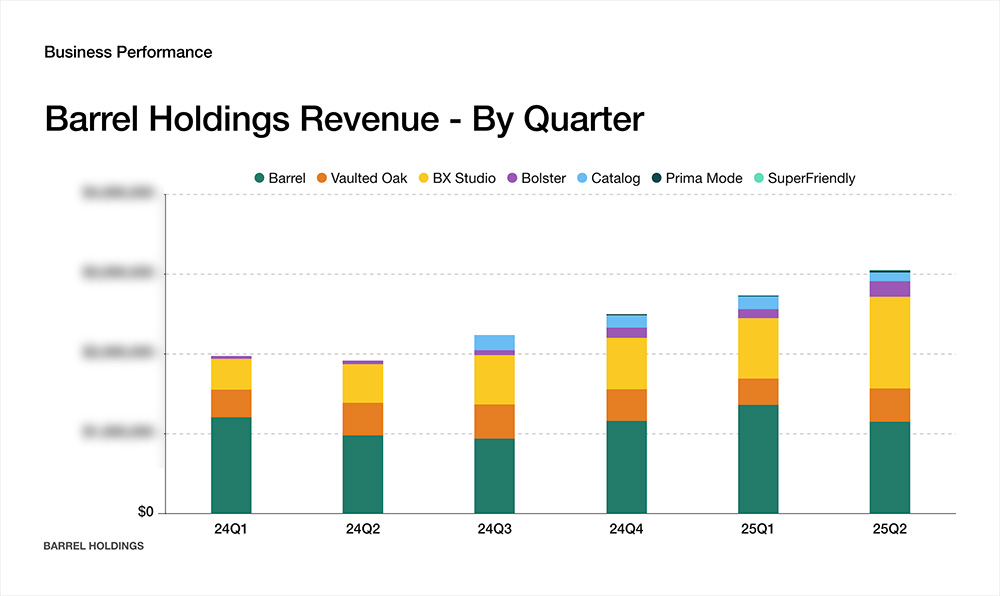

Our portfolio, in the aggregate, had a strong Q2. The record level revenue and profits were primarily driven by BX Studio’s outstanding results. BX logged 50% quarter-over-quarter growth from Q1, a huge jump given that Q1 had been the prior best revenue quarter ever. Profitability was also at record levels.

Good momentum on the revenue front for Barrel Holdings. You can see the big increase in BX Studio’s contribution.

Bolster also registered a great quarter, hitting record level of revenue and profits. This was thanks to a major project with a healthcare client. It remains to be seen whether Bolster can repeat such a quarter or if we’ll see numbers come back down in Q3.

The other agencies didn’t fare as well. Barrel had a soft revenue quarter and lower profits. Vaulted Oak improved on its subpar Q1 performance but is still behind expected pace. Prima Mode, SuperFriendly, and Catalog struggled to book new revenue throughout Q2.

While we were very pleased with BX and Bolster’s impactful results, we’re concerned with how things will play out in Q3. July was not a great start to the quarter with most of our agencies struggling to book new revenue with new and existing clients. We see slow months every now and then, but to feel it across all the agencies was a bit worrisome.

For Barrel and BX Studio, we’re making significant investments into sales and marketing, and I’m optimistic that opportunities will come their way in the coming weeks and months. For the others, being smaller, the initiatives are scrappier and largely dependent on how the agency leaders source and close deals. While we’ll continue to explore ways for Barrel Holdings to provide support and supplemental deal flow, our smaller agencies will need to generate a minimum level of momentum on their own.

Goodbye to Catalog

Speaking of momentum, our product design agency Catalog couldn’t generate enough of it in the past 6 months. It’s been a tough slog in acquiring new clients. CEO Fitch Li has done a commendable job rebuilding the design team and retaining the existing clients, but the lack of new clients made it increasingly difficult for the business to generate positive cash flow.

Back when Fitch began, Sei-Wook and I shared how we had a “line” at which we would look to shut down the business. This was the max amount of cash investment we had in mind for the business to backstop any losses. If the business looked like it would exceed this line and wouldn’t be able to recover anytime soon, that would signal to us that we would need to shut it down.

We also began to look more critically at Catalog’s strategic fit within our portfolio. It was not aligned with any platform like most of our other agencies, and it did not have a vertical focus. We had tried to refine the positioning around startups to target those at Series A and B stages, but we couldn’t quite crack the demand gen motion for those prospects.

With these things in mind, we spoke to Fitch a couple months ago about making plans to shut down the business. Fitch came back to us and wondered if he could take over the business, effectively removing himself as a fixed cost and assuming all the liabilities for the entity going forward. We liked this approach and executed a deal, transferring control of Catalog to Fitch.

We wish Fitch the best and will continue referring him work that doesn’t fit what we do at Barrel Holdings. While the outcome wasn’t what we had hoped for, we learned a great deal from the Catalog acquisition and subsequent integration, allowing us to gain more confidence in doing bigger deals.

This experience was also a great reminder that opportunity cost is a real thing. Catalog made up a couple percent of total Barrel Holdings revenue and yet, we spent just as much time on it as some of our larger agencies. This is fine temporarily, but in the long run, it takes our focus away from supporting agencies and working on deals that can really move the needle.

Having a portfolio of agencies means we not only need to add to the portfolio, but we also need to prune the portfolio when necessary.

Top of Mind

Developing the Agency Sales & Marketing Playbook

I’m more and more convinced that there may be greater benefit to Barrel Holdings being more prescriptive and hands-on with the sales and marketing aspects of our agency businesses. I’m talking more specifically about helping our agencies set up and implement sustainable sales and marketing roles and processes. Once they have pieces in place, we don’t have to be as involved, but I think when there’s little to nothing in place, we ought to be more hands-on.

We’ve hesitated to go in this direction because we were intent on keeping a much lighter footprint at the HQ level while pushing most decision-making to the agencies. The exception has been on the finance side, we we help manage bookkeeping, cash flow management, and taxes centrally.

But upon closer inspection, we’re finding that agencies at the scale we play in–$2 million to $10 million in annual revenue–are still largely dependent on founder/principal-led sales and lots of room to improve across their sales and marketing functions. There’s opportunity for us to develop a proven playbook that we can help agencies implement.

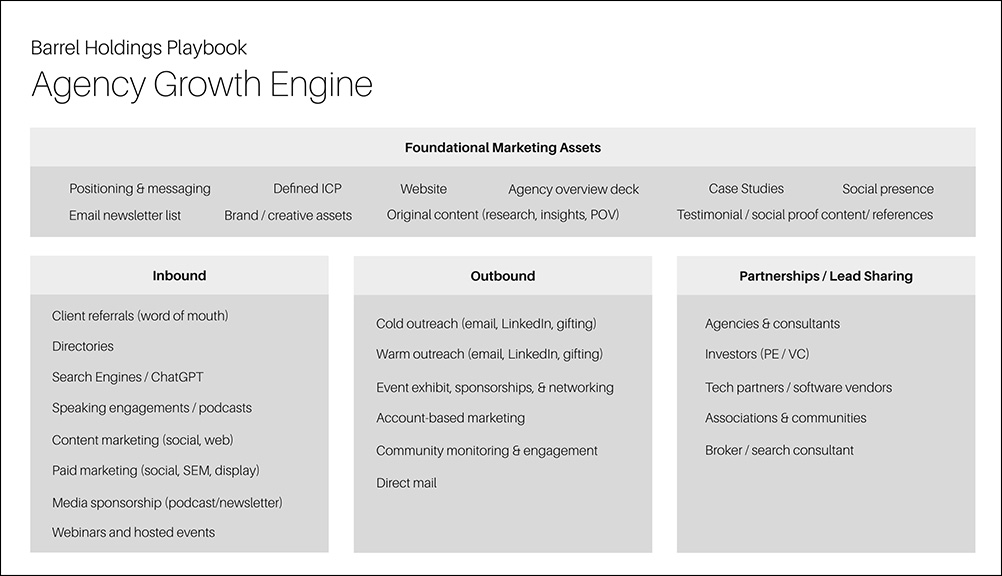

Some frameworks and ideas we mapped out earlier in the year to help our agencies think about sales and marketing.

For the smaller agencies that we’ve grown from scratch, we could view our involvement as an investment to quickly get them to an appropriate level of scale. It can also more quickly help us determine whether or not there is service-market fit. Post-investment, if the agency is unable to reach a certain revenue size, then we should seriously consider exiting or shutting the business down.

Long-term, this approach will be most impactful for newly acquired agencies. It’d be great to have the infrastructure to support the agency with improving their sales and marketing capabilities. This can range from tightening up their sales process, building out their sales team, solidifying a partnerships motion, getting an internal content marketing engine going, and activating campaigns across various channels like social, earned media, outbound emails, conferences, etc. We’d also work to install a solid measurement process and a way to evaluate effectiveness.

This is a nascent thought, but it wouldn’t surprise me if, in 6-9 months, we make this a more standard process. We’re also designing a cross-agency referral program, so that, too, marks a step in the direction of Barrel Holdings playing a larger role in sales and marketing.

Shared Quotes

“Blame truly gets in the way of effectively framing the issue. In fact, it gets in the way of effective advising in general. An advisor spending any energy blaming a client (or almost anyone else) is wasting energy that could be focused on doing something useful for the client. Even in the rare cases where blame is “justified,” it is useless at best. Blame is a defense mechanism protecting the ego of the one doing the blaming. As such, it is just another form of self-orientation. By systematically telling the truth and eliminating blame from his or her repertoire, a trusted advisor can maneuver toward full ownership of a blame-free problem statement that can be acted upon, evaluated, and transcended.” (David H. Maister, Charles H. Green, Robert M. Galford, The Trusted Advisor)

One mark of an agency team’s maturity is how much time they spend blaming their clients versus taking responsibility and trying to figure out what they can improve. This doesn’t mean that “toxic” or problematic clients don’t exist, but there’s no upside to blaming them for how things are versus changing how you engage with them or taking steps to part ways.

“In our experience, the consistency and clarity of your communications are extremely important to customer experience. Knowing when they expect to hear from you and how then to communicate with them quickly and efficiently is part of the challenge. Communicating with your clients in a planned and purposeful manner is much better than a lot of communication just thrown at them. In this instance, timeliness with purpose is more important than time.” (Gary Keller, Jay Papasan, Dave Jenks, Gary Keller, Dave Jenks, The Millionaire Real Estate Agent)

This is gold. One of our Agency Fundamentals is “Communicate Exceptionally” and part of communicating well is to be very intentional, clear, and consistent. Agencies would do well to spend time reinforcing communication skills with every employee, especially those who interface with clients.

“Eliminating unnecessary expenses will bring more health to your business than you can ever imagine.” (Mike Michalowicz, Profit First)

Part of taking over another company after an acquisition is to bring fresh eyes to the cost structure and to go line-by-line to identify and eliminate unnecessary expenses while also funding and increasing budgets for tools, initiatives, and service providers that can really move the business forward.