There are a few stocks in my portfolio that, had I just left them alone, would have done very, very well for me. But I ended up selling too prematurely, “diversifying” into other stocks, or parking the dollars into a money market account. Sometimes, inaction and patience is the best course.

I think about this when it comes to our portfolio of agencies. There’s the urge to want to provide greater support–perhaps bordering on meddling–to help drive more revenue and profits. Active management, the desire to live in the action and feel the rush of change.

The extreme alternative would be to sit back and do nothing. Go read some more books. Be a sounding board to our agency CEOs but no prescriptions or actions on their behalf. Compound the cash flows patiently. Let the agency leaders figure out problems on their own.

I sometimes suffer from an abundance of ideas along the lines of “things I would do to improve this business”, and with it, I sometimes feel impatient or frustrated when I see dips in performance or slowdown in activity.

This is why I think it’s worthwhile to take a pause and acknowledge that we’ve already done the work of designing the structure and putting talented people in place. Let them cook. Be there to help if they need it, but for the most part, stay out of their way.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

Mixed Results for Q3 Across Barrel Holdings

We closed the books on Q3 in October and met with our respective agency leaders to debrief on performance and talk about the upcoming months.

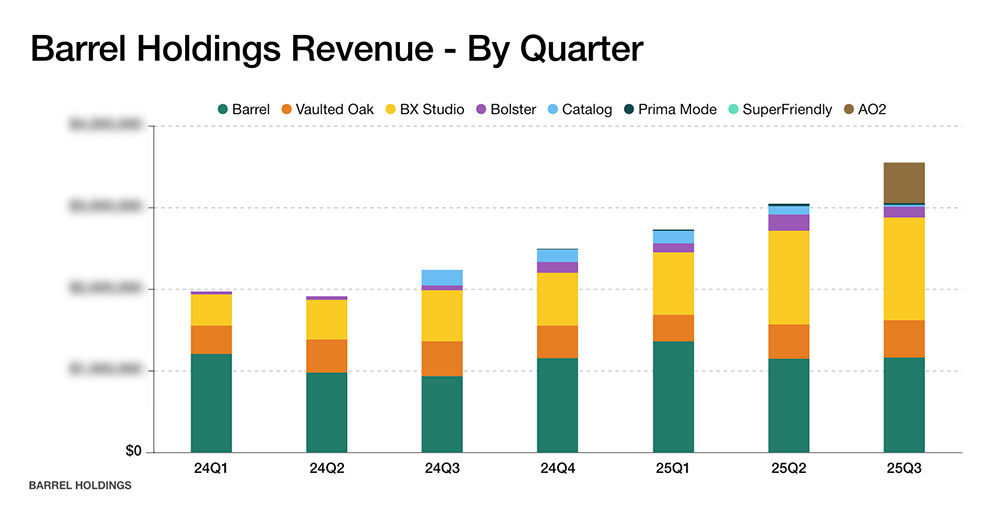

Overall, we hit record levels of revenue for Barrel Holdings in Q3 thanks to BX Studio’s highest-ever revenue quarter and the addition of AO2, our new Amazon agency. Vaulted Oak also saw revenue growth in Q3.

Promising revenue growth trends for Barrel Holdings. It helps to add chunks of revenue through acquisition.

Barrel continued to struggle on the revenue front, staying flat from Q2, which was another soft quarter in terms of revenue. Thankfully, the outlook for Q4 is much better, the result of deals being signed in late Q3 and early Q4.

On the profit side, we were down 20% from the previous quarter. BX Studio burned hot on costs as it tried to keep up with the work. So while revenue numbers were great, the profit margins will need improvement. Profits were also dragged down by losses from SuperFriendly and Catalog as well as a significant drop for Bolster. All three of these agencies are no longer in the portfolio, which should improve profitability figures next quarter.

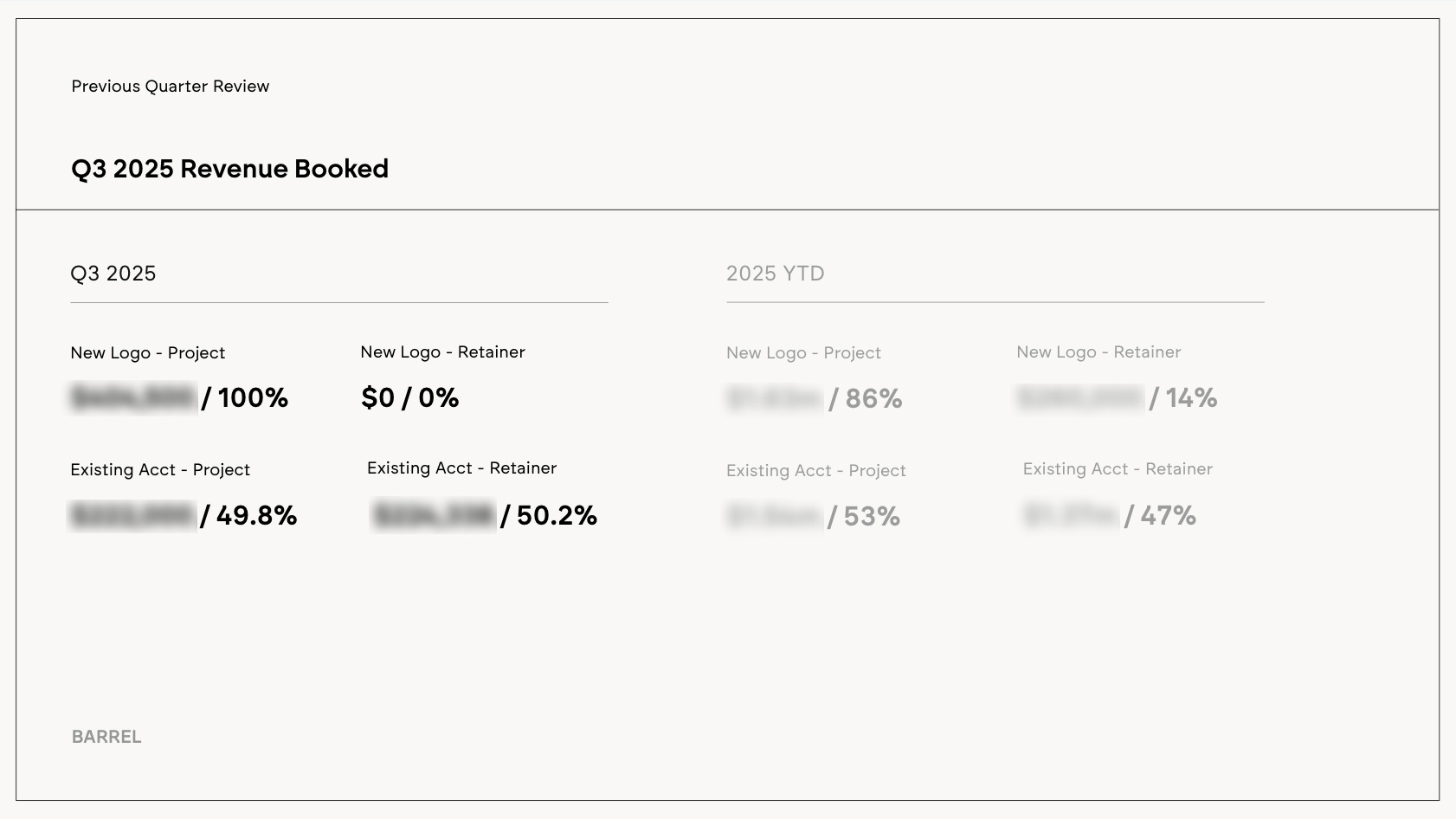

New reporting feature at the agency level of showing new logo revenue types vs. existing account rev types.

A change we made at the agency level was to have each agency report on revenue booked (signed contract value amounts) not only by new logo or existing account but segmenting further into project vs. retainer. This way, we could see what percent, especially on the existing accounts side is project-based vs. retainer.

As we collect more data each quarter on this, we’ll get a better picture over time of the revenue quality. For some of our agencies, we know that they have a high occurrence of repeat projects but clients are less likely to sign recurring revenue contracts (even with a 30-60 day out). While we’d prefer contractual recurring revenue across the board, we’d also like to know how strong repeat purchase rates are and how much of the revenue is from satisfied clients buying again and again from our agencies.

The early versions of this report are very rudimentary. We’ll continue to tweak these so they show a more holistic picture of how well our agencies retain and drive lifetime value from clients.

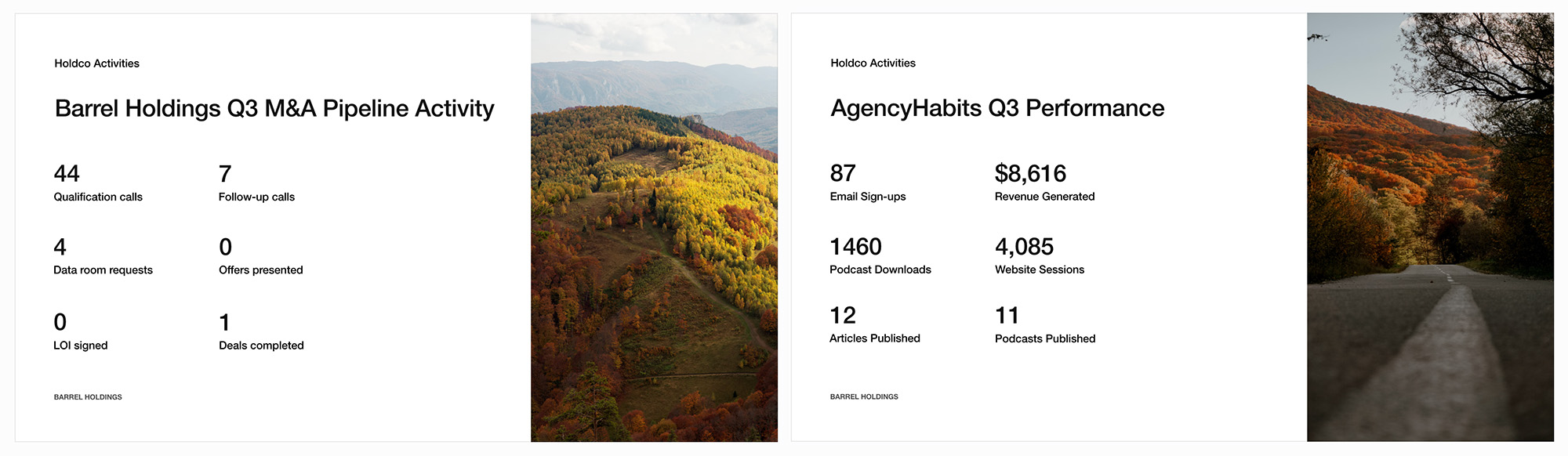

Left, some stats from our M&A pipeline activity. And right, stats from our AgencyHabits work.

For the first time, we shared what’s been happening on the M&A side of Barrel Holdings. We started more carefully tracking the number of calls we take with agency owners and how they progress through different deal stages. While we had a lot of “opportunities”, Q3 was light on any that we pursued seriously. The deal completed was AO2. Some of the qualifications from Q3 have already turned into a couple of presented offers in Q4 and we’re hoping to sign an LOI before the end of the year.

We also shared stats from our AgencyHabits efforts. The 87 email sign-ups have been disappointing but I think this number should ramp up in Q4 with some campaigns we’re running. I’m surprised it’s generated as much revenue as it has, most of it from the sale of our Biz Dev Collection product supplemented by a newsletter sponsorship deal.

We’re optimistic about Q4 and ending 2025 on a strong note. We’ll keep our eyes especially on revenue booked in Q4. We anticipate a lot of renewals for 2026 to sign over the next couple of months. This will help us enter the new year with momentum.

Racking Up AgencyHabits Podcast Episodes

After recording 12 or so episodes of The AgencyHabits Podcast, a few weeks of skipping recordings here and there left us on a week-to-week publishing schedule, which isn’t ideal. We’d rather have a few weeks of buffer in case we have to cancel a recording last minute.

Me and Sei-Wook recording yet another episode of The AgencyHabits Podcast.

We spent October building up a buffer. We recorded 5 episodes with topics ranging from agency buyers, to how agencies can better market themselves, to managing risk in the agency. We’re getting into a good rhythm for these podcasts. I’ll come up with a topic and then on the morning of, while I’m on my walk, Sei-Wook and I will talk through the topic and jot down points we can make during the recording. I thought our episodes would typically be 10-15 minutes, but most of these episodes have gone over 20.

Anyway, if you haven’t already, subscribe to our podcast. I’ll list a few of the most popular episodes to date below:

- How We’d Generate Leads If We Started Our Agency Today

- How We Exited Our Agency Without Selling It

- The 6 Types of Agency Buyers: Who They Are and What They Really Want

A Couple of Seasoned Hires for Our Agencies

For AO2, we signed a new Chief Revenue Officer that we’re really excited about. We can’t publicly announce it just yet, but it’s someone who’s been in the Amazon ecosystem for a while and well-known in the community. We think AO2 can benefit greatly from a partnerships-driven go-to-market to generate quality leads and move upmarket.

On the BX Studio front, we welcomed an old friend and collaborator from the early days of Barrel. We’ll announce this more officially in a couple of months, but it’s someone who has deep experience in agency operations and brings much-needed discipline to project management at BX.

These are major investments not only in dollar terms but in responsibility and the potential trajectory of each of these agencies. Very exciting to see these moves as both organizations continue to grow and mature.

Top of Mind

More Refinement in the Barrel Holdings Strategy

When I read episodes from the past months of Agency Journey, I can see all the ways in which my initial thoughts and convictions have played out poorly.

Take for example my thoughts on the agency venture studio model from January 2025, when I felt that the upside for launching a successful was so enticing that it was worth creating 1-2 new ones a year. By August 2025, I was disillusioned with the concept and doubled down on M&A.

In December 2024, I laid out my long-term hold vision for Barrel Holdings and wrote this: “The mantra heading into 2025: stay focused, be patient, don’t try to do too much, and keep going.”

So much for trying not to do too much!

To outsiders, to the extent they care at all, we might seem wishy washy on our strategy and unclear on the focus. But I’d like to think about it in a different way: we’re grasping our way through the dark and slowly finding out what we’d like to do and what we’d like to avoid.

I spent some time trying to reframe what Barrel Holdings is and what we’re trying to accomplish. It’s by no means a finished product, and I’ve already received questions/feedback from those who’ve seen it about some of the long-term implications. But I’m going to share it anyway because then I can look back on this post in 6 months and laugh at my naiveté.

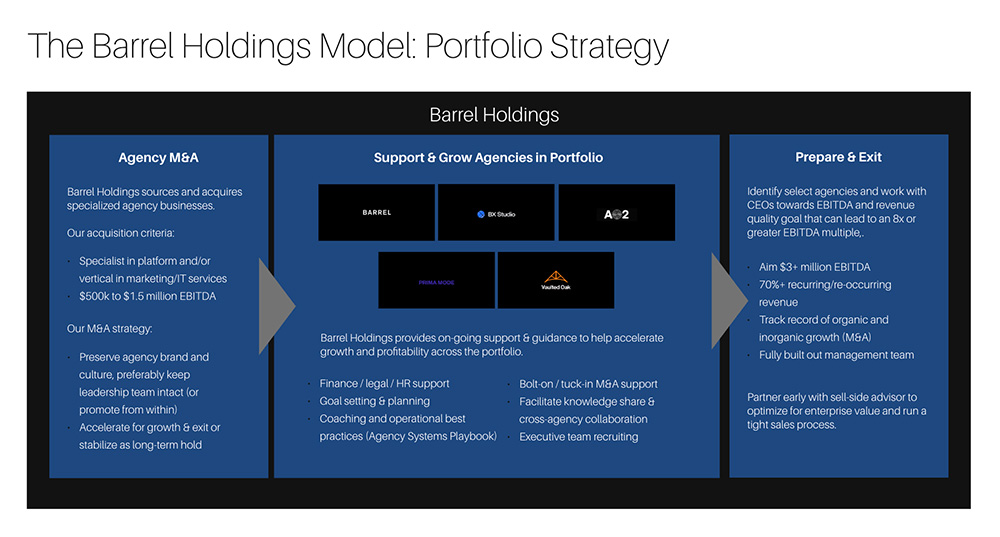

Gone is the agency venture studio model and our portfolio is strictly about acquiring and growing agencies, some which we’ll be able to exit.

The main difference in our portfolio strategy is that we’ve done away with the agency venture studio model and we’re focused on acquiring agencies, helping them to grow, and for those that achieve a certain scale, helping prepare them for an exit. There’s always the possibility that we’ll hold on to an agency indefinitely and we have no outside pressure to sell. However, as I mentioned in last month’s episode, we have agency leaders who have an appetite for scale and growth with an eye towards a successful exit. We’d love to support them in achieving such outcomes.

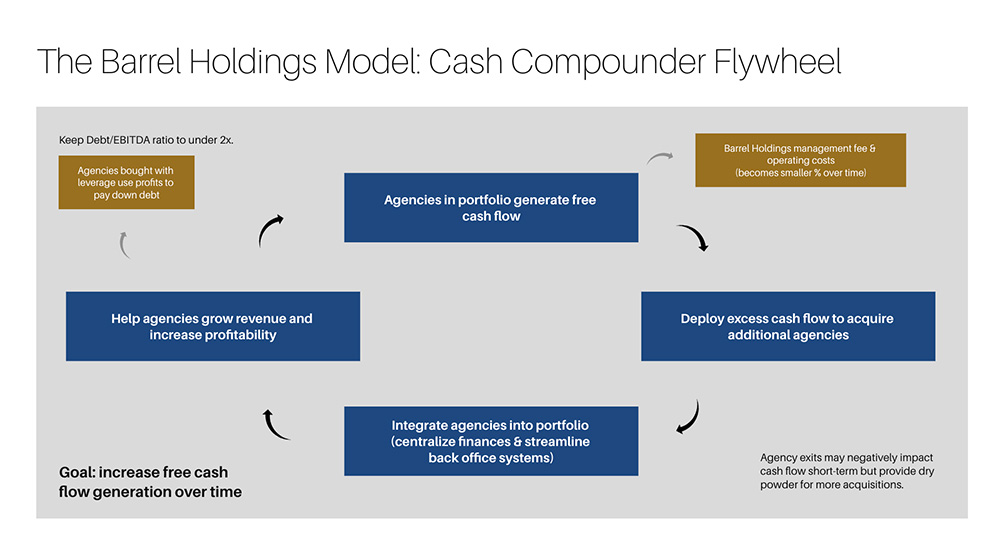

The cash compounder flywheel is still intact but you could argue that exiting some agencies runs counter to this.

We’re still laser focused on building profitable agencies that generate cash and provide us with the means to buy more agencies. That remains the same. Along the way, if we end up exiting one or more agencies, the cash flow generation will take a hit, but we’ll have more dry powder to deploy in acquiring new agencies. If we play it right, an exit here or there could really help accelerate the flywheel in the long run.

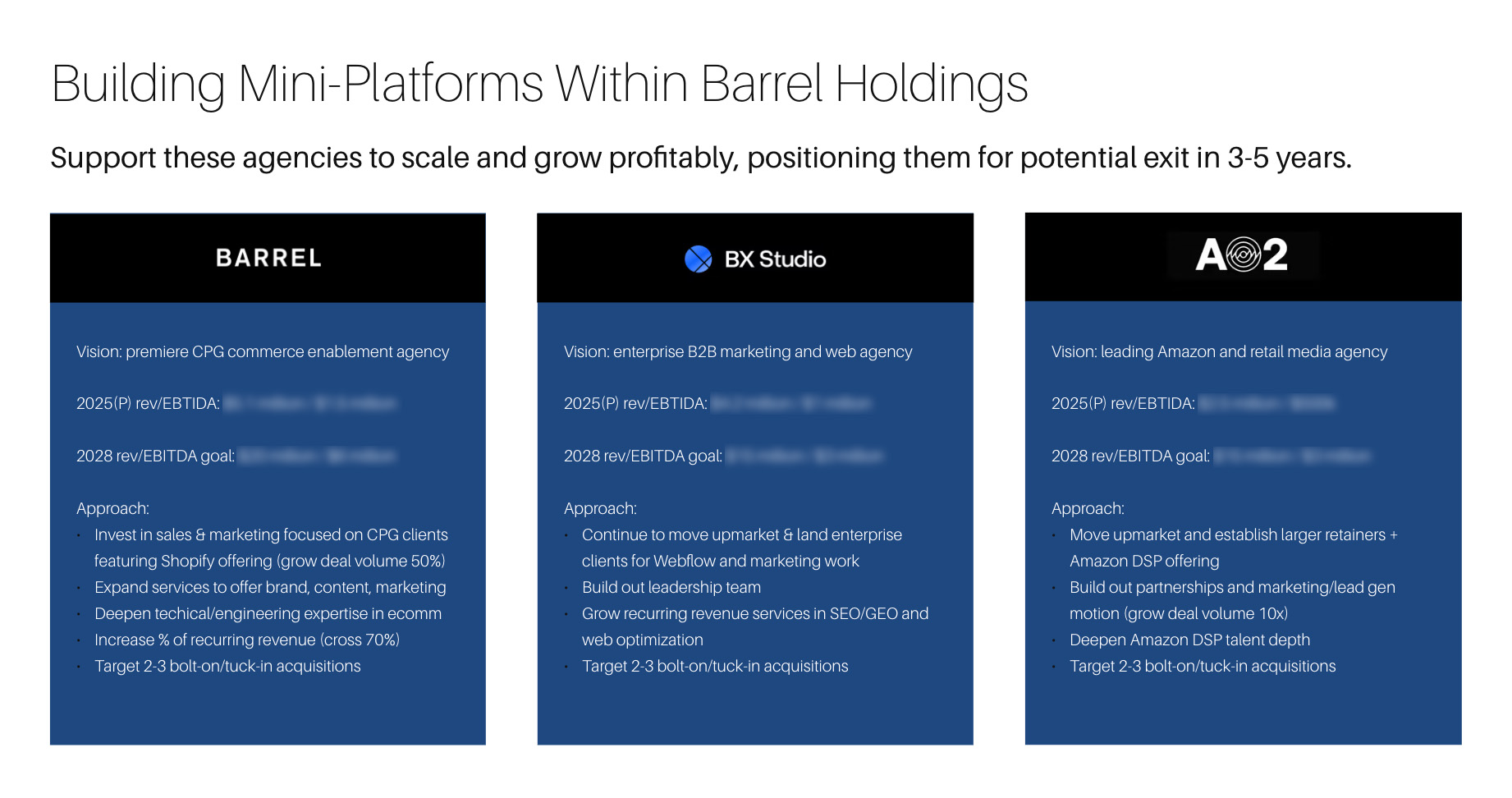

These three agencies, as of today, have the most immediate potential to work towards an exit in 3-5 years.

The slide above is just more of what I was alluding to with building some of our agencies for an eventual exit. These three show the most promise as of today, and I wouldn’t be surprised if we take one or two of them to market in the next 24-36 months. There’s a lot of work to be done to get the outcomes we’d like to see (download our Exit-Readiness Checklist over at AgencyHabits), but I’m confident our CEOs will continue to execute.

So there you have it, some slides from our refined strategic approach at Barrel Holdings. It’s not a total departure from the ideas we had 15 months ago when we started working on this full time, but we’ve also learned a lot along the way that’s helped us to tweak and tighten things.

Shared Quotes

“Do not confuse debt with capital. Capital is the cash you leave in the business to fund your receivables and inventory for normal business conditions, and debt is financing for special cases. Once you start financing normal receivables with debt, you are lowering the odds of your business being able to survive a downturn. As you can imagine, clearly making this distinction is a frequent topic in my classes.” (Greg Crabtree, Simple Numbers, Straight Talk, Big Profits!)

Normal operations should be funded with retained capital (the amounts left after paying expenses or cash reserves) vs. with borrowed money. A line of credit is helpful in rare situations where you have some really disadvantageous payment terms with a client (90+ days), but ideally you can fund that with your capital vs. debt. It’s not that you should never have debt (they’re useful for funding certain investments/growth opportunities), but once you start going down the road of being used to having debt stand in place for receivables, it’s a slippery slope. We fell into this trap–having a fully drawn line of credit to fund the business–about a decade ago and it took a solid 2 years of cleaning up our operations and cost structure to get out of it.

“What you’ll find is that the only thing you really want from life is to feel enthusiasm, joy, and love. If you can feel that all the time, then who cares what happens outside? If you can always feel up, if you can always feel excited about the experience of the moment, then it doesn’t make any difference what the experience is. No matter what it is, it’s beautiful when you feel that way inside. So you learn to stay open no matter what happens. If you do, you get for free what everybody else is struggling for: love, enthusiasm, excitement, and energy. You simply realize that defining what you need in order to stay open actually ends up limiting you. If you make lists of how the world must be for you to open, you have limited your openness to those conditions. Better to be open no matter what.” (Michael A. Singer, The Untethered Soul)

I appreciate this line of thinking. We have more power over our lives than we think. We can simply choose to feel a certain way in our lives. That’s incredibly empowering. A big part of getting older has been this realization. Certain things used to gnaw at me and stress me out for long stretches of time. I learned that I could simply choose not to be bothered and to look at these things with greater perspective to realize they were fleeting nothingburgers.