We said goodbye to another one of our Barrel Holdings agencies recently. Bolster, the design studio and Framer agency that we co-founded with Henry Alcock-White in 2023, is no longer part of the portfolio.

This one was a tough decision. I had personally put in a lot of time and effort to get Bolster off the ground. The work they did on the branding side was very gratifying, and there was some promise with the Framer websites. However, as Sei-Wook and I started to crystallize our strategy for building the holding company, we couldn’t quite see a clear path for Bolster to achieve the level of scale that’s required for us to stay on track.

Despite the Omakase Design Sprint offering and the leads coming from the Framer expert directory, Bolster’s business development engine just never achieved escape velocity. The team also struggled operationally to deliver consistently when they got incredibly busy, which led to either uneven client experiences or compromised margins as they scrambled to staff up.

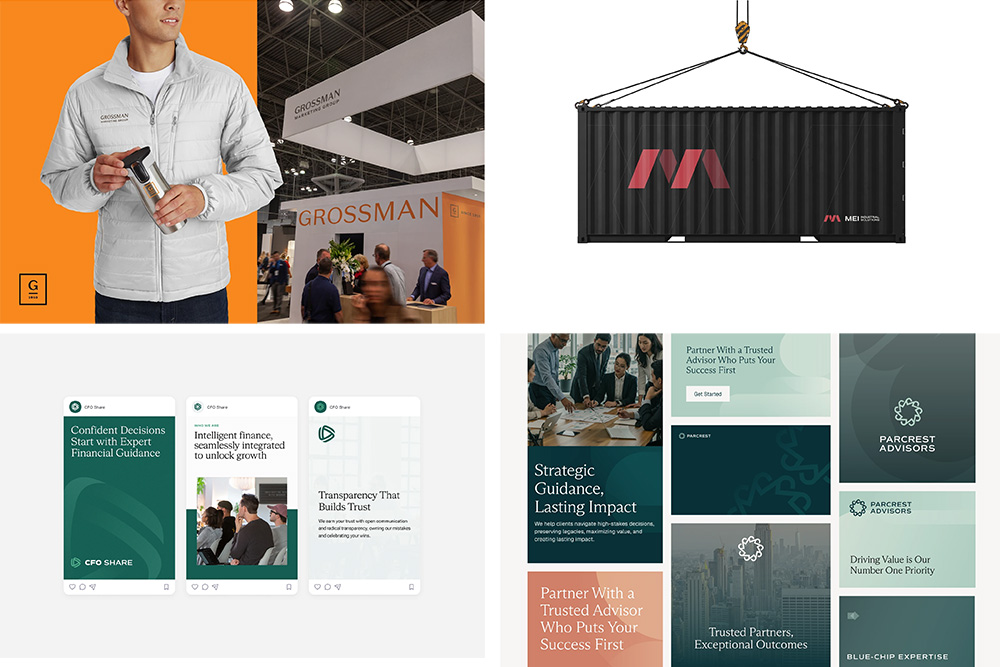

Bolster’s specialty was in creating beautiful visual identity systems for B2B companies. We’ll miss having this capability in the portfolio, but we’ll continue to collaborate with them on projects.

But these are common challenges for any young agency, and I’m sure Henry, along with studio manager and now co-owner Quetta Haythorn, will figure their way around it. It’s just that with the focus on acquisitions and scaling up our other agencies (see Top of Mind), we felt that there was a clear opportunity cost to continuing on with Bolster.

We had some heartfelt convos about Bolster’s future, especially as we collaborated so closely together the past few years. If Henry and Quetta can continue to build out systems to expand existing client relationships, increase deal flow, and scale up capacity as needed, then Bolster can blossom into a durable independent business. I wish them the best.

About Agency Journey: This is a monthly series detailing the happenings at Barrel Holdings, a portfolio of agency businesses. You can find previous episodes here.

Highlights

Ramping Up Deal Sourcing

I mentioned in the last episode that in order for Barrel Holdings to succeed, we really need to up our sourcing game. We need a way to reach more agencies and talk to more agency owners who are interested in selling.

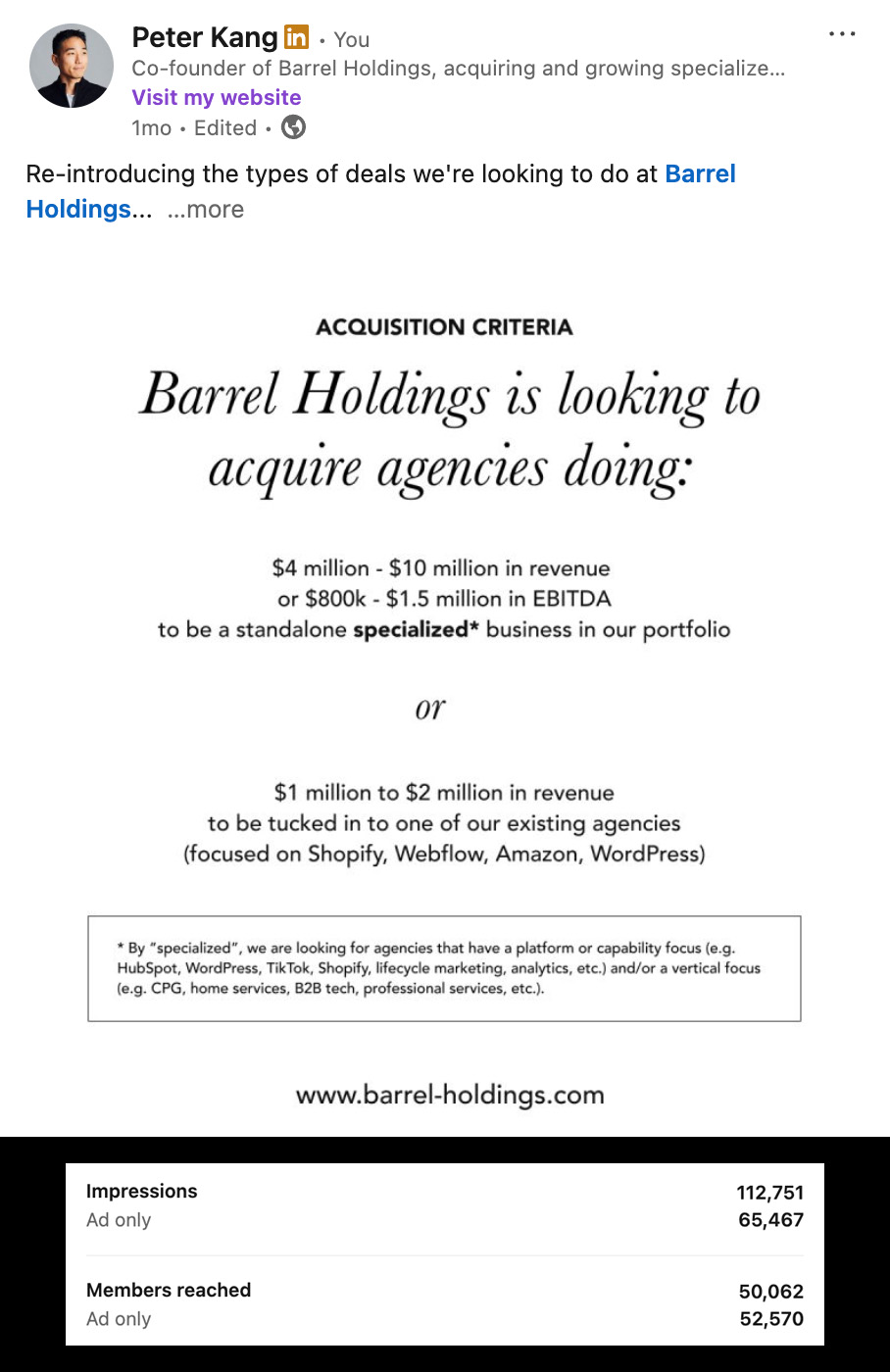

We’ve been ramping up our efforts in a few different ways. The first has been to put some dollars behind my LinkedIn post about our acquisition criteria. When I first posted this, I got a bunch of inbound inquiries, which was a positive signal. With about 10,000 organic impressions, I wanted to see how this post would do if promoted with a few dollars. I set a $100 budget and quickly saw some more results, getting 3-4 inbound leads per week.

I’ve since set the ad to run for another month. It’s already at 100k impressions and over 50k members reached, something my organic posting would not have been able to achieve. I’ll be creating more agency M&A type content in the future and boosting those on LinkedIn with a paid marketing budget.

This LinkedIn post has been effective in driving inbound inquiries from agency owners interested in selling.

We’ve also been having more convos with boutique investment banks, accounting firms, and agency coaches. They are often in the know about agencies that are looking to sell. If we can stay top of mind and establish good relationships with them, they can be another source of deal flow. In fact, my LinkedIn ad has led to convos with these intermediaries, who have already sent us some deals to look at.

Another channel is AgencyHabits, our resource for agency leaders. I recorded a short segment that’ll play in every one of our podcasts encouraging interested agency owners to contact us to talk about selling their business. I also tweaked the homepage message to make clear that Barrel Holdings is looking to buy.

Conferences are also an opportunity to connect with agency owners who may be looking to sell. I had a few such convos with agency owners in the past month at Webflow Conf and at Leadership Love in Portland. These in-person meetings are always great for building relationships. Even if there isn’t a fit right now, having spent time together in-person makes it more likely that we’ll stay in touch. Perhaps we recommend a different buyer for them or we end up picking up the convo again in the future.

And lastly, we’re continuing to invest in our cold outbound email efforts. We have some additional inboxes ramping up and we’re looking to enrich our lists so that we can get better results from our campaigns. Our buy-side partner Rainier Associates continues to bring us a couple opportunities each week to review.

We’re still nailing down the target number, but high level, if we can get to a point where we have around 200 screening calls a year, we should be able to get to 2-3 closed deals annually.

It’s nice to have this very focused initiative set as a priority for Barrel Holdings. Most of my activities get clarified by asking myself: “Does this help drive more deal flow for Barrel Holdings?” If not, then I have to consider whether it’s a good use of my time.

My Talk at Leadership Love in Portland

I was invited to speak at the Bureau of Digital’s Leadership Love conference in Portland, Oregon at the end of September.

It was an intimate event with less than 100 attendees. Many of the speakers touched on topics around overcoming burnout and trauma, balancing the various challenges of work and personal life. I was very inspired by the vulnerability and depth of the stories.

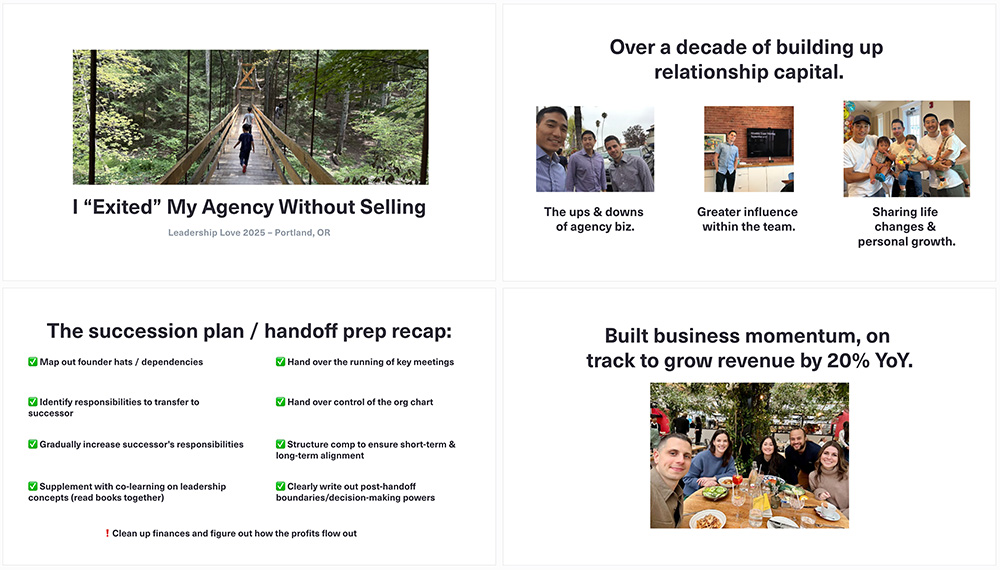

Select slides from my talk on how I “exited” my agency without selling. The story centered largely on Sei-Wook and my relationship with Lucas and how we worked with him on the transition.

My own topic, about how I “exited” my agency without selling it, was perhaps meant as a way to provide attendees, many of them agency owners, with an option to consider as they explored ways to be less and less involved in the day-to-day of their businesses or to pursue something different while continuing to benefit from what they’ve built.

I tried my best to share practical tips in how Sei-Wook and I were able to transition Barrel over to Lucas, but it was also clear that we were very lucky to have someone like Lucas in the first place. We all benefitted greatly from having worked closely together for 10+ years while developing a very strong and trusting relationship.

The trip to Portland was the 2nd leg of a weeklong trip. I had spent 3 nights in NYC for Columbia alumni-related events, so it was an entire week away from home and the family. I enjoyed the experience and met a lot of nice people, but I’m also very glad to return to my routine.

Top of Mind

Working Towards Growth and Scale

Amongst the leaders at our 3 largest agencies–Barrel, BX, and AO2–we’ve been talking about how getting to $3 million+ in EBITDA with 70%+ in recurring/re-occurring revenue will make an agency a very attractive target for prospective buyers.

At Barrel Holdings, we are all about building for the long-term, but we want our agency leaders to work towards growing an agency so good that others will want to buy it. An attractive business opens up all kinds of options. Strong cash flows can enable rich dividends or bigger bets (e.g., tuck-in acquisitions, service expansions, etc.). A prospective buyer may show up promising to pay out 8 or even 10 years’ worth of cash flows upfront, something that would merit serious consideration.

There are other factors that go into making our agencies more attractive, like the year-over-year growth rates, gross margins, quality/stability of the team, client concentration, etc., but the shorthand of EBITDA + repeating revenue is a great focusing mechanism for our agencies.

In September, I was able to spend some time in NYC, supporting Lucas at his Naturally NY media bootcamp talk and Jacob at Webflow Conf on stage to share how BX helped enterprise client Verifone migrate to Webflow. We enjoyed a wonderful dinner along with Sei-Wook where we discussed the importance of growth and scaling for the agencies.

Getting to $3 million+ in EBITDA implies that the agency most likely has to do $10 million+ in top-line revenue. And 70%+ in recurring/re-occurring revenue means the agencies are offering sticky ongoing services and retaining clients for years at a time, not relying on one-off projects. Not a problem for AO2, which is already mostly a recurring revenue business, but definitely more of a challenge for BX and Barrel, whose revenues are still majority one-off web projects.

Our agency leaders are incentivized both short-term (quarterly profit share) and long-term (phantom equity in the business), so they can realize rewards along the way and also stand to have a significant payday if we were to exit.

I like how we’ve evolved to talking about business in this way. Originally, we had over-emphasized a long-term or perhaps “forever hold” approach to our portfolio, but this implied that we were striving for stability over growth. And in the agency world, I’ve come to believe that “stability” is an illusion. An agency has to keep on evolving and embrace a growth mindset to keep up with the changing needs of clients as well as the accompanying changes in the tech/CX/UX landscape.

We might not always have double or triple-digit year-over-year growth, but growth can be more than just revenue or profit gains. It can mean process updates, service offering changes, or a restructuring of the team’s makeup. They key is to always play offense and strive towards growth.

For Barrel, BX, and AO2, they’re each unique in their own way, but many of the areas we’re focusing on are very similar: investing in sales and marketing to drive more leads and grow revenue; refining and expanding service offering to increase average client spend; identifying and filling gaps on the leadership team; and streamlining internal processes and adopting AI and automation to improve margins.

When listed out, these just sound like the basics of running an agency business. However, pair this with some aggressive annual growth targets, and each one of these areas take on a greater degree of intensity. For example, the volume of leads has to go up meaningfully, which means the investments are quite serious–new personnel, experimentation with channels, and real budgets attached to our efforts. Likewise, hiring for key leadership roles means shelling out big salaries, bonuses, and other forms of variable comp to align incentives and drive performance. If we were looking to be conservative, we’d most likely prioritize being cost-conscious and eking out most efficiency gains. In the growth scenario, efficiency is important, but it has to happen concurrently with changes in scale: more clients, more revenue, more profits, more people involved.

When the flywheel gets going, it’s a beautiful thing to see. More dollars to reinvest in further growth all while still delivering healthy excess cash flows to the holding company. As the business scales up, the reinvestments, if done right, can build up greater resiliency within the agency, a kind of foundational infrastructure that can withstand shocks while perpetually generating opportunities and delivering profits.

Whether we get there in the next couple of years or over the next 5+ years, getting the flywheel going for each agency will be a worthwhile endeavor.

Shared Quotes

“One of the most dangerous sentences in any language is one that begins, ‘What clients want is… .’ No matter how you finish that statement, you will be wrong. The whole point is that clients are, and want to be treated as, unique individuals.” (David H. Maister, Charles H. Green, Robert M. Galford, The Trusted Advisor)

I often write about service offering and client relationships in a generalized way, but this quote is a great reminder that agencies need to continue to build deep, personal relationships with their clients and understand what they care about and how best to work with them. There are absolutely ways to streamline and make repeatable certain aspects of the business, but it’s also important to remember that no client wants to feel like they’re a dime a dozen.

“For every part, TransDigm is maniacally focused on earning an appropriate economic return. That means that as older planes are retired and production runs of spare parts become less frequent and more challenging to predict, TransDigm demands that it be compensated, not just for the direct cost of the part, but for the costs of keeping production lines “hot” with skilled labor and working machinery. The company takes reliability seriously, and it expects to be paid for delivering a high-quality, usable part quickly. This mentality of driving an appropriate level of value out of every order is ingrained in the product line managers across the company.” (Scott Davis, Carter Copeland, and Rob Wertheimer, Lessons From the Titans)

For some reason, this story got me thinking about websites built on WordPress with some very complex content management system setups and custom plug-in implementations. Provided that these features solve a very particular problem and enable the client to benefit in a positive way (vs. being a bloated and unnecessary byproduct of a poor build), then the agency has every right to charge a premium to maintain the website. There’s a lock-in effect that you can get when you have an agency that can perform very valuable, highly technical work that the client values greatly.