The biggest splurge for me, perhaps ever, is getting a custom sauna built on our property. I’m working with an architect. It’s very bespoke with a weird shape and will cost a few times more than a standard sauna. The designs are approved and it should be done, weather permitting, by the end of the year. It’s going to sit right under our treehouse and look out into the woods. Most of my writing in personal finance has been about saving and investing money, but sometimes, it’s nice to be able to spend it on something that necessarily won’t have a financial return but will bring some joy and health benefits.

You can see all my past personal finance updates right here.

Note: All content here is for informational purposes only and do not constitute any investment advice. Please do your own due diligence and make your own investment decisions.

Note on What’s Included / Excluded

The numbers discussed in this post are basically my most liquid assets, assets that can easily be converted to cash (if not already cash) with a click of a few buttons. They include most of my brokerage accounts, bank accounts, and retirement accounts. They do not include all of my wife’s accounts, just our joint accounts. Over time, we have moved to handle most of our family finances centrally, but we still maintain our personal bank accounts separately, so cash amounts held by my wife are not reflected here nor are her retirement amounts. I’ve also excluded our three sons’ 529 plans which we contribute regularly to each month.

I’ve excluded our physical real estate holdings as well as any angel/LP investments and real estate partnership investments to keep things simpler. This snapshot also excludes the value of my stake in Barrel Holdings and any investments via Barrel Venture Partners. And this also excludes my joint brokerage account with Sei-Wook, which we’ve had for 10+ years with investments in various public companies.

Snapshot & Performance

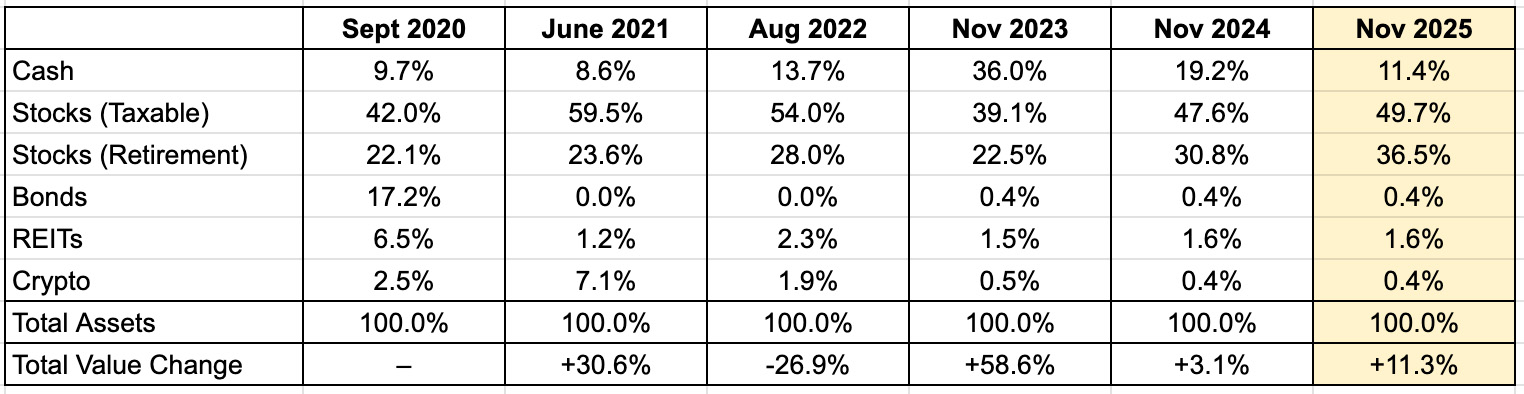

The overall value of my assets increased by 11.3% since late November 2024 (1 year). Since 2020, I’ve seen compound annual growth (CAGR) of about 11.7%, below the S&P 500, which has been around 14.5% during that time.

You can see the changes in allocation and the value change over the previous snapshot periods:

Note: I use Empower Personal Dashboard to track my holdings. I bring the numbers over to Google Sheets and also add in any other accounts that don’t connect.

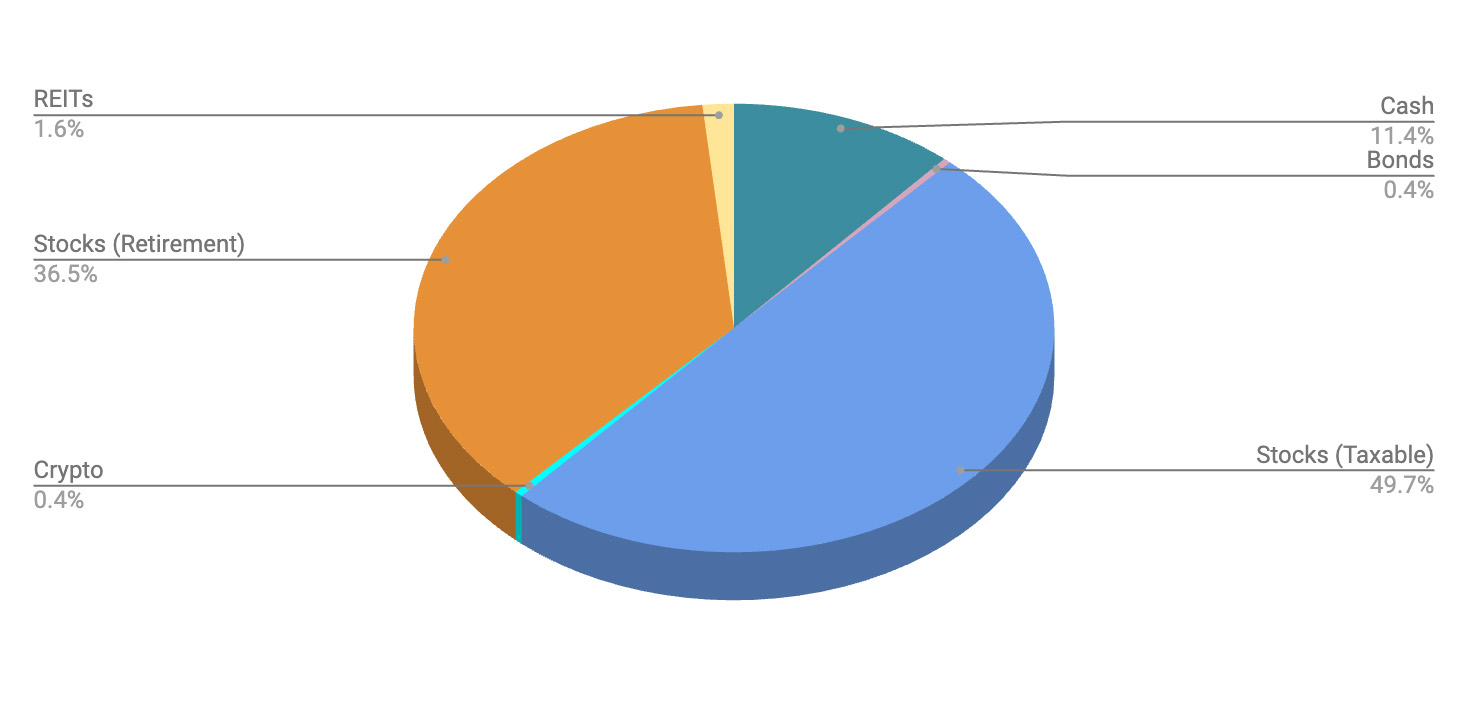

Here’s the breakdown of my assets in pie chart format. I’ve simplified the chart so that stocks also include equities-based ETFs and mutual funds. Values as of November 21, 2025:

The stock market, for most of the year, was very bullish and my positions benefitted greatly in both my brokerage and retirement accounts. I stuck with my boring automated investments into index funds and Fundrise REITs. All my investment focus these days is on buying businesses for Barrel Holdings, something I explain more of below.

Income Source

My primary income source this year was from Barrel Holdings. Sei-Wook and I pay each other a monthly salary that comes from the profits that flow from our agencies up to the holding company. In these early days, a fairly significant percentage of the profits go towards our “management fee” but as we add more companies and the cash flow grows, this should become a smaller percentage, allowing us to have more dry powder on hand for acquisitions.

That said, we’re still leaving excess profits in Barrel Holdings. In the past, we would have distributed more of the profits to ourselves. We’re making the bet that by reinvesting these dollars within Barrel Holdings, we will get a higher return than if we were to take it out of the business and park it in a money market account or in an index fund.

This bet didn’t get off to a great start in 2025. Our acquisition of the SuperFriendly trademark and investment of seed capital to start up the business ultimately didn’t pan out. We shut the business down after six months and no revenue. This cost us a few hundred thousand dollars, not the most efficient use of capital.

Nonetheless, this experience was valuable. It nudged us to really focus our efforts on acquisitions vs. an agency venture studio model. We deployed a similar amount combined with an SBA 7(a) loan to acquire our Amazon agency AO2 this year. This has been working out so far, and we have high hopes for its growth.

We’re all set with acquisitions for the rest of 2025, but we have some deals in the works which may materialize in early 2026. In the near term, I think my income will stay fixed where it is. There may be some incremental increases to keep up with rising living costs, but for the most part, we’re keen on investing Barrel Holdings cash flow into assets that will produce more cash flow.

Fronting Big Costs for a Big Move

I mentioned last year that we bought a house about 10 minutes from us so that Melanie’s parents could move in this year. The thinking was that we could rent out the basement, a separate unit, and make some rental income while we renovated the top floor to suit my in-laws’ needs.

Unfortunately, in December of 2024, the pipes in the house froze and burst, flooding the entire basement (see pics of the damage in my 2024 annual review). We had a tenant ready to move in 2 weeks later but we had to back out. The damage was significant and the basement would need a gut renovation as well. The top floor also had water damage, which required replacement of the flooring. We luckily had insurance to cover some of the damage, but the renovation work to the entire house became a much bigger project.

Even before the renovation, the house, which was built in the 1950s, needed a lot of other fixes: a new roof, a new furnace, a new heating system, you name it. The costs added up.

The renovation cost itself was significant and lengthy. It would be a 7-month process and cost hundreds of thousands of dollars.

A sigh of relief as the upper floor of the house wrapped up renovations. We opened up the kitchen into the dining/living room space. Right, we created a separate laundry room where it was once an unfinished storage area.

I’d joke with Mel that for all the money we spent on this place, we could’ve just bought a newer, nicer home for about the same cost if not less. It’s not certain the home, even with all of its upgrades, will fetch market prices in the future high enough to make a return.

As part of the renovation, we built out a new area where my mother-in-law can stage and take photos of her ikebana creations.

Thankfully, this isn’t something we were banking on anyway. The most important part was that the home was comfortable and well-prepared for my in-laws to move in. They finally made the move in late October and have been settling down. It’s been great to have them close by. On the days Mel works from home, instead of kicking me out of my home office, she just goes and works at her parents’ place.

While a significant drain on our cash position over the past year, we’ve got something worked out with Mel’s parents where they’ll help us recoup some of the upfront costs and we’ll treat that amount as a sort of rent credit. I don’t want to go into too much detail here, but we came up with something that felt fair and logical.

All that said, we feel pretty fortunate that we were able to get through this process with relatively low stress. Sure, the change orders and minor mix-ups during renovations were annoying, but we didn’t let it affect our day-to-day much. And we also feel incredibly lucky that we had the buffer and resources to see this through without sweating about the money.

Return of Capital

I have to give huge props to my friend Welton. He exited his startup Pyrra in 2025. I was an early investor and wrote my largest ever angel check ($150,000) when he started. He worked incredibly hard and was always conscious of his responsibility to investors, many of them his close friends.

While the exit itself wasn’t life-changing for Welton, he protected early investors with a pref stack and returned our capital. During a year when I was getting hit with weekly $20k+ invoices for renovations, getting a $150k wire into my bank account was a welcomed sight.

Startups are inherently risky and just because you raise funding from investors doesn’t mean you’ll make it. In fact, the majority of startups end up returning $0 to their investors. I wouldn’t have faulted Welton at all if he had returned $0, but the fact that he was able to sell his business and return our money is, in my book, an astounding success.

Things turned out great for Welton as well–not too long after the acquisition, Welton ended up taking a job at Anthropic and is very happy there.

Besides one other startup that also returned capital, I’ve yet to see a dollar from my other angel investments. In fact, I’ve been totally ghosted by a couple of founders, not even a response to my emails or LinkedIn messages long after their investor updates stopped coming. I don’t care about a startup failing, but I would appreciate some communication. Ghosting just feels like my money never mattered.

I’ve also not seen a single dollar from any of the fund investments I’ve made. Most of them are coming up on 5 or 6 years. I’m hoping some of them can start to transition to harvest mode since they’ve deployed most or all of their capital already. Forget about any healthy returns, I’d be content just getting my money back at this point.

If I summed up the dollars spent on angel checks and VC/PE funds (most of it deployed in 2018-2022 timeframe), I probably would have had enough money to use as equity injections on at least 2-3 agency businesses. I don’t feel bad or anything, but it’s just a good reminder that I have very different options for allocating my personal capital now.

Understanding the Game

What’s become clearer to me over the years is that in capitalism, the name of the game is to own quality assets. Preferably, these are assets that either generate cash flow or appreciate. Great if they can do both. This is the core message of books like Rich Dad, Poor Dad which I was familiar with growing up but still did not embrace or understand due to lack of explicit role models in my life and little personal curiosity early on.

Even as a youth working hourly at a low-paying job or getting paid an entry-level salary out of college, it’s a smart move to convert some of those dollars, the savings, into assets. Buying a few hundred dollars worth of an S&P 500 index fund is a good move. You now own bits of 500 of the top American businesses.

Over time, assuming you also max out your retirement options, you can take savings from your job and invest in other assets–individual stocks, real estate, small businesses, etc. You get to learn about the risk profile of different assets, the concept of compounding, and how taxes and fees play into what you keep and make.

You might mix up investing with speculation and buy into things that make you a lot all at once or lose you a lot all at once. There will be expensive mistakes along the way, but as long as you don’t bet the farm and avoid catastrophic wipe-outs, you’ll be able to keep on playing, a bit wiser each time.

And maybe one day, you get to a point where your assets generate a not-too-insignificant amount of income. Maybe enough to give you peace of mind if you ever lost your salaried job. Or, if you’ve really done well, maybe the cash flows from the assets exceed your salary. You have financial wealth that makes your job completely optional. You work because you want to, not because you have to.

And one day, maybe you feel like you’re done with your salaried career. You’d rather manage your portfolio of assets while also pursuing other things you’re interested in. Or perhaps the management of your assets coincides with your interests. Maybe you have a collection of real estate properties and want to develop more with a creative vision. Maybe you have one or a collection of businesses in specific industries that excite you and present you with opportunities to grow. Or maybe you enjoy mentoring others and providing them with seed capital to pursue their dreams. So many options that can be tailored if you know the game to play.

It’s not easy, and it’s not guaranteed you’ll get to such a situation, but nothing’s stopping you from starting with at least a small purchase of some asset today.

This is something I wish I had better spelled out to a younger me. I’ll try to gently remind my kids as they get older.

It’s Only a Tool

My annual reminder: money is a tool, not a signifier of worthiness or some kind of destination. I’m fairly certain that there are people with a fraction of my net worth who live healthy, active, fulfilling, and happy lives in ways that I’d envy. Likewise, I know there are people with 10x, 100x, 1000x my net worth who are miserable, unhealthy, and full of regret. Money, when treated and used effectively as a tool, can enable a great deal and contribute much to life.

In a year of significant expenses and capped distributions from my business, I’m pleased that my liquid assets still grew by over 11%. It was only 10 years ago that I committed myself to being better about saving and investing. I was only a couple of years into the journey and vowed to “make up for lost time” for not being smart with money in my twenties. Now in my forties, I’m glad I took personal finance seriously and designed ways to continually save and invest. I’ve a learned a lot over the past decade, and it’s served me well.

If I were to open my various accounts and show all of my investment decisions or spending over the past few years, I’m sure there would be much to second-guess and criticize (e.g, I’m terrible with maximizing rewards points). But I’m not aiming for perfection or 100% optimization. Good enough is good enough, the family is secure, and there’s nothing we’re lacking for. Keep compounding.